Proportion of LiFePO4 batteries increased

Proportion of LiFePO4 Batteries Increased

The Global Shift Toward Lithium Iron Phosphate Technology

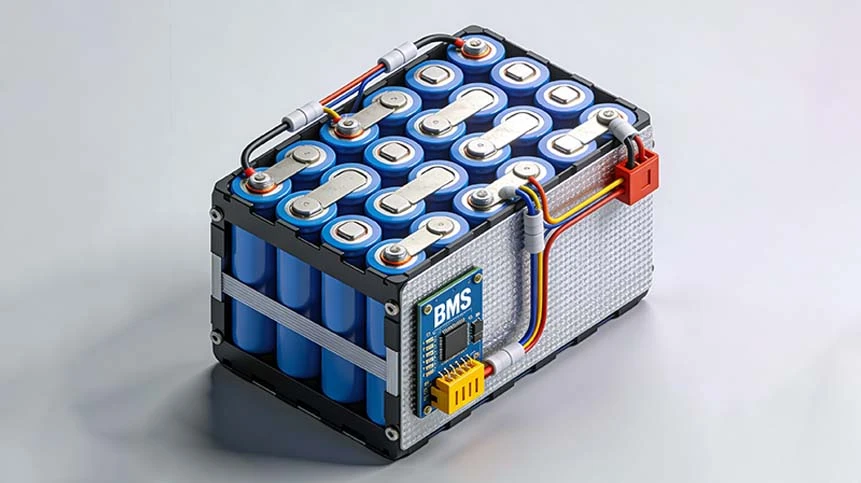

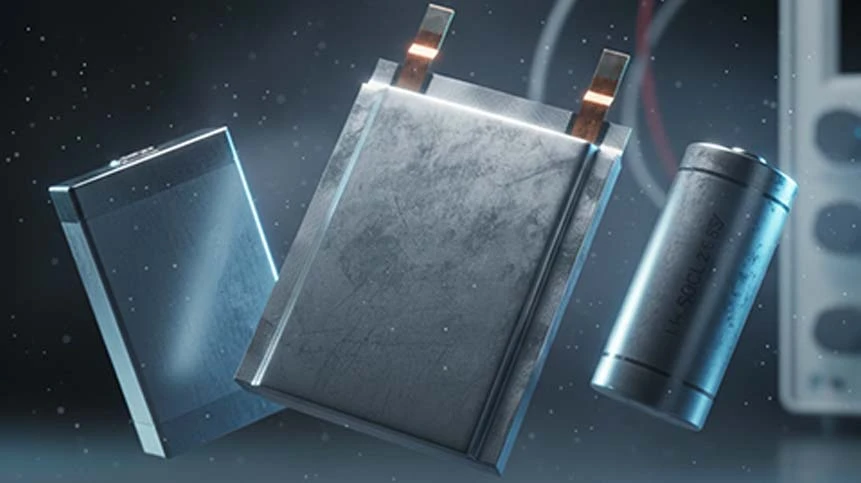

The energy storage industry is currently experiencing a significant transformation as lithium iron phosphate (LiFePO4 or LFP) batteries continue to capture an increasing share of the global market across multiple sectors. This remarkable transition represents a fundamental shift in battery chemistry preferences that is reshaping manufacturing strategies, supply chain dynamics, and product development roadmaps throughout the energy storage ecosystem. While lithium-ion batteries utilizing nickel manganese cobalt (NMC) and other cathode chemistries have dominated the market for decades, recent years have witnessed a dramatic reversal in this trend as technical improvements, manufacturing scale, and changing market priorities have propelled LFP batteries to the forefront of energy storage innovation. The growing proportion of LFP batteries in the global market reflects a sophisticated reevaluation of performance priorities by both manufacturers and end-users, who are increasingly valuing safety, cycle life, and cost-effectiveness over the maximum energy density that has traditionally driven battery chemistry selection. This transition is particularly evident in the electric vehicle industry, where leading manufacturers have announced strategic shifts toward LFP chemistry for standard-range vehicles, as well as in the stationary storage market, where the operational economics increasingly favor LFP's extended lifespan and reduced maintenance requirements.

Technical Advantages Driving Market Adoption

Enhanced Safety Characteristics and Thermal Stability

The superior safety profile of lithium iron phosphate batteries represents one of the most significant factors driving their increased market share, particularly in applications where thermal runaway risks present unacceptable hazards. Unlike conventional lithium-ion chemistries that utilize cobalt-based cathodes, LFP batteries demonstrate exceptional thermal and chemical stability that fundamentally reduces the risk of catastrophic failure events even under abusive conditions such as overcharging, short-circuiting, or physical damage. This inherent safety advantage stems from the strong phosphorus-oxygen bonds in the phosphate cathode material, which remain stable at high temperatures and prevent the oxygen release that can fuel thermal runaway in other lithium-ion chemistries. The higher thermal runaway threshold of LFP batteries—typically exceeding 270°C compared to approximately 150-200°C for NMC batteries—provides crucial additional time for protection systems to activate before dangerous situations develop. These safety characteristics have proven particularly valuable in electric vehicles, where high-profile battery fires have damaged consumer confidence, and in residential energy storage applications, where batteries are installed in close proximity to living spaces.

Extended Cycle Life and Degradation Resistance

The exceptional cycle life of lithium iron phosphate batteries has emerged as a decisive economic factor in applications where frequent charging and discharging operations make long-term durability a critical performance metric. LFP chemistry typically delivers 3,000-5,000 complete charge-discharge cycles while maintaining at least 80% of original capacity, significantly outperforming the 1,000-2,000 cycle lifespan of conventional NMC batteries under similar operating conditions. This extended operational lifespan dramatically reduces the lifetime cost of energy storage systems by minimizing replacement frequency and associated maintenance expenses, particularly in demanding applications such as commercial energy storage, electric buses, and renewable energy integration where daily cycling is common. The degradation mechanisms of LFP batteries also differ favorably from other chemistries, exhibiting more gradual capacity fade without the sudden drop-off that can occur in cobalt-based batteries as they approach end of life. This predictable aging pattern allows for more accurate remaining useful life estimations and reduces the safety margins required in system design, further improving the economic value proposition of LFP technology.

Performance Across Temperature Extremes

Lithium iron phosphate batteries demonstrate superior performance characteristics across a wide temperature range compared to alternative lithium-ion chemistries, maintaining operational capability in environments that would significantly degrade or disable other battery systems. The stable electrochemical properties of the phosphate-based cathode material enable reliable operation at elevated temperatures that would accelerate degradation in cobalt-based batteries, reducing cooling requirements and associated energy consumption in applications such as electric vehicles and grid storage installations. Similarly, LFP batteries maintain better low-temperature performance than many alternatives, with specially formulated versions capable of operating at temperatures as low as -30°C while retaining a significant portion of their room-temperature capacity. This temperature resilience has proven particularly valuable in applications with limited thermal management capabilities, including solar-powered outdoor equipment, marine applications, and infrastructure installations in extreme climates where active temperature control is impractical or prohibitively expensive.

Market Segment Analysis and Adoption Trends

Electric Vehicle Industry Transformation

The automotive industry has emerged as the primary driver behind the increasing proportion of lithium iron phosphate batteries in the global market, with major manufacturers rapidly expanding LFP adoption across their vehicle portfolios. This strategic shift began with standard-range and entry-level vehicles but has progressively expanded to include mid-range models as battery performance improvements have narrowed the energy density gap with alternative chemistries. The economic advantages of LFP chemistry have proven particularly compelling for high-volume vehicle segments where purchase price sensitivity is greatest, enabling manufacturers to offer electric vehicles at increasingly competitive price points without compromising safety or durability. Industry analysts project that LFP batteries will power approximately 40% of all electric vehicles produced globally by 2025, increasing to over 60% by 2030 as manufacturing capacity expands and production costs continue to decline relative to nickel-based alternatives. This transition is supported by substantial investments in LFP production facilities across North America, Europe, and Asia, with announced projects totaling over 500 GWh of annual capacity by 2025.

Stationary Energy Storage Expansion

The stationary energy storage market has demonstrated even more rapid adoption of lithium iron phosphate technology, with LFP batteries capturing an estimated 70-80% of new grid-scale and commercial storage installations globally in 2023. The economic fundamentals of stationary storage applications strongly favor LFP's combination of long cycle life, minimal maintenance requirements, and enhanced safety characteristics, which collectively reduce the levelized cost of storage despite the slightly lower energy density compared to alternative chemistries. Utility-scale projects increasingly specify LFP chemistry due to its superior performance in frequency regulation applications requiring frequent cycling, as well as its reduced fire risk which simplifies insurance underwriting and regulatory approval processes. The residential energy storage market has similarly embraced LFP technology, particularly in markets like Germany and Australia where high penetration of rooftop solar creates demand for safe, durable battery systems that can operate for decades with minimal degradation. The following table illustrates the growing market share of LFP batteries across key applications based on data from industry analysts and market research firms:

| Application Segment | 2021 Market Share | 2023 Market Share | 2025 Projected Share |

|---|---|---|---|

| Electric Vehicles | 18% | 32% | 45% |

| Grid-Scale Storage | 52% | 78% | 85% |

| Residential Storage | 41% | 67% | 80% |

| Commercial Storage | 48% | 75% | 82% |

| Consumer Electronics | 12% | 23% | 35% |

| Industrial Equipment | 35% | 58% | 70% |

Manufacturing Capacity and Supply Chain Dynamics

Global Production Expansion and Geographic Distribution

The increasing proportion of lithium iron phosphate batteries in the global market has triggered massive investments in manufacturing capacity that are reshaping the geographic distribution of battery production worldwide. China currently dominates LFP battery production with approximately 85% of global capacity, though this concentration is rapidly decreasing as new manufacturing facilities come online in North America, Europe, and other Asian countries. The relative simplicity of LFP chemistry compared to nickel-rich alternatives has lowered barriers to entry for new manufacturers, while the absence of cobalt and reduced nickel content eliminates supply chain dependencies on geographically constrained resources that have complicated production of other lithium-ion batteries. Current projections indicate that global LFP battery production capacity will exceed 1,500 GWh annually by 2025, representing a compound annual growth rate of approximately 45% from 2022 levels and sufficient capacity to support continued market share expansion across multiple application segments. This capacity expansion is being driven by both specialized LFP manufacturers and diversified battery producers who are reallocating investment from nickel-based chemistries in response to changing market demand.

Raw Material Availability and Cost Stability

The raw material requirements for lithium iron phosphate batteries create fundamentally different supply chain dynamics than those associated with nickel-manganese-cobalt chemistries, contributing significantly to the increasing market proportion of LFP technology. The absence of cobalt in LFP cathodes eliminates exposure to price volatility and supply chain uncertainties associated with cobalt sourcing, which is predominantly concentrated in the Democratic Republic of Congo and has faced significant ethical and environmental concerns. While LFP batteries require high-purity iron and phosphorus, these materials are abundantly available from diverse geographic sources with established mining and processing infrastructure, reducing supply chain vulnerability and price volatility. Lithium requirements per kilowatt-hour are somewhat higher for LFP chemistry than for nickel-rich alternatives, but this disadvantage is offset by the relative abundance of lithium resources and expanding extraction capacity worldwide. The overall raw material cost for LFP batteries has consistently remained 20-30% lower than for NMC batteries of equivalent capacity, providing a structural cost advantage that persists regardless of fluctuations in commodity markets.

Future Outlook and Development Trajectory

Technological Innovations and Performance Enhancements

The increasing market share of lithium iron phosphate batteries is being further accelerated by ongoing technological innovations that address historical limitations while enhancing inherent advantages. Research and development efforts have significantly improved the energy density of LFP cells through advanced electrode engineering techniques including nanostructuring, carbon coating optimization, and particle size distribution control, narrowing the performance gap with nickel-based chemistries. Contemporary LFP batteries now achieve energy densities of 160-180 Wh/kg at the cell level compared to 120-140 Wh/kg for earlier generations, with further improvements to 200-220 Wh/kg projected within the next 3-5 years through structural innovations such as cell-to-pack integration that reduces inactive material. Concurrent developments in charging technology have addressed the historically slower charging rates of LFP chemistry, with current-generation cells supporting 2-4C continuous charging that enables 15-30 minute recharge times compatible with modern electric vehicle requirements. These performance enhancements are systematically eliminating the traditional trade-offs between LFP and alternative chemistries, making the safety and cost advantages increasingly compelling across a broader range of applications.

Market Projections and Long-Term Trends

Industry analysts unanimously project continued expansion of lithium iron phosphate battery market share across all major applications through at least 2030, driven by the converging factors of performance improvements, cost advantages, and shifting market priorities. The electric vehicle sector is expected to remain the primary driver of LFP adoption as manufacturers seek to reduce costs while maintaining safety standards, particularly for high-volume models where purchase price sensitivity is greatest. The stationary storage market will likely approach near-universal adoption of LFP chemistry for new installations by 2025-2026, with the exception of specialized applications where extreme energy density requirements justify alternative chemistries despite higher costs and reduced safety. The increasing proportion of LFP batteries is also creating self-reinforcing ecosystem effects including expanded recycling infrastructure, improved manufacturing efficiency, and enhanced research focus that further accelerate performance improvements and cost reduction. While alternative battery technologies including sodium-ion and solid-state batteries show long-term promise, their commercial impact is unlikely to significantly affect the dominance of LFP chemistry in its target applications before 2030, providing a clear runway for continued market share expansion throughout the current decade.

Environmental Impact and Sustainability Considerations

Lifecycle Assessment and Carbon Footprint

The growing proportion of lithium iron phosphate batteries in the global market carries significant environmental implications that extend beyond immediate performance characteristics to encompass full lifecycle impacts from raw material extraction through end-of-life management. Comprehensive lifecycle assessments consistently demonstrate that LFP batteries generate 20-30% fewer greenhouse gas emissions per kilowatt-hour of capacity than nickel-based alternatives when considering all phases from material production through manufacturing, transportation, and recycling. This reduced carbon footprint stems from multiple factors including the lower energy intensity of cathode material production, the absence of energy-intensive cobalt and nickel refining processes, and the longer operational lifespan that distributes manufacturing impacts across more energy storage cycles. The transportation emissions associated with LFP batteries are also typically lower due to the reduced supply chain complexity and more geographically distributed raw material sources, further contributing to the environmental advantages that are increasingly influencing procurement decisions among environmentally conscious consumers and corporations.

Recycling and Circular Economy Compatibility

Lithium iron phosphate batteries demonstrate superior compatibility with circular economy principles compared to alternative lithium-ion chemistries, facilitating more complete material recovery and reducing waste generation throughout the product lifecycle. The relatively simple material composition of LFP batteries—primarily lithium, iron, phosphorus, graphite, copper, and aluminum—enables more straightforward separation and purification processes during recycling compared to the complex mixtures of metals found in nickel-cobalt-based batteries. Several specialized recycling processes have been developed specifically for LFP batteries that achieve recovery rates exceeding 95% for lithium, iron, and phosphorus, with the recovered materials exhibiting quality suitable for direct reuse in new battery production without significant downgrading. The non-toxic nature of LFP battery materials reduces environmental concerns associated with storage, transportation, and processing of end-of-life batteries, simplifying regulatory compliance and reducing recycling costs. These recycling advantages are becoming increasingly important as early generations of LFP batteries reach end-of-life, creating opportunities for closed-loop material systems that further reduce the environmental impact of energy storage while enhancing supply chain security for critical materials.

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More