Tech Breakthrough: Is This The End Of Lithium-Ion Batteries?

Tech Breakthrough: Is This The End Of Lithium-Ion Batteries?

The Emerging Challenge to Lithium-Ion Dominance

The energy storage industry is currently experiencing a period of unprecedented innovation that is fundamentally challenging the long-standing dominance of lithium-ion battery technology across multiple sectors. For nearly three decades, lithium-ion batteries have represented the gold standard in portable power solutions, enabling everything from the mobile computing revolution to the ongoing transition toward electric transportation systems. However, a convergence of scientific breakthroughs across several alternative battery technologies is now threatening to disrupt this established order, promising performance characteristics that could potentially render current lithium-ion solutions obsolete in certain applications. These advancements come at a critical juncture when the limitations of lithium-ion technology are becoming increasingly apparent—from resource constraints and supply chain vulnerabilities to safety concerns and performance ceilings that have proven difficult to突破. While lithium-ion batteries will undoubtedly maintain commercial relevance for the foreseeable future, the technological landscape is shifting in ways that suggest their unchallenged reign may be approaching its conclusion as newer, more advanced technologies transition from laboratory demonstrations to commercial products.

Solid-State Battery Technology Revolution

Fundamental Architecture and Performance Advantages

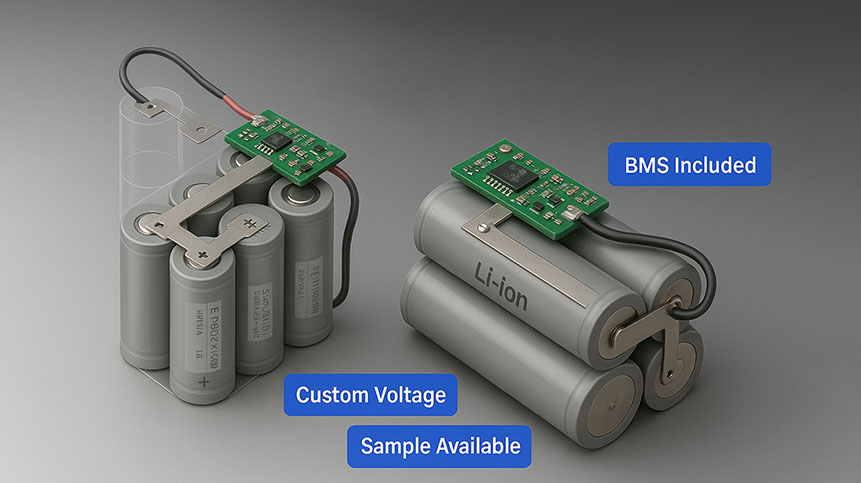

Solid-state battery technology represents the most direct threat to conventional lithium-ion dominance, addressing many of the fundamental limitations that have persisted despite incremental improvements to liquid electrolyte systems. Unlike traditional lithium-ion batteries that utilize liquid or gel electrolytes, solid-state batteries employ solid electrolytes that completely eliminate the flammable components responsible for thermal runaway events that have plagued consumer electronics and electric vehicles. This architectural shift enables the use of lithium metal anodes instead of the graphite anodes found in conventional batteries, dramatically increasing energy density potential to levels that could potentially double the range of electric vehicles while significantly reducing the size and weight of portable electronics. The solid electrolyte also demonstrates superior stability at extreme temperatures, overcoming one of the most significant limitations of current lithium-ion technology and expanding potential applications to environments where thermal management has previously been problematic or impossible.

Commercialization Progress and Manufacturing Challenges

The transition from laboratory prototype to commercial product has historically represented the most significant hurdle for alternative battery technologies, but solid-state batteries are rapidly overcoming these challenges through substantial investments from both established industry players and well-funded startups. Several automotive manufacturers have announced partnerships with solid-state battery developers targeting production vehicle integration within the next 2-3 years, with pilot manufacturing facilities already producing sample cells at near-commercial specifications. The manufacturing processes for solid-state batteries differ significantly from conventional lithium-ion production, requiring new equipment and techniques for handling solid electrolyte materials and ensuring perfect interfacial contact between components. These production complexities initially raised concerns about cost scalability, but recent innovations in materials processing and cell assembly have demonstrated a clear path toward cost parity with advanced lithium-ion cells once manufacturing achieves sufficient scale, potentially within the next 5-7 years according to industry analysts.

Sodium-Ion Battery Technology Development

Cost and Resource Advantages Over Lithium-Ion

Sodium-ion battery technology has emerged as another formidable challenger to lithium-ion dominance, particularly for applications where cost, resource availability, and environmental considerations outweigh the need for maximum energy density. The fundamental advantage of sodium-ion technology lies in the abundance and geographic distribution of sodium resources, which are approximately 1000 times more plentiful in the Earth's crust than lithium and far more evenly distributed globally, eliminating the supply chain concerns and price volatility associated with lithium mining. Sodium-ion batteries utilize aluminum rather than copper for the current collector on the anode side, further reducing material costs and simplifying recycling processes while maintaining performance characteristics that are increasingly competitive with lithium iron phosphate (LFP) batteries in stationary storage applications. The similar electrochemistry between sodium-ion and lithium-ion systems has allowed manufacturers to adapt existing production infrastructure with relatively modest retooling requirements, accelerating commercialization timelines and reducing barriers to market entry.

Performance Characteristics and Application Focus

While sodium-ion batteries traditionally lagged behind lithium-ion in terms of energy density, recent advancements have narrowed this gap significantly, with current commercial offerings achieving energy densities that approach those of early lithium-ion batteries while offering superior performance in other metrics. Sodium-ion chemistry demonstrates exceptional cycle life, typically exceeding 3000-5000 cycles with minimal capacity degradation, making it particularly suitable for applications requiring frequent charging and discharging such as grid energy storage and frequency regulation. The thermal stability of sodium-ion systems surpasses that of conventional lithium-ion batteries, operating safely across a wider temperature range without the risk of thermal runaway events that necessitate complex battery management systems in large-scale installations. These characteristics have positioned sodium-ion technology as the leading contender to replace lithium-ion in stationary storage applications where weight and volume are less critical than cost, safety, and longevity, with several major energy storage projects already specifying sodium-ion batteries for upcoming installations.

Comparative Analysis of Battery Technologies

Performance Metrics and Trade-Offs

The evolving landscape of energy storage technologies presents potential adopters with a complex array of options, each offering distinct advantages and compromises across multiple performance dimensions. The following comparative analysis illustrates the relative positioning of emerging technologies against established lithium-ion solutions based on current commercial offerings and near-term projections from leading developers:

| Performance Metric | Lithium-Ion (NMC) | Solid-State | Sodium-Ion | Lithium Iron Phosphate |

|---|---|---|---|---|

| Energy Density (Wh/kg) | 200-250 | 350-500 (projected) | 120-160 | 140-180 |

| Cycle Life (to 80% capacity) | 1000-2000 | 1000+ (estimated) | 3000-5000 | 3000-6000 |

| Cost ($/kWh) | $120-150 | $200-300 (projected) | $70-100 | $90-120 |

| Charge Rate (C) | 1-3 | 2-4 (estimated) | 1-2 | 1-2 |

| Temperature Range | -20°C to 60°C | -30°C to 100°C (estimated) | -30°C to 70°C | -20°C to 65°C |

| Safety Profile | Moderate | High | High | High |

| Resource Availability | Limited | Limited | Abundant | Moderate |

Application-Specific Technology Selection

The diversification of battery technologies is creating increasingly specialized solutions optimized for particular use cases rather than the one-size-fits-all approach that has characterized the lithium-ion era. Electric vehicles are likely to see a bifurcation between premium segments adopting solid-state technology for maximum range and performance and mass-market segments utilizing improved lithium iron phosphate or advanced sodium-ion batteries where cost considerations dominate. Stationary energy storage applications appear to be shifting toward sodium-ion and lithium iron phosphate chemistries due to their superior cycle life, enhanced safety characteristics, and reduced resource constraints, particularly for large-scale grid storage where these factors outweigh energy density considerations. Consumer electronics will likely continue to prioritize energy density above other factors, maintaining demand for advanced lithium-ion formulations until solid-state technology achieves sufficient manufacturing scale to become cost-competitive, potentially around 2028-2030 according to industry projections.

Market Impact and Transition Timeline

Industrial Response and Strategic Positioning

The battery industry and its downstream customers are responding to these technological developments with strategic repositioning that acknowledges the likelihood of a diversified energy storage landscape rather than a single dominant technology. Established lithium-ion manufacturers are investing heavily in research and development to improve their existing products while simultaneously developing next-generation technologies through specialized subsidiaries or partnerships with research institutions. Automotive manufacturers are pursuing multi-technology sourcing strategies to avoid over-reliance on any single battery chemistry, with several major companies announcing partnerships across solid-state, sodium-ion, and advanced lithium-ion developers to ensure access to the most appropriate technology for each vehicle segment. This strategic diversification is creating a more resilient supply chain less vulnerable to resource constraints or geopolitical tensions surrounding critical materials, potentially leading to more stable pricing and improved availability as multiple technology pathways develop in parallel rather than sequential replacement.

Adoption Timeline and Technology Coexistence

The transition from current lithium-ion technology to emerging alternatives will likely occur gradually over the next decade rather than as an abrupt replacement, with different technologies dominating specific application segments based on their particular advantages. The existing manufacturing infrastructure for lithium-ion batteries represents a massive investment that will continue to produce cells for years to come, particularly as incremental improvements extend the performance and cost competitiveness of current technologies. Industry analysts project that lithium-ion will maintain majority market share in most applications until at least 2025-2027, with alternative technologies gradually capturing specific segments where their advantages are most pronounced before expanding into broader markets as manufacturing scale improves costs. This extended transition period will allow for the necessary development of supply chains, recycling infrastructure, and industry standards for newer technologies while minimizing disruption to existing markets and applications that continue to be well-served by lithium-ion solutions.

Environmental and Sustainability Considerations

Lifecycle Assessment and Circular Economy Potential

The environmental implications of transitioning beyond lithium-ion batteries extend beyond simple performance comparisons to encompass full lifecycle considerations including resource extraction, manufacturing emissions, operational efficiency, and end-of-life management. Solid-state batteries offer potential environmental advantages through higher energy density (reducing materials usage per unit of storage) and the elimination of flammable electrolytes that complicate transportation and recycling, though their dependence on lithium and other scarce elements remains a concern. Sodium-ion technology demonstrates superior environmental credentials across multiple metrics due to the abundance of its primary materials, reduced mining impacts, and compatibility with less energy-intensive manufacturing processes that can be powered by renewable energy sources. The evolving regulatory landscape around battery recycling and material recovery is likely to further advantage technologies that utilize more common materials with established recycling pathways, potentially accelerating the adoption of alternatives to conventional lithium-ion chemistry in markets with stringent environmental regulations.

Resource Constraints and Geopolitical Implications

The geopolitical dimensions of energy storage technology are becoming increasingly significant as countries seek to secure access to critical materials while reducing dependence on potentially unstable or adversarial trading partners. Conventional lithium-ion batteries rely heavily on materials including lithium, cobalt, and nickel that are concentrated in relatively few countries, creating supply chain vulnerabilities that have prompted extensive research into alternative chemistries. Solid-state batteries typically reduce but do not eliminate dependence on lithium, though some formulations utilize significantly smaller quantities per kilowatt-hour of capacity. Sodium-ion technology offers the most dramatic reduction in geopolitical supply risk by utilizing some of the most abundant materials on Earth, potentially enabling more distributed manufacturing and reducing the strategic importance of specific mineral-producing regions. This geopolitical dimension is driving significant government investment in alternative battery technologies through research funding, manufacturing incentives, and strategic stockpiling programs that are accelerating development timelines beyond what market forces alone would achieve.

-

May.2025.08.19Temperature and Resistance Characteristics of Lithium-Ion BatteriesLearn More

May.2025.08.19Temperature and Resistance Characteristics of Lithium-Ion BatteriesLearn More -

May.2025.08.1225.2 Volt 8.7 Ah Lithium Battery for the EV Rider Transport AF S19AF – Complete GuideLearn More

May.2025.08.1225.2 Volt 8.7 Ah Lithium Battery for the EV Rider Transport AF S19AF – Complete GuideLearn More -

May.2025.08.11Analysis of Lithium-Ion Battery Electrolyte Materials and Their FunctionsLearn More

May.2025.08.11Analysis of Lithium-Ion Battery Electrolyte Materials and Their FunctionsLearn More -

May.2025.08.05How Rechargeable Batteries Are Suitable in 2025: The Future of Energy StorageLearn More

May.2025.08.05How Rechargeable Batteries Are Suitable in 2025: The Future of Energy StorageLearn More -

May.2025.08.04Are Lithium-ion or NiMH Battery Packs More Cost EffectiveLearn More

May.2025.08.04Are Lithium-ion or NiMH Battery Packs More Cost EffectiveLearn More