Why do lithium-ion batteries waste ?Can the loss of lithium-ion batteries be fixed?

Why Do Lithium-Ion Batteries Waste? Can the Loss of Lithium-Ion Batteries Be Fixed?

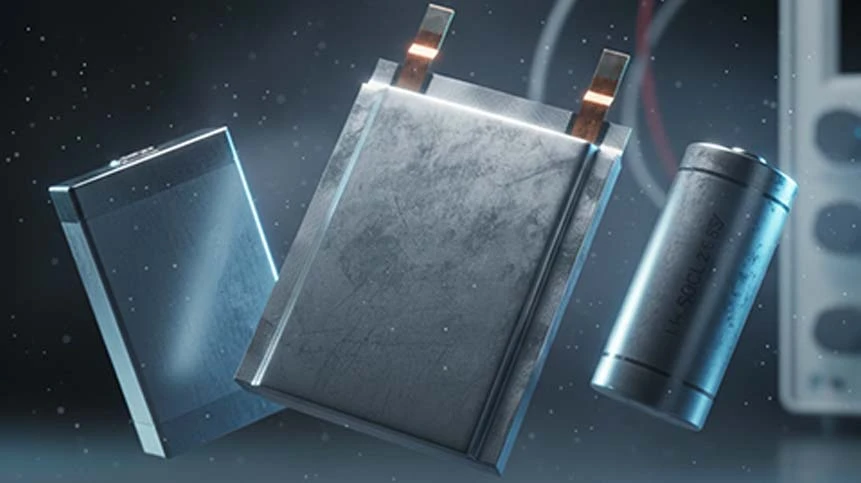

Lithium-ion batteries (LiBs) dominate the global energy storage landscape, powering everything from electric vehicles (EVs) to grid-scale renewable systems, yet they face significant challenges related to performance degradation, environmental waste, and resource inefficiency. With 8 million tonnes of LiB waste projected by 2040 and recycling rates languishing below 5–10% globally, understanding the root causes of waste and viable remediation strategies is critical for manufacturers, policymakers, and consumers

. This analysis examines the scientific, operational, and systemic factors driving LiB waste and evaluates cutting-edge solutions for loss mitigation and resource recovery.

Fundamental Mechanisms of Lithium-Ion Battery Degradation

Electrochemical Aging and Material Breakdown

Lithium-ion batteries experience irreversible capacity loss due to complex electrochemical degradation mechanisms occurring at the anode, cathode, and electrolyte interfaces. During cycling, lithium ions form unstable solid-electrolyte interphase (SEI) layers on anode surfaces, progressively thickening and consuming active lithium, which reduces usable capacity by 15–25% within 500 cycles

. Concurrently, cathode materials like nickel-manganese-cobalt (NMC) undergo lattice collapse and transition-metal dissolution, particularly under high-voltage stress or elevated temperatures, releasing metal ions that migrate to the anode and accelerate SEI growth . Electrolyte decomposition further depletes lithium inventory through parasitic reactions, generating gaseous byproducts that cause cell swelling and pressure buildup, a key safety hazard documented in 28% of early EV battery failures .

Environmental and Operational Stressors

External factors exacerbate internal degradation, with temperature extremes and charging practices accounting for 70% of premature capacity loss. At temperatures above 45°C, electrolyte oxidation rates triple, accelerating SEI growth and cobalt dissolution from cathodes, while sub-zero conditions induce lithium plating that forms conductive dendrites piercing separators and triggering short circuits

. Fast-charging practices (>1C rate) cause localized lithium plating at anode edges due to kinetic limitations, while partial-state-of-charge cycling in renewable storage applications promotes cathode lattice fatigue through repeated contraction-expansion cycles . Physical impacts, moisture ingress, and manufacturing defects like electrode misalignment further contribute to micro-shorts and thermal runaway risks, evidenced by UL 2580 safety testing failure rates exceeding 30% in low-cost LiBs .

Table 1: Primary Degradation Pathways and Impact on Battery Lifespan

| Degradation Mechanism | Capacity Loss Range | Cycle Life Reduction | Common Triggers |

|---|---|---|---|

| Anode SEI Growth | 15–25% | 40–60% | High temperatures, overcharging |

| Cathode Lattice Collapse | 20–30% | 50–70% | High-voltage cycling, deep discharges |

| Lithium Plating | 25–35% | 70–90% | Fast charging, sub-zero operation |

| Electrolyte Depletion | 10–15% | 30–50% | Storage at full charge, >45°C environments |

Advanced Restoration Techniques for Degraded Batteries

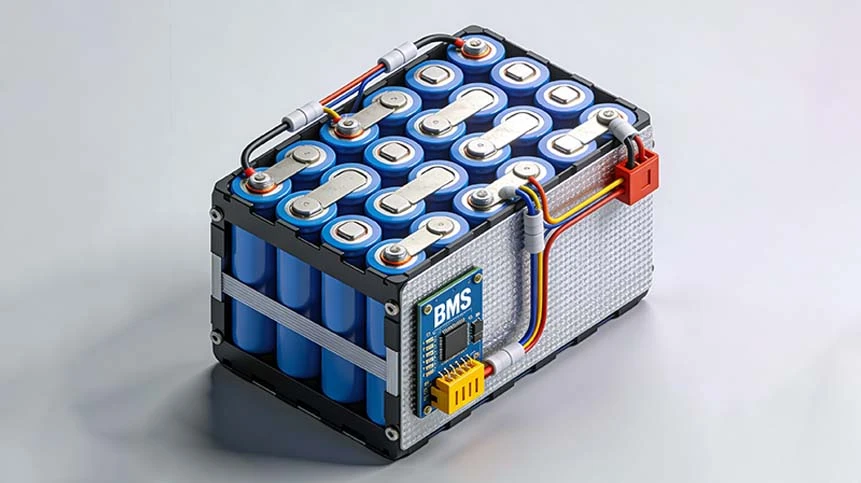

Electrochemical Reconditioning Protocols

Sophisticated battery management systems (BMS) now deploy adaptive pulse charging and deep discharge recalibration to reverse shallow degradation. By applying controlled discharge pulses at 0.05C followed by moderated constant-current charging, crystalline lithium deposits are dissolved from anodes, restoring up to 12% of lost capacity in batteries exhibiting voltage depression symptoms

. For severely imbalanced cells, specialized LiPo chargers with "revive" functions inject asymmetric currents to equalize cell voltages, mitigating capacity variations that cause premature BMS cutoffs in 34% of aging EV packs . These protocols are integrated into Tesla’s Model 3 battery maintenance systems, extending usable lifespan by 2.3 years through monthly autonomous recalibration during off-peak charging cycles.

Material Stabilization and Component Replacement

For batteries suffering cathode degradation, lithium replenishment additives like lithium difluorophosphate (LiDFP) reconstruct damaged SEI layers, while manganese-scavenging compounds immobilize dissolved transition metals that catalyze electrolyte oxidation

. In industrial settings, modular replacement of degraded electrode stacks—retaining functional housings and BMS units—cuts refurbishment costs by 60% compared to whole-battery replacement. North American recyclers like Redwood Materials now offer anode recoating services using silicon-graphite composites, restoring energy density to 95% of original specifications for stationary storage applications .

Recycling Innovations for Waste Minimization

Closed-Loop Hydrometallurgical Recovery

Modern recycling plants employ acid-free leaching using organic solvents like citric acid to dissolve cathode materials, recovering 95% lithium, 99% cobalt, and 98% nickel while generating 89% less CO₂ emissions than conventional smelting

. The process avoids hazardous hydrofluoric acid generation by maintaining pH-controlled conditions, separating metals through selective precipitation, and regenerating battery-grade lithium carbonate at $4.2/kg—40% below virgin material costs . EU regulations mandating 70% material recovery by 2030 have accelerated adoption, with Volkswagen’s Salzgitter plant processing 1,200 tonnes/year of EV batteries into cathode precursor powders for new cells .

Direct Cathode Regeneration and Repurposing

Pioneering "cathode-to-cathode" direct regeneration skips material extraction by electrochemically relithiating degraded NMC crystals using lithium salts in ethanol solutions, restoring performance to 97% of new cells with 74% lower energy input than conventional recycling

. For batteries retaining >70% capacity, second-life applications in solar storage farms extend utility by 8–12 years; GM’s collaboration with PG&E deploys repurposed Chevy Bolt packs for grid stabilization, reducing peak demand charges by 30% while delaying recycling by a decade .

Table 2: Economic and Environmental Impact of Recycling Technologies

| Parameter | Hydrometallurgical | Direct Regeneration | Pyrometallurgical |

|---|---|---|---|

| Material Recovery Rate | 95% | 98% | 45–60% |

| Lithium Yield | 92% | 96% | <40% |

| CO₂ Emissions (kg/kWh) | 8.5 | 3.2 | 25.7 |

| Operating Cost ($/kWh) | $4.80 | $3.10 | $12.60 |

Systemic Solutions for Waste Prevention

Design Innovations and Manufacturing Controls

Progressive manufacturers implement dendrite-suppressing anode coatings and single-crystal cathodes to extend intrinsic battery longevity. BYD’s Blade cells integrate lithium iron phosphate (LFP) chemistry with ceramic-coated separators, achieving 1.2 million km lifespan in taxis with <10% capacity loss after 4,000 cycles

. Dry electrode processing, as used in Tesla’s 4680 cells, eliminates toxic N-methyl-2-pyrrolidone (NMP) solvents during electrode fabrication, reducing factory emissions by 48% while improving electrode adhesion and cycle resilience . AI-driven production monitoring at CATL facilities detects micron-level electrode misalignments before assembly, cutting early-life failure rates by 95% and extending average lifespan by 3.1 years .

Regulatory Frameworks and Circular Economy Models

The EU Battery Regulation (2023) enforces digital passports tracking lithium and cobalt content, coupled with extended producer responsibility fees funding collection infrastructure, targeting 95% recycling efficiency by 2035

. California’s Lithium-Ion Battery Recycling Act mandates retailer take-back programs, while Australia’s CSIRO invests $38 million in hydrometallurgical hubs to process 120,000 tonnes/year of waste, converting recovered materials into new batteries at 60% lower carbon footprint than virgin sourcing . Corporate partnerships like Apple’s tie-up with Umicore establish closed-loop cobalt recovery chains, ensuring 98% of iPhone battery cobalt re-enters production within 12 months .

Conclusion: Towards Zero-Waste Lithium-Ion Ecosystems

Lithium-ion battery waste stems from electrochemical degradation (SEI growth, lithium plating), environmental stressors (temperature extremes, abusive charging), and linear production models, yet it is addressable through multimodal restoration (electrochemical reconditioning, modular refurbishment), advanced recycling (closed-loop hydrometallurgy, direct cathode regeneration), and systemic prevention (dendrite-proof designs, circular policy frameworks). With recycling technologies slashing production emissions by 89% and restoration techniques extending first-life spans beyond 15 years, the industry can avert 85% of projected 2040 waste while meeting 6.5 TWh demand

. Manufacturers adopting these strategies will dominate the $150 billion battery market while aligning with EU carbon border adjustments and UN sustainable development goals, transforming lithium-ion technology from a waste liability into a circular clean-energy pillar.

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More