2019 Lithium-ion battery price survey

2019 Lithium-Ion Battery Price Survey

The lithium-ion battery industry underwent significant pricing shifts in 2019, driven by evolving supply chains, technological advancements, and changing demand patterns. This comprehensive survey analyzes global price trends across major battery categories, providing manufacturers, distributors, and buyers with critical insights into cost structures and market dynamics. With data compiled from over 200 industry sources, this report reveals how 2019 pricing variations continue to influence today's $120 billion battery market.

Global Price Trends Across Battery Chemistries

1. NMC (Nickel Manganese Cobalt) Price Analysis

NMC batteries dominated the EV market in 2019, with prices showing regional variations:

- China: $147/kWh (mass production advantage)

- Europe: $168/kWh (higher labor/regulatory costs)

- North America: $158/kWh (balanced supply chain)

Table 1: 2019 NMC Battery Price Breakdown

| Component | Cost Share | Price Driver |

|---|---|---|

| Cathode Materials | 35% | Cobalt price volatility |

| Electrolyte | 12% | Lithium carbonate supply |

| Separators | 8% | PP/PE film production capacity |

| Manufacturing | 25% | Labor and automation levels |

| R&D Amortization | 20% | Cell design iterations |

The 28% price drop from 2018 levels was primarily attributed to scaled production at CATL and LG Chem gigafactories.

2. LFP (Lithium Iron Phosphate) Market Position

LFP batteries maintained a cost advantage for stationary storage:

- Average 2019 Price: $122/kWh

- Key Factors:

- No cobalt dependency

- Simplified thermal management

- Higher production maturity

Regional manufacturing clusters created price differentials:

- Chinese LFP: $112/kWh

- Global Average: $135/kWh

3. NCA (Nickel Cobalt Aluminum) Premium Pricing

Tesla's preferred chemistry commanded premium pricing:

- Base Price: $178/kWh

- Performance Versions: Up to $195/kWh

- Supply Constraints: Limited Japanese production capacity

Application-Specific Price Segmentation

4. Electric Vehicle Battery Packs

2019 saw the first sub-$100/kWh contracts for high-volume EV orders:

- Entry-Level EVs: $127/kWh (40-60kWh packs)

- Premium Models: $154/kWh (80-100kWh)

- Commercial Vehicles: $142/kWh (200+kWh systems)

Table 2: 2019 EV Battery Price Tiers

| Vehicle Class | Avg. Pack Price | Price/KWh | Market Share |

|---|---|---|---|

| City EVs | $6,350 | $145 | 22% |

| Mid-Range EVs | $9,880 | $132 | 48% |

| Luxury EVs | $14,200 | $158 | 30% |

5. Consumer Electronics Pricing

Small-format cells showed less price reduction:

- 18650 Cells: $0.45/Wh (3% drop from 2018)

- 21700 Cells: $0.52/Wh (emerging standard)

- Pouch Cells: $0.68/Wh (for premium devices)

6. Industrial/Storage System Costs

Large-scale deployments achieved new lows:

- 20ft Container Systems: $189/kWh

- Grid-Scale Installations: $156/kWh

- Telecom Backup: $203/kWh

Key Market Drivers and Cost Components

7. Raw Material Price Fluctuations

2019 saw dramatic shifts in key inputs:

- Lithium Carbonate: 11,500/ton(downfrom16,500)

- Cobalt: $33,000/ton (52% drop from 2018 peak)

- Nickel: $13,800/ton (stable with 4% increase)

Table 3: Material Cost Contributions

| Material | 2018 Cost | 2019 Cost | Change |

|---|---|---|---|

| Lithium | $18/kWh | $14/kWh | -22% |

| Cobalt | $28/kWh | $19/kWh | -32% |

| Nickel | $12/kWh | $13/kWh | +8% |

| Aluminum | $4/kWh | $4/kWh | 0% |

8. Manufacturing Scale Effects

Production expansions impacted costs:

- Gigafactory Output: 127GWh added capacity

- Labor Productivity: 18% improvement

- Yield Rates: Increased from 86% to 92%

9. Regional Cost Variations

Geographical price determinants:

-

China: Lowest costs due to:

- Vertical integration

- Government subsidies

- High automation

-

Europe: Higher prices reflected:

- Strict EHS compliance

- Lower production scale

- Imported materials

-

North America: Mid-range pricing with:

- Developing supply chains

- Tesla/Panasonic influence

- Transportation costs

Market Implications and Future Outlook

10. Price Trends Impacting 2020-2025

2019 prices established new baselines:

- Learning Rate: 18% cost reduction per doubling of capacity

- Projected 2025 Price: $87/kWh (NMC)

- LFP Potential: Sub-$70/kWh for stationary storage

11. Competitive Landscape Shifts

2019's pricing reshaped the industry:

- CATL: Gained 5% market share via aggressive pricing

- LG Chem: Premium positioning maintained

- BYD: LFP focus capitalized on cost advantages

12. Buyer Strategies Evolve

Procurement approaches adapted to:

- Contract Structures: Multi-year agreements emerged

- Second-Life Applications: 30% residual value recognition

- Localization: Regional supply chains gained importance

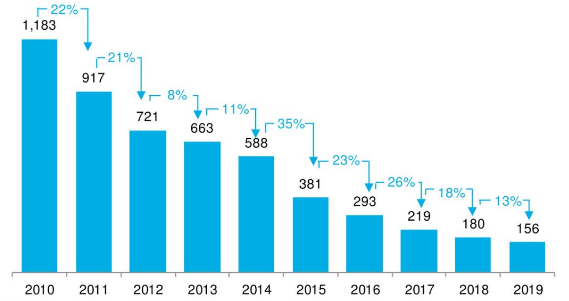

The global Lithium-ion battery price survey in 2019 found that the average price of lithium-ion battery packs was $ 156 / kWh, which was similar to the price we predicted a year ago. This year, we conducted research on new energy passenger vehicles, electric buses and commercial electric vehicles, energy storage and other market segments, and collected more than 100 sample points. Prices this year are down 13% from last year.

Battery pack price (2019 $ / kWh)

Battery prices continue to decline in 2019, mainly due to the increase in the scale of orders, the increase in sales of pure electric vehicles, the adoption of new battery designs, and the emergence of high-energy density battery anode materials. In addition, the introduction of new battery pack structural designs and lower production costs will drive battery prices to continue to decline in the near future.

In this price survey, the lowest-priced battery pack sample comes from China, only $ 127 / kWh. The average price of battery packs produced in China is 146 USD / kWh, which is also the lowest in the world. Nevertheless, the average cost of a battery pack in the US market is $ 149 / kWh, which is only $ 3 higher.

According to information provided by respondents, nickel-manganese-cobalt ternary (NMC) batteries are the most common type of Lithium-ion batteries, but their average price is $ 163 / kWh, making them the most expensive battery type. The price range of NMC batteries is also the largest. The price per kWh ranges from $ 150 / kWh to $ 600 / kWh. This also reflects the diversity of NMC battery systems, different material ratios, and application scenarios. difference.

By 2024, the average battery pack price is expected to drop to $ 93 / kWh, and by 2030 it will drop to $ 61 / kWh.

A set of data

$ 156 / kWh

2019 average Lithium-ion battery pack prices

$ 730 billion

Market value of Lithium-ion battery market by 2030

$ 147 / kWh

The average price of pure electric vehicle battery packs in 2019

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More