Which is better, lead-acid battery or Lithium iron phosphate battery?

Which is better, lead-acid battery or Lithium iron phosphate battery?

In the rapidly evolving world of energy storage, a critical question emerges for industries, businesses, and consumers alike: Which power source truly delivers superior performance, reliability, and value for your specific application? The longstanding dominance of lead-acid batteries is being rigorously challenged by the advanced capabilities of Lithium Iron Phosphate (LFP) technology, creating a complex landscape of technical specifications and economic considerations. This comprehensive analysis delves into the fundamental characteristics, operational parameters, and long-term viability of both battery chemistries, providing you with the empirical data and contextual understanding necessary to make a fully informed decision. We will systematically explore every critical aspect, from energy density and lifecycle costs to environmental impact and safety protocols, ensuring you possess all the requisite knowledge to select the optimal energy storage solution for your unique requirements and operational constraints. The global shift towards more efficient and sustainable technologies makes this comparison not merely an academic exercise but a crucial strategic evaluation for anyone invested in the future of power management.

Fundamental Technical Specifications and Performance Metrics

When evaluating energy storage solutions, the core technical specifications provide the most objective foundation for comparison. These metrics determine how a battery will perform under real-world conditions and what kind of operational overhead it will require.

Energy Density and Physical Footprint

Lithium Iron Phosphate batteries demonstrate a decisive advantage in energy density, a metric that defines the amount of energy stored per unit of volume or weight. Typical LFP batteries offer an energy density ranging from 90 to 160 watt-hours per kilogram (Wh/kg), whereas traditional lead-acid batteries only provide between 30 and 50 Wh/kg. This significant disparity means that for the same amount of stored energy, an LFP battery system will be substantially smaller and lighter, often by 50-70%. This characteristic is absolutely critical for applications where space and weight are at a premium, such as in electric vehicles, marine applications, and portable power stations. The reduced physical footprint allows for more flexible installation options and can lead to overall design improvements in the final product, enabling engineers to allocate saved space and weight to other critical systems or simply to create a more compact and user-friendly end product.

Cycle Life and Long-Term Durability

Perhaps the most compelling argument for LFP technology lies in its exceptional cycle life. A standard lead-acid battery, even with meticulous maintenance, typically withstands between 300 and 500 full charge-discharge cycles before its capacity degrades to 80% of its original value. In stark contrast, Lithium Iron Phosphate batteries routinely achieve 2,000 to 5,000 cycles, with high-quality models exceeding 7,000 cycles under optimal conditions. This order-of-magnitude difference in longevity translates directly into a dramatically lower cost per cycle over the battery's operational lifespan. For a business or consumer, this means far fewer battery replacements, reduced downtime, and considerably lower long-term ownership costs. The extended cycle life of LFP chemistry is primarily due to its stable cathode material and sophisticated battery management systems that meticulously control charging parameters, preventing the harmful stress and degradation that commonly plague lead-acid units.

Economic Analysis: Initial Investment vs. Total Cost of Ownership

The upfront purchase price often becomes the primary focus for many buyers, but a truly informed economic assessment must extend far beyond this initial figure to encompass the total cost of ownership (TCO).

Upfront Acquisition Costs and Installation

It is an undeniable fact that the initial purchase price of a lead-acid battery bank is significantly lower than that of an equivalent LFP system. One can procure a lead-acid setup for roughly half, or sometimes even a third, of the capital required for a lithium-based alternative. This lower barrier to entry makes lead-acid technology appear immediately attractive for projects with extremely tight initial budgets. However, this narrow focus on acquisition cost paints a dangerously incomplete financial picture. The installation process itself can also incur hidden costs; lead-acid batteries, due to their considerable weight and larger size, often require more robust structural support, specialized handling equipment, and greater labor time for placement and wiring. These ancillary installation expenses can erode a portion of the initial price advantage before the system even becomes operational.

Long-Term Operational and Maintenance Expenses

The true economic superiority of LFP technology reveals itself over time through drastically reduced operational expenditures. Lead-acid batteries suffer from very high rates of self-discharge, often losing 5% or more of their charge per month, which necessitates frequent topping charges even when not in use, thereby increasing electricity consumption. Furthermore, they require regular and labor-intensive maintenance, including periodic watering to replenish lost electrolytes, cleaning of terminals to prevent corrosion, and equalization charges to balance the cells. LFP batteries, conversely, boast exceptionally low self-discharge rates (typically 1-3% per month) and are completely maintenance-free, requiring no watering, terminal cleaning, or equalization. This elimination of routine upkeep saves not only on material costs but also on valuable labor time. When these factors are combined with the vastly longer service life, the total cost of ownership for an LFP system consistently proves to be lower than that of a lead-acid system within a few years, making it the unequivocally smarter financial investment for any long-term application.

Comparative Total Cost of Ownership Over 10 Years (Per kWh of Capacity)

| Cost Component | Lead-Acid Battery | Lithium Iron Phosphate (LFP) Battery |

|---|---|---|

| Initial Purchase Price | $150 - $200 | $400 - $700 |

| Number of Replacements | 3 - 4 times | 0 - 1 time |

| Replacement Cost | $450 - $800 | $0 - $700 |

| Estimated Energy Loss | 15% - 20% | 5% - 8% |

| Maintenance Labor & Materials | Significant | Negligible |

| **Total Projected Cost ** | $1,100+ | $800 - $1,000 |

Safety, Environmental Impact, and Operational Applications

The choice between these technologies extends beyond performance and economics into the critical realms of safety, sustainability, and suitability for specific use cases.

Intrinsic Safety and Built-in Protection Mechanisms

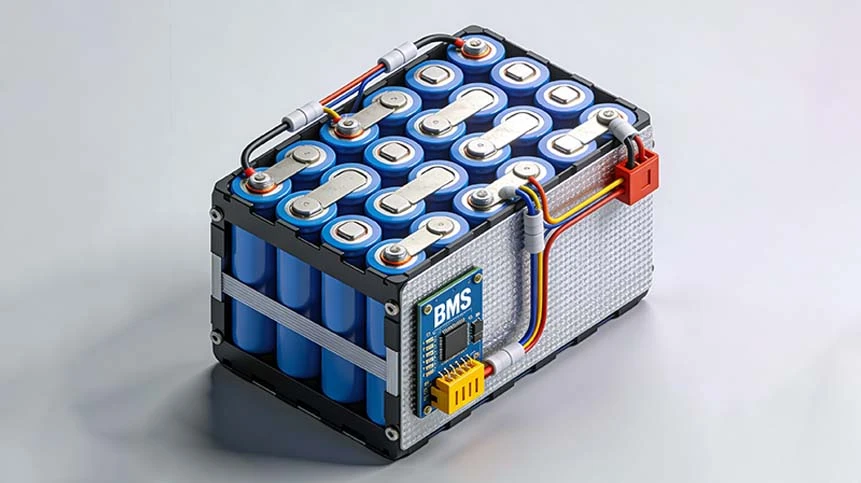

Safety remains a paramount concern for any energy storage system. Lead-acid batteries contain a highly corrosive sulfuric acid electrolyte and can vent explosive hydrogen gas during charging, necessitating installation in well-ventilated areas. LFP batteries are fundamentally safer due to their exceptionally stable chemistry. The phosphate-based cathode material provides outstanding thermal and structural stability, significantly raising the temperature threshold at which thermal runaway could occur. Advanced Battery Management Systems (BMS) are integral to LFP packs, providing multi-layered protection against overcharging, over-discharging, short-circuiting, and extreme temperatures. This proactive electronic oversight continuously monitors and balances each individual cell, ensuring the entire pack operates within its perfectly safe parameters at all times, thereby providing a level of operational safety that is simply unattainable with conventional lead-acid technology.

Environmental Footprint and End-of-Life Recycling

The ecological impact of battery production and disposal is an increasingly important factor for globally conscious businesses. Lead-acid batteries have a well-established and efficient recycling pipeline, with over 99% of the lead content being recoverable in many regions. However, the mining and processing of lead are highly energy-intensive and pose significant environmental and health risks if not managed with extreme care. The electrolyte (sulfuric acid) also presents a hazardous waste challenge. LFP batteries contain no heavy metals like lead or cobalt, which are associated with ethical mining concerns. Their manufacturing process, while still energy-consuming, is generally considered to have a lower overall environmental burden per kilowatt-hour of storage capacity over the full lifecycle. While the recycling infrastructure for lithium-ion batteries is still developing compared to lead-acid, it is rapidly expanding due to growing market volume, driven by investments aimed at recovering valuable lithium, copper, and aluminum, thus promoting a more sustainable circular economy for battery materials.

Ideal Application Scenarios for Each Technology

Each battery type possesses a distinct profile that makes it ideally suited for specific applications. Lead-acid batteries, particularly the Absorbent Glass Mat (AGM) variant, can still be a viable option for projects with severely constrained upfront capital where the system will be used very infrequently, such as in backup power systems for emergency lighting or uninterruptible power supplies (UPS) that may only experience a few discharge cycles per year. Their ability to deliver very high cranking amps also makes them suitable for starting engines in automobiles and generators. Conversely, Lithium Iron Phosphate batteries are the unequivocal superior choice for any application involving regular, deep cycling and where total cost of ownership, reliability, and minimal maintenance are key priorities. This includes solar energy storage systems, electric powertrains for vehicles and marine vessels, off-grid power installations, and industrial equipment that requires dependable daily power. Their resilience, efficiency, and longevity make them the cornerstone of modern, sustainable energy solutions.

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More