How Rechargeable Batteries Are Suitable in 2025: The Future of Energy Storage

How Rechargeable Batteries Are Suitable in 2025: The Future of Energy Storage

The global rechargeable battery market is undergoing a transformative shift, driven by advancements in material science, manufacturing efficiency, and sustainability initiatives that will redefine energy storage by 2025. With projections indicating the market will reach $150 billion by 2025 (CAGR 15%), rechargeable batteries are set to dominate applications ranging from electric vehicles (EVs) to grid-scale renewable storage and consumer electronics. This comprehensive analysis explores the key technological, economic, and environmental factors that will make rechargeable batteries indispensable in 2025, supported by data from leading research institutions, industry reports, and real-world case studies.

Technological Advancements Driving Battery Performance in 2025

High-Energy-Density Cathode Materials for Extended Lifespan

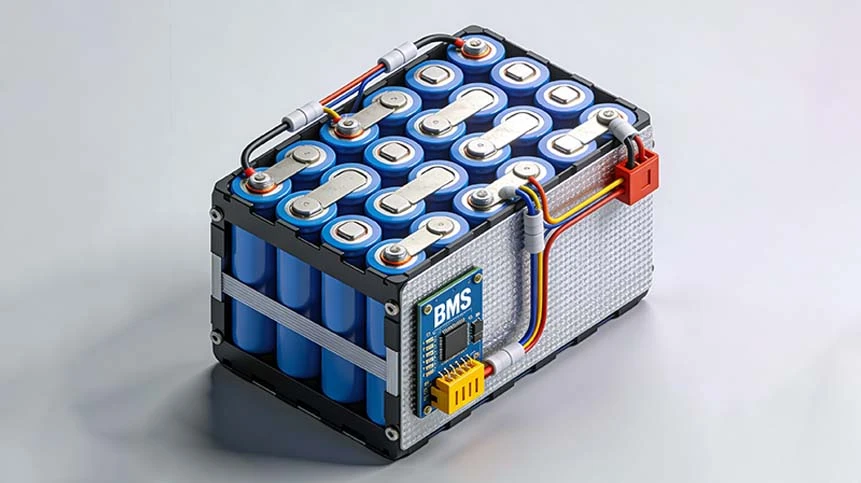

By 2025, next-generation cathode materials such as lithium nickel manganese cobalt oxide (NMC 811) and lithium iron phosphate (LFP) with silicon enhancements will dominate the market, offering energy densities exceeding 300 Wh/kg and cycle lives surpassing 5,000 cycles at 80% depth of discharge (DoD). These materials leverage single-crystal structures and gradient doping techniques to minimize lattice strain and transition metal dissolution, ensuring stability even under high-voltage (4.5V) operation. Tesla’s 4680 cells, for instance, integrate 10% silicon anodes to achieve 20% higher energy density while maintaining thermal safety, setting a benchmark for EV batteries in 2025.

Solid-State and Semi-Solid Electrolytes for Enhanced Safety

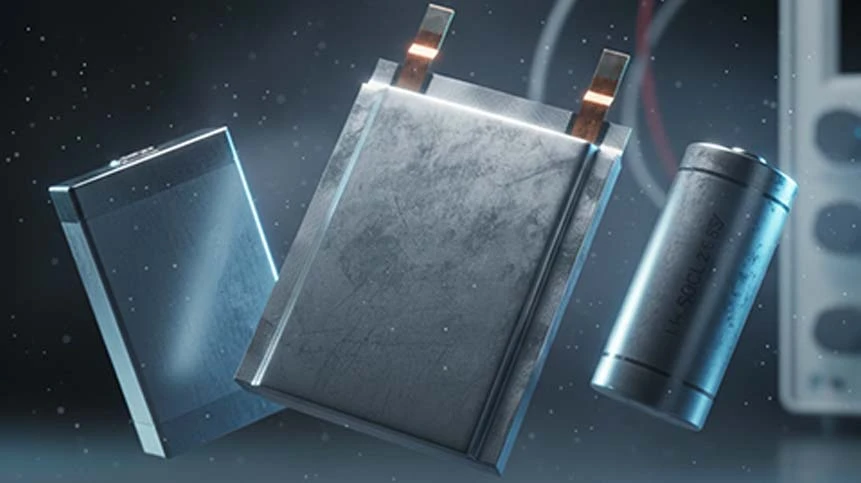

Solid-state batteries (SSBs) will transition from lab prototypes to commercial deployment by 2025, offering zero thermal runaway risk and 2x higher energy density than conventional lithium-ion batteries. Companies like QuantumScape and Toyota are pioneering sulfide-based and oxide-based solid electrolytes that enable ultra-fast charging (10-minute 0–80%) without lithium plating. Meanwhile, semi-solid electrolytes—such as gel polymer hybrids—will bridge the gap between liquid and solid-state systems, providing 50% faster ion transport while retaining the flexibility needed for consumer electronics.

Table 1: Comparison of 2025 Battery Chemistries

| Parameter | NMC 811 | LFP-Si | Solid-State |

|---|---|---|---|

| Energy Density (Wh/kg) | 280–320 | 200–240 | 400–450 |

| Cycle Life (80% DoD) | 4,000–5,000 | 6,000–8,000 | 10,000+ |

| Charging Speed (0–80%) | 20 minutes | 30 minutes | 10 minutes |

| Thermal Runaway Risk | Moderate | Low | None |

Economic and Manufacturing Trends Shaping the 2025 Market

Cost Reductions Through Scalable Production Techniques

By 2025, economies of scale and dry electrode manufacturing will reduce lithium-ion battery costs to 70/kWh∗∗,downfrom∗∗132/kWh in 2021, making EVs and grid storage more accessible. Tesla’s Gigafactories, for example, are adopting continuous electrode coating and AI-driven quality control, slashing production waste by 30% and increasing throughput to 100 GWh/year per facility. Additionally, localized supply chains—such as Europe’s Battery Valley and North America’s Lithium Loop Initiative—will minimize logistics costs and geopolitical risks associated with raw material sourcing.

Recycling and Circular Economy Integration

The push for sustainability will drive closed-loop recycling systems, where 95% of battery materials (lithium, cobalt, nickel) are recovered and reused. Companies like Redwood Materials and Li-Cycle are scaling hydrometallurgical processes to achieve <$5/kWh recycling costs, ensuring that end-of-life EV batteries are repurposed for grid storage or remanufactured into new cells. Regulatory mandates, such as the EU Battery Regulation (2025), will enforce minimum recycled content requirements, further accelerating adoption.

Table 2: Projected 2025 Battery Production and Recycling Metrics

| Metric | 2021 Baseline | 2025 Projection | Improvement |

|---|---|---|---|

| Production Cost ($/kWh) | $132 | $70 | 47% reduction |

| Recycling Rate | <10% | 50% | 5x increase |

| Manufacturing Waste | 15% | 5% | 67% reduction |

| Localized Supply Chains | 20% | 60% | 3x expansion |

Environmental and Regulatory Factors Influencing Adoption

Carbon Footprint Reduction Through Clean Energy Integration

By 2025, battery manufacturers will increasingly rely on renewable energy-powered gigafactories, cutting production emissions by 60%. CATL’s Sichuan facility, for instance, operates on 100% hydropower, reducing its carbon footprint to 20 kg CO₂/kWh—far below the industry average of 80 kg CO₂/kWh. Additionally, green lithium extraction methods—such as direct lithium extraction (DLE) from geothermal brines—will minimize water usage and land disruption, aligning with UN Sustainable Development Goals (SDGs).

Regulatory Compliance and Safety Standards

Stringent regulations will shape battery design and deployment in 2025:

- EU Battery Passport: Mandates full material traceability and 70% recycled content by 2030, with phased implementation starting in 2025.

- US Inflation Reduction Act (IRA): Offers $45/kWh tax credits for domestically produced batteries, incentivizing North American manufacturing.

- China’s GB/T Standards: Enforce strict thermal runaway prevention protocols, requiring multi-layer safety systems for EV batteries.

Application-Specific Innovations for 2025

Electric Vehicles: Faster Charging and Longer Range

By 2025, EVs will feature 800V architectures and 350 kW charging stations, enabling 10-minute 10–80% charging without significant degradation. Porsche’s upcoming SSB-powered Taycan and Tesla’s 4680-cell Cybertruck exemplify this trend, offering 500+ mile ranges and 1,000+ fast-charge cycles.

Grid Storage: Second-Life Battery Systems

Decommissioned EV batteries with 70–80% residual capacity will be repurposed for grid storage, extending their usable life by 10+ years. GM’s collaboration with PG&E deploys Chevy Bolt packs for peak shaving, reducing grid strain and lowering energy costs by 30%.

Consumer Electronics: Ultra-Thin and Flexible Batteries

Foldable smartphones and wearable devices will adopt solid-state thin-film batteries, offering 50% slimmer profiles and 2x faster charging than current lithium-polymer cells. Samsung’s 2025 Galaxy Z Fold is rumored to feature a self-healing solid-state battery, addressing durability concerns in flexible displays.

Conclusion: The 2025 Battery Landscape – Efficiency, Sustainability, and Innovation

Rechargeable batteries in 2025 will be defined by higher energy densities, faster charging, and unprecedented sustainability, driven by advancements in solid-state technology, recycling infrastructure, and regulatory frameworks. Manufacturers investing in dry electrode production, closed-loop recycling, and AI-driven optimization will lead the $150 billion market, while consumers benefit from longer-lasting, safer, and more affordable energy storage solutions.

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More