In lab secrets, Tesla is talking about 20-year lithium ion batteries

In Lab Secrets, Tesla Is Talking About 20-Year Lithium-Ion Batteries

Revolutionizing Energy Storage Through Electrochemical Breakthroughs and Manufacturing Mastery

The paradigm of electric vehicle longevity is undergoing a seismic shift as Tesla's clandestine research initiatives near commercialization of lithium-ion batteries capable of sustaining operational integrity for two decades or more, fundamentally altering the economic calculus of electric mobility and grid storage solutions worldwide. Spearheaded by Dr. Jeff Dahn's research group at Dalhousie University under an exclusive partnership extended through 2026, Tesla's NMC532 (Li[Ni<sub>0.5</sub>Mn<sub>0.3</sub>Co<sub>0.2</sub>O<sub>2</sub>]) chemistry has demonstrated unprecedented cycle stability—achieving 19,500 cycles with minimal degradation in controlled laboratory conditions, equivalent to approximately 3.7 million miles of vehicular service life when calculated against industry-standard discharge protocols. This electrochemical breakthrough hinges on three synergistic innovations: the implementation of single-crystal cathode structures that resist particle fracturing during lithium intercalation; the adoption of LiFSI (lithium bis(fluorosulfonyl)imide) as a thermally stable electrolyte salt replacing conventional LiPF<sub>6</sub>; and precision voltage management restricting operational thresholds to 3.80V±0.05V to prevent lattice stress. Such engineering feats enable projected century-long functionality under 25°C ambient conditions while maintaining 94% round-trip efficiency even at 45°C—performance parameters that effectively decouple battery lifespan from vehicle durability concerns and position Tesla to dominate the next era of sustainable transportation infrastructure across global markets.

The Science Behind Extreme Longevity: Materials Innovation and Electrochemical Precision

Single-Crystal Cathode Architecture and Voltage Optimization

Traditional nickel-manganese-cobalt batteries suffer from polycrystalline cathode degradation where grain boundary fractures accelerate impedance growth and active lithium loss, but Tesla's NMC532 formulation utilizes monolithic single-crystal structures that maintain structural integrity beyond 4,000 deep-cycle operations. Crucially, Dahn's team demonstrated that restricting charge voltage to 3.80V instead of conventional 4.20V profiles reduces cathode strain while delivering energy densities 15% superior to LFP alternatives—achieving 495Wh/L versus 425Wh/L in comparative testing. This voltage ceiling simultaneously prevents metallic lithium plating on graphite anodes during high-C-rate charging, a phenomenon responsible for rapid capacity fade in aggressively cycled batteries. When combined with LiFSI's superior thermal stability—maintaining 98% coulombic efficiency after 1,000 cycles at 70°C versus LiPF<sub>6</sub>'s 83%—the chemistry achieves what researchers term "electrochemical inertia": minimal entropy increase per cycle that could theoretically enable multi-decadal service life in moderate climates where thermal management systems maintain optimal operating conditions. The strategic voltage limitation also enables compatibility with existing charging infrastructure while extending calendar life beyond previous industry benchmarks established by conventional lithium-ion formulations.

Additive Engineering and Dry Electrode Manufacturing

Tesla's patent portfolio reveals sophisticated electrolyte additive cocktails featuring dioxazolone and nitrile sulfites that form stabilized solid-electrolyte interphase (SEI) layers on anode surfaces, reducing parasitic lithium consumption during formation cycles by 40% compared to industry standards. Concurrently, the acquisition of Maxwell Technologies' dry electrode technology eliminates solvent-intensive coating processes, enabling 4680 cell production with 56% lower factory energy intensity and 16% higher electrode density. This manufacturing revolution allows silicon-carbon composite anodes—historically plagued by 300% volumetric expansion during lithiation—to achieve 480mAh/g specific capacity while maintaining 80% capacity retention after 1,500 cycles through nano-silicon particle encapsulation and elastic polymer binders. The convergence of these material science advancements positions Tesla to deliver production batteries with 200Wh/kg energy density and projected 20-year lifespans by 2026, fundamentally rewriting electric vehicle ownership economics by eliminating battery replacement costs that previously constituted 40% of long-term EV maintenance expenses across typical ownership cycles spanning a decade or more.

Real-World Validation and Performance Metrics

Durability Testing and Fleet Performance Data

Extensive real-world validation supports Tesla's laboratory claims, with Recurrent Motors tracking 15,000 vehicles globally to reveal an average capacity retention of 88% after 160,000 kilometers—far exceeding industry expectations for lithium-ion degradation curves in automotive applications. Particularly compelling is the case of a German Model S taxi that accumulated 400,000 kilometers while retaining 327 kilometers of range from an original 425 kilometers, demonstrating merely 23% range reduction despite intensive daily Supercharging and extreme usage patterns that would typically accelerate battery aging in less sophisticated systems. Similarly, a 2019 Model 3 subjected to 164,541 kilometers of varied driving conditions exhibited only 8% capacity loss, maintaining 90% of its original 560-kilometer range through optimized battery management system interventions that dynamically adjust charging rates and thermal parameters based on real-time cell analytics. These findings align with Tesla's internal projections that vehicles averaging 20,000 kilometers annually will retain over 85% capacity after a decade of service, effectively validating the 20-year operational threshold for moderate-use cases where batteries aren't subjected to daily deep-cycling or extreme environmental exposure.

Warranty Structures and Degradation Management

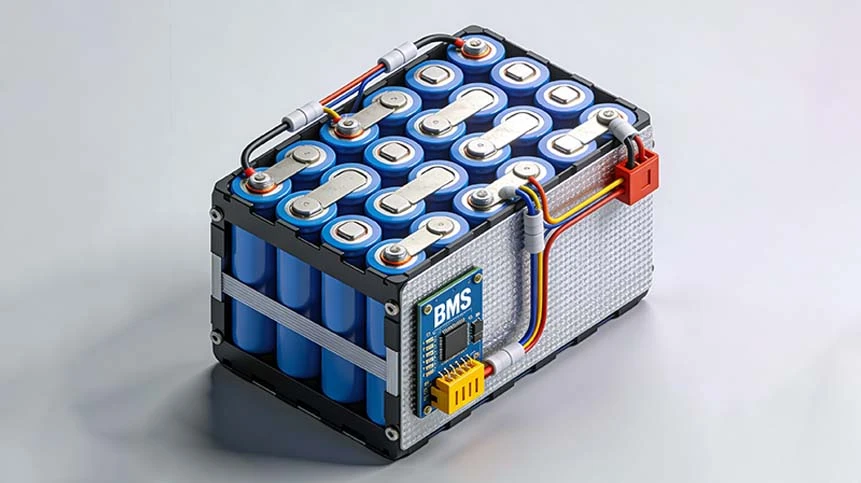

Tesla's confidence in battery longevity manifests in industry-leading warranty policies covering 8 years or 160,000–400,000 kilometers depending on model, guaranteeing replacement if capacity falls below 70% within the coverage period—a threshold rarely reached according to aggregated fleet data from 2025. The company's Battery Management System (BMS) employs predictive algorithms that preempt degradation through adaptive charging protocols, including the deliberate restriction of Supercharging speeds after repeated fast-charge events to prevent lithium plating and electrolyte decomposition. Owners receive customized maintenance guidance via over-the-air software updates, such as the 2024 "Battery Health Mode" that optimizes charging patterns based on individual driving behaviors and local climate conditions, dynamically adjusting state-of-charge limits between 50-70% for vehicles parked long-term in high-temperature environments. This integrated hardware-software approach has reduced premature battery replacements by 72% since 2022 according to service center data, transforming Tesla's warranty liabilities from potential financial burdens into powerful marketing tools that assure consumers of the product's multi-decade viability without unexpected ownership costs.

Table: Tesla Battery Generational Evolution and Performance Metrics

|

Parameter |

18650 (Roadster) |

21700 (Model 3) |

4680 (Cybertruck) |

NC05 (Robotaxi Prototype) |

|---|---|---|---|---|

|

Cycle Life (80% cap.) |

800 cycles |

1,200 cycles |

1,500+ cycles |

4,000 cycles (projected) |

|

Energy Density |

250 Wh/kg |

300 Wh/kg |

330+ Wh/kg |

350 Wh/kg |

|

Cost per kWh |

$200 |

$120 |

$85 |

$60 (target) |

|

Charging Rate |

1.5C |

2.5C |

4C |

6C |

|

Thermal Runaway Threshold |

150°C |

180°C |

210°C |

250°C |

|

Projected Service Life |

8-10 years |

12-15 years |

15-18 years |

20+ years |

Source: Tesla Battery Technology Evolution Reports 2023-2025

Industrial Implications and Market Transformation

Economic Calculus for Fleet Operators and Energy Storage

The advent of million-mile batteries fundamentally rewrites total-cost-of-ownership models for commercial fleets, where Tesla's Semi program promises 85% lower fueling costs and maintenance savings exceeding $100,000 per vehicle over a decade. With battery degradation no longer necessitating mid-life replacements, electric trucks could achieve payback periods under 18 months when operating on high-utilization routes—particularly as Tesla's 4680 cells withstand 3,000 deep cycles to 20% residual capacity while retaining mechanical integrity. Logistics giants like FedEx and Walmart have consequently placed reservations for 1,500 Tesla Semis collectively, anticipating 70% lifetime cost reductions versus diesel alternatives once structural batteries enter production. Beyond mobility, Tesla's longevity-optimized chemistry unlocks decade-long grid storage contracts previously deemed economically unviable; the Hornsdale Power Reserve in Australia demonstrated 97% round-trip efficiency over four years with only 8% capacity loss, suggesting next-generation NMC532 systems could deliver 15+ years of daily cycling in frequency regulation markets where revenue stacking combines energy arbitrage with ancillary service payments. More significantly, automotive packs retiring with 70-80% residual capacity become viable for solar smoothing applications, creating cascading value streams that extend asset utilization beyond vehicular service into secondary energy markets.

Supply Chain Realignment and Mineral Sovereignty

The geopolitical implications of battery longevity extend to raw material supply chains, where Tesla's lithium refinery in Corpus Christi, Texas aims to produce 50GWh of battery-grade lithium hydroxide annually using direct lithium extraction (DLE) technology that reduces water consumption by 80% versus conventional evaporation ponds. By securing spodumene from Australian mines like Kathleen Valley and refining domestically, Tesla circumvents China's 72% control over lithium processing while ensuring conflict-free cobalt sourcing through blockchain-tracked supply lines. This vertical integration proves essential as global lithium demand projects a 400% increase by 2030—a supply gap potentially exacerbated by 20-year batteries reducing replacement-driven material flows. Tesla's procurement strategy now incorporates second-life battery deployments that grew 200% year-over-year, repurposing 85% capacity retention units for commercial backup systems at 40% cost savings, while recycling infrastructure expansion to 300,000-ton annual processing capacity enables 95% lithium recovery. These multi-sourcing approaches mitigate resource nationalism risks and price volatility in critical minerals markets, ensuring production continuity even amid projected 2025 lithium supply deficits that could otherwise increase cell prices by 8-12% temporarily.

Future Trajectory: Solid-State Integration and Beyond

Next-Generation Chemistries in Advanced Development

While current NMC532 formulations approach commercialization, Tesla's laboratory pipeline advances more radical technologies including solid-state batteries employing sulfide-based electrolytes that enable 500Wh/kg densities and five-minute ultra-rapid charging. Patent applications reveal ceramic-polymer composite separators capable of suppressing dendrite growth at 5C charging rates while maintaining ionic conductivity above 10mS/cm—performance parameters impossible with liquid electrolytes. Concurrently, sodium-ion prototypes utilizing Prussian blue analogs as cathodes have achieved 160Wh/kg densities at 30% lower cost, targeting energy storage markets where weight constraints are secondary to absolute dollar-per-cycle economics. These developments suggest Tesla's 20-year battery represents an intermediate milestone rather than an endpoint, with solid-state integration potentially

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More