Lithium battery growth space is optimistic? Yes

2021-07-02

1.Policy aspect, the Ministry of Commerce announced the "passenger car enterprise average fuel consumption and new energy vehicles integration management approach (Draft)" requirements, The year 2018 to the year 2020, the proportion of new energy vehicles integral passenger car business requirements were 8%, 10%, and 12%. The introduction of documents, reflecting the country's commitment to the development of new energy vehicles, but also means that the pace of formal introduction of the policy will accelerate. From subsidies to double points, but in fact, the government's hands into market regulation based, favorable new energy automotive industry long-term sustainable development. Lithium batteries as upstream plate, long-term benefit.

Days the wind securities pointed out that in the double integral Model3 and China under double pressures of global automakers accelerate to the new energy transformation, and will start mass since the second half of 2017 on the new energy vehicles, new supply will improve effectively leverages the demand, in 2018 will be a big market the outbreak of the year, and now is still low. Industry began to appear at the same time "as + power battery" new cooperation pattern, output < - > "production cost" double under the action of promoting, power battery will continue to strengthen, the superiority of main item of domestic leading CATL power battery and its industrial chain.

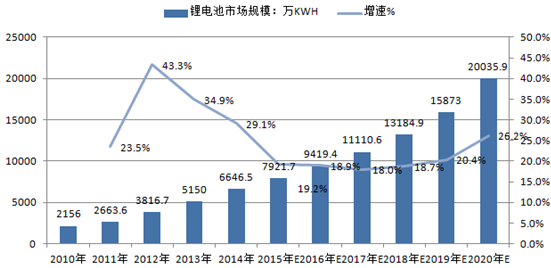

2.Lithium battery, Joaquin securities pointed out that the ternary lithium battery technology development direction, instead of the lithium iron phosphate, high-growth period. Expects 2017 to 2020 in our country power battery compound growth rate will reach 59%, ternary compound growth rate of lithium-ion batteries will be as high as 88%, to 2020 the permeability of the ternary lithium battery is expected to reach 80%. Investors can focus on the ternary lithium related targets.

Shenzhen A&S Power focus on rechargeable lithium battery.