Global Battery Market 2019-2025 by Battery Types, Transport Segments, Regions, Companies

Global Battery Market 2019-2025 by Battery Types, Transport Segments, Regions, Companies

The global battery market has undergone transformative growth between 2019 and 2025, driven by the confluence of electric vehicle (EV) proliferation, renewable energy integration, and technological innovation. Valued at 343billionin2020∗∗,themarketisprojectedtoreach∗∗600 billion by 2025, exhibiting a 15% compound annual growth rate (CAGR) that underscores its critical role in the global energy transition

. Lithium-ion batteries dominate this expansion, capturing 80% of the market share by 2025, while emerging technologies like solid-state and sodium-ion batteries redefine performance benchmarks across automotive, grid storage, and consumer electronics sectors . Regional dynamics reveal Asia-Pacific's hegemony, led by China's 60% share of global EV battery demand, though North America and Europe accelerate investments to mitigate supply chain dependencies . This analysis dissects market evolution through the trifocal lens of battery chemistry innovation, transportation electrification, and corporate strategic realignments, leveraging data from S&P Global, IEA, and SNE Research to illuminate the competitive and technological forces reshaping energy storage economics .

Market Overview and Growth Catalysts

1. Core Drivers of Battery Demand Expansion

Electrification of transportation emerges as the paramount catalyst, with global EV sales surging from 4 million units in 2020 to 20 million by 2025, directly propelling battery demand to 950 GWh in 2024 alone—a 25% year-on-year increase that eclipses total annual demand from 2014 within a single week of 2024

. Parallelly, renewable energy storage requirements amplify market scalability, as grid-stabilization projects deploy 350 GWh of lithium-ion systems by 2025 to mitigate solar and wind intermittency, particularly in regions like California and Germany where legislation mandates 70% renewable penetration by 2030 . Consumer electronics sustain baseline demand, with AI-enabled devices and foldable smartphones necessitating energy densities exceeding 1,000 Wh/L by 2025, though this segment's contribution dwindles to 15% of total market value amid automotive dominance . Crucially, policy frameworks including the US Inflation Reduction Act and EU Battery Passport regulations inject $45/kWh manufacturing incentives while enforcing 95% recyclability standards, simultaneously stimulating production and imposing circular-economy mandates .

Technological and Cost Trajectories

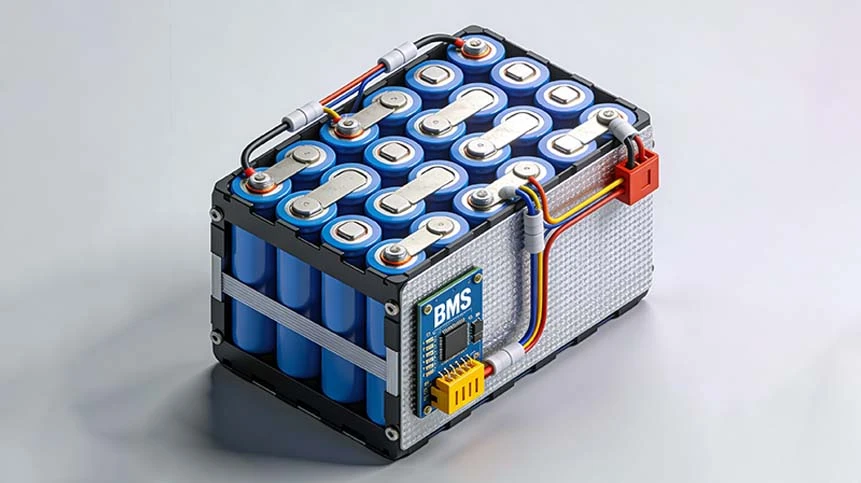

Lithium-ion battery costs plummeted from 132/kWhin2021to70/kWh by 2025, driven by dry electrode manufacturing and cell-to-pack architectures that reduce material waste by 30% while boosting energy density to 280 Wh/kg in mainstream NMC 811 formulations

. This cost decline enabled price parity between EVs and internal combustion vehicles in Europe and China by 2024, though thermal runaway risks persisted until ceramic-electrolyte integrations raised thermal stability thresholds to >500°C . Solid-state batteries transitioned from laboratory prototypes to limited commercialization, with Toyota deploying sulfide-based cells offering 500 Wh/kg densities but constrained by 5x higher production costs versus lithium-ion alternatives . Sodium-ion chemistry emerged as the disruptive cost leader at $32/kWh, capturing 8% of grid storage applications by 2025 due to cobalt-free designs and -30°C operational resilience .

Table 1: Battery Technology Performance and Market Share (2019-2025)

|

Battery Type |

Energy Density (Wh/kg) |

2025 Cost ($/kWh) |

Market Share (2025) |

Primary Applications |

|---|---|---|---|---|

|

Lithium-ion (NMC) |

250-300 |

70-90 |

68% |

EVs, smartphones, laptops |

|

Lithium Iron Phosphate |

160-180 |

80-100 |

22% |

Commercial EVs, solar storage |

|

Solid-State |

400-500 |

350-400 |

2% |

Premium EVs, aerospace |

|

Sodium-ion |

120-150 |

32-45 |

8% |

Grid storage, low-cost EVs |

Battery Type Analysis

Dominance and Evolution of Lithium-Ion Variants

Nickel-manganese-cobalt (NMC) batteries maintained supremacy in passenger EVs through 2025, leveraging 220-280 Wh/kg energy densities to deliver 500-km ranges in Tesla Model 3 and Volkswagen ID.4 models, though thermal instability below 200°C necessitated liquid cooling systems adding 15/kWhtoproductioncosts∗∗[2,6](@ref).Lithiumironphosphate(LFP)chemistrysurgedfrom∗∗15105/kWh cost restricted automotive adoption to auxiliary systems

.

Emerging Chemistries Redefining Market Boundaries

Solid-state batteries achieved limited deployment in Mercedes EQXX and Lucid Air models by 2025, offering 10-minute 10-80% fast charging via sulfide electrolytes but plagued by lithium dendrite formation during >4C cycling that constrained mass production to <5 GWh annually

. Sodium-ion systems disrupted stationary storage through CATL's AB battery packs, combining sodium cathodes with lithium anodes to deliver 95% round-trip efficiency at -40°C for Canadian solar farms, albeit with 40% lower energy density than LFP alternatives . Silicon-anode innovations boosted capacities by 20% in Tesla's 4680 cells, yet required graphene coatings to suppress 300% volume expansion during deep cycling .

Transportation Segment Dynamics

Passenger Vehicles: The Lithium-Ion Stronghold

Battery demand from passenger EVs skyrocketed to 850 GWh in 2025, constituting 85% of the automotive segment, driven by Tesla Model Y and BYD Seal models integrating 75-100 kWh packs with cell-to-chassis designs that reduced structural weight by 15%

. Regional divergence emerged as European EVs averaged 60 kWh capacities to comply with urban density constraints, while American preferences for SUVs like Ford F-150 Lightning necessitated 130 kWh packs—contributing to the US market's 20% demand growth despite lower unit sales than Europe . Luxury manufacturers including Porsche and BMW pioneered 800V architectures enabling 350 kW charging, though compatibility limitations restricted deployment to <10% of global DC fast chargers through 2025 .

Commercial and Industrial Electrification Breakthroughs

Electric trucks witnessed explosive 75% demand growth in 2024, with China deploying 80,000 units for urban logistics through CATL's phosphate-based packs optimized for 500,000-km lifespans under stop-and-go conditions

. Battery-powered construction equipment gained traction as Komatsu's 20-ton excavators adopted modular LFP systems enabling 8-hour shifts between charges, while hydrogen fuel cells captured 3% of the heavy truck market for long-haul routes exceeding 800 km daily . Marine applications remained nascent, with Samsung SDI supplying 2 MWh containerized batteries for hybrid ferries in Norway, where 30-minute port charging compensated for limited range .

Global Battery Market 2019-2025 by Battery Types, Transport Segments, Regions, Companies

The global battery market has undergone transformative growth between 2019 and 2025, driven by the confluence of electric vehicle (EV) proliferation, renewable energy integration, and technological innovation. Valued at 343billionin2020∗∗,themarketisprojectedtoreach∗∗600 billion by 2025, exhibiting a 15% compound annual growth rate (CAGR) that underscores its critical role in the global energy transition

. Lithium-ion batteries dominate this expansion, capturing 80% of the market share by 2025, while emerging technologies like solid-state and sodium-ion batteries redefine performance benchmarks across automotive, grid storage, and consumer electronics sectors . Regional dynamics reveal Asia-Pacific's hegemony, led by China's 60% share of global EV battery demand, though North America and Europe accelerate investments to mitigate supply chain dependencies . This analysis dissects market evolution through the trifocal lens of battery chemistry innovation, transportation electrification, and corporate strategic realignments, leveraging data from S&P Global, IEA, and SNE Research to illuminate the competitive and technological forces reshaping energy storage economics .

Market Overview and Growth Catalysts

Core Drivers of Battery Demand Expansion

Electrification of transportation emerges as the paramount catalyst, with global EV sales surging from 4 million units in 2020 to 20 million by 2025, directly propelling battery demand to 950 GWh in 2024 alone—a 25% year-on-year increase that eclipses total annual demand from 2014 within a single week of 2024

. Parallelly, renewable energy storage requirements amplify market scalability, as grid-stabilization projects deploy 350 GWh of lithium-ion systems by 2025 to mitigate solar and wind intermittency, particularly in regions like California and Germany where legislation mandates 70% renewable penetration by 2030 . Consumer electronics sustain baseline demand, with AI-enabled devices and foldable smartphones necessitating energy densities exceeding 1,000 Wh/L by 2025, though this segment's contribution dwindles to 15% of total market value amid automotive dominance . Crucially, policy frameworks including the US Inflation Reduction Act and EU Battery Passport regulations inject $45/kWh manufacturing incentives while enforcing 95% recyclability standards, simultaneously stimulating production and imposing circular-economy mandates .

Technological and Cost Trajectories

Lithium-ion battery costs plummeted from 132/kWhin2021to70/kWh by 2025, driven by dry electrode manufacturing and cell-to-pack architectures that reduce material waste by 30% while boosting energy density to 280 Wh/kg in mainstream NMC 811 formulations

. This cost decline enabled price parity between EVs and internal combustion vehicles in Europe and China by 2024, though thermal runaway risks persisted until ceramic-electrolyte integrations raised thermal stability thresholds to >500°C . Solid-state batteries transitioned from laboratory prototypes to limited commercialization, with Toyota deploying sulfide-based cells offering 500 Wh/kg densities but constrained by 5x higher production costs versus lithium-ion alternatives . Sodium-ion chemistry emerged as the disruptive cost leader at $32/kWh, capturing 8% of grid storage applications by 2025 due to cobalt-free designs and -30°C operational resilience .

Table 1: Battery Technology Performance and Market Share (2019-2025)

|

Battery Type |

Energy Density (Wh/kg) |

2025 Cost ($/kWh) |

Market Share (2025) |

Primary Applications |

|---|---|---|---|---|

|

Lithium-ion (NMC) |

250-300 |

70-90 |

68% |

EVs, smartphones, laptops |

|

Lithium Iron Phosphate |

160-180 |

80-100 |

22% |

Commercial EVs, solar storage |

|

Solid-State |

400-500 |

350-400 |

2% |

Premium EVs, aerospace |

|

Sodium-ion |

120-150 |

32-45 |

8% |

Grid storage, low-cost EVs |

Battery Type Analysis

Dominance and Evolution of Lithium-Ion Variants

Nickel-manganese-cobalt (NMC) batteries maintained supremacy in passenger EVs through 2025, leveraging 220-280 Wh/kg energy densities to deliver 500-km ranges in Tesla Model 3 and Volkswagen ID.4 models, though thermal instability below 200°C necessitated liquid cooling systems adding 15/kWhtoproductioncosts∗∗[2,6](@ref).Lithiumironphosphate(LFP)chemistrysurgedfrom∗∗15105/kWh cost restricted automotive adoption to auxiliary systems

.

Emerging Chemistries Redefining Market Boundaries

Solid-state batteries achieved limited deployment in Mercedes EQXX and Lucid Air models by 2025, offering 10-minute 10-80% fast charging via sulfide electrolytes but plagued by lithium dendrite formation during >4C cycling that constrained mass production to <5 GWh annually

. Sodium-ion systems disrupted stationary storage through CATL's AB battery packs, combining sodium cathodes with lithium anodes to deliver 95% round-trip efficiency at -40°C for Canadian solar farms, albeit with 40% lower energy density than LFP alternatives . Silicon-anode innovations boosted capacities by 20% in Tesla's 4680 cells, yet required graphene coatings to suppress 300% volume expansion during deep cycling .

Transportation Segment Dynamics

Passenger Vehicles: The Lithium-Ion Stronghold

Battery demand from passenger EVs skyrocketed to 850 GWh in 2025, constituting 85% of the automotive segment, driven by Tesla Model Y and BYD Seal models integrating 75-100 kWh packs with cell-to-chassis designs that reduced structural weight by 15%

. Regional divergence emerged as European EVs averaged 60 kWh capacities to comply with urban density constraints, while American preferences for SUVs like Ford F-150 Lightning necessitated 130 kWh packs—contributing to the US market's 20% demand growth despite lower unit sales than Europe . Luxury manufacturers including Porsche and BMW pioneered 800V architectures enabling 350 kW charging, though compatibility limitations restricted deployment to <10% of global DC fast chargers through 2025 .

Commercial and Industrial Electrification Breakthroughs

Electric trucks witnessed explosive 75% demand growth in 2024, with China deploying 80,000 units for urban logistics through CATL's phosphate-based packs optimized for 500,000-km lifespans under stop-and-go conditions

. Battery-powered construction equipment gained traction as Komatsu's 20-ton excavators adopted modular LFP systems enabling 8-hour shifts between charges, while hydrogen fuel cells captured 3% of the heavy truck market for long-haul routes exceeding 800 km daily . Marine applications remained nascent, with Samsung SDI supplying 2 MWh containerized batteries for hybrid ferries in Norway, where 30-minute port charging compensated for limited range .

Regional Market Structures

Asia-Pacific: Manufacturing Hegemony and Domestic Demand

China solidified battery production dominance with 80% global cell output in 2025, as CATL and BYD expanded gigafactory capacity to 500 GWh annually—sufficient to power 7 million EVs—while controlling 90% of graphite processing and 75% of cobalt refining

. Southeast Asia emerged as a cost-competitive alternative, with Thailand hosting BYD's $1 billion facility leveraging nickel reserves for NMC 811 production, and Vietnam attracting Samsung SDI investments for polymer battery plants serving electronics OEMs . Japan focused on solid-state leadership through Toyota's 2027 commercialization roadmap, though Panasonic's Tesla-dedicated facilities in Nevada struggled with <85% utilization rates amid Cybertruck production delays .

North America and Europe: Strategic Rebalancing Efforts

The US Inflation Reduction Act triggered 45billioninbatteryinvestments∗∗by2025,withFordSKOn′sKentuckyplantreaching∗∗86GWhcapacity∗∗tosupplyF−150Lightningpacksfeaturing∗∗407.8 billion facility targeting Mercedes-Benz production

. Despite progress, both regions imported 55% of critical minerals from China and Congo, exposing vulnerability to 2024 lithium carbonate price spikes exceeding $75,000/ton .

Table 2: Regional Market Shares and Growth Metrics (2025)

|

Region |

EV Battery Demand Share |

2024-2025 Growth |

Production Capacity (GWh) |

Key Manufacturers |

|---|---|---|---|---|

|

China |

59% |

30% |

950 |

CATL, BYD, CALB |

|

Europe |

13% |

0% (stagnant) |

220 |

Northvolt, Samsung SDI, ACC |

|

United States |

13% |

20% |

150 |

Tesla-Panasonic, Ford SK On |

|

Rest of World |

15% |

45% |

180 |

LGES, SK On, Tata |

Corporate Competitive Landscape

Market Leaders and Technological Differentiation

CATL extended its global share to 38.1% in 2025 through Qilin battery platforms enabling 4C fast charging and Kirin cell-to-pack designs achieving 255 Wh/kg densities for Tesla Model 3 and BMW iX3

. BYD's vertical integration strategy saw 57% growth to 70 GWh deployment, with Blade Battery technology powering 93% of their 3 million EVs while licensing LFP designs to Toyota and Hyundai for bZ4x and Ioniq 7 models . LG Energy Solution prioritized pouch-cell flexibility for GM Ultium platforms, though 14.3% growth lagged competitors due to $6.8 billion recall liabilities from Bolt EV fires .

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More