Austria Announces New 2018 Solar energy and Storage Incentive Mechanism

Austria Announces New 2018 Solar Energy and Storage Incentive Mechanism

Overview of Austria's Renewable Energy Policy Shift

The Austrian government has introduced a comprehensive overhaul of its renewable energy incentive structure, implementing significant changes to its solar feed-in tariff (FIT) system while establishing a national energy storage incentive mechanism for the first time in the country's history12. This strategic policy shift represents a substantial commitment to accelerating the adoption of solar photovoltaic systems and complementary energy storage solutions across residential, commercial, and utility-scale applications. The new regulatory framework prioritizes self-consumption of solar-generated electricity rather than grid feed-in, marking a fundamental transformation in how renewable energy projects are evaluated and subsidized throughout Austria. This approach aligns with broader European energy trends that emphasize local consumption, grid stability, and energy independence through distributed generation resources and storage capabilities.

The 2018 incentive mechanism introduces a total funding allocation of approximately 23 million euros, with 8 million euros dedicated specifically to feed-in tariff support for photovoltaic systems with output capacities ranging between 5kW and 200kW110. An additional 15 million euros has been allocated for solar rebates and energy storage initiatives, with 6 million euros of this amount designated exclusively for storage technology deployment12. This financial commitment demonstrates Austria's serious dedication to building a robust renewable energy infrastructure that combines generation and storage capabilities to maximize the value of solar investments while enhancing grid reliability. The new policies are scheduled to take effect in March 2018, with detailed FIT rates announced on January 9, 2018, when the application process officially opens for prospective project developers and system owners1.

This policy transformation occurs within the context of Austria's broader energy strategy, which aims to increase the share of renewables in its total energy mix while reducing dependence on imported fossil fuels. The emphasis on storage integration recognizes the growing importance of addressing solar energy's intermittency challenges while maximizing the economic value of photovoltaic installations for system owners. By establishing a national storage incentive framework, Austria positions itself among European leaders in recognizing the critical role of energy storage in facilitating higher renewable energy penetration rates while maintaining grid stability and reliability under increasingly variable generation conditions.

Detailed Breakdown of the Solar Feed-in Tariff Revisions

Application Process and Selection Criteria

The revised feed-in tariff system introduces a fundamentally different approach to evaluating and prioritizing solar energy projects based on their self-consumption rates rather than simply their generation capacity or projected energy output14. Under the new mechanism, projects will be ranked and selected for funding based on the proportion of solar-generated electricity that will be consumed on-site rather than fed back into the grid. This represents a significant departure from previous FIT structures that primarily rewarded total energy production regardless of when it was generated or how it was utilized. The application process begins on January 9, 2018, when the new FIT rates are officially announced, and all prospective project developers must submit comprehensive documentation regarding their expected self-consumption patterns and energy usage profiles1.

The application requirements have been designed to ensure that funded projects maximize the value of solar generation by aligning production with local consumption patterns, thereby reducing the need for grid infrastructure upgrades to accommodate bidirectional power flows. Only a specified percentage of electricity fed into the grid will qualify for subsidy payments, with any "extra" feed-in electricity compensated at standard market rates rather than premium FIT rates15. This structure creates a strong economic incentive for system owners to size their installations according to their actual consumption patterns rather than simply maximizing generation capacity to capture FIT payments. Additionally, project developers who combine solar rebates with FIT support must complete construction of their photovoltaic systems within nine months of securing funding, ensuring timely project implementation and avoiding delays that could undermine the policy's effectiveness1.

Financial Allocation and Capacity Targets

The Austrian government has allocated 8 million euros specifically for the feed-in tariff program targeting medium-scale photovoltaic systems with output capacities between 5kW and 200kW110. This funding level is expected to support a significant expansion of Austria's distributed solar capacity while ensuring that projects are developed with a focus on self-consumption rather than pure export to the grid. The precise FIT rates will be determined based on project characteristics and self-consumption ratios, with higher levels of compensation anticipated for systems that demonstrate optimal alignment between generation and consumption patterns. The financial allocation reflects a careful balance between encouraging solar adoption and managing the cost impact on ratepayers who ultimately fund the incentive programs through electricity bills.

The selection process will prioritize projects with the highest self-consumption ratios, ensuring that public funding supports installations that maximize direct consumption of solar energy rather than export to the grid14. This approach reduces the system integration costs associated with high levels of variable renewable generation while providing greater value to system owners who can displace retail electricity prices rather than lower wholesale rates. The capacity targets associated with this funding allocation have not been explicitly stated, but the financial commitment suggests a substantial expansion of Austria's distributed solar infrastructure, particularly in the commercial and industrial sectors where electricity demand profiles often align well with solar generation patterns.

National Energy Storage Incentive Program

Storage System Specifications and Eligibility Requirements

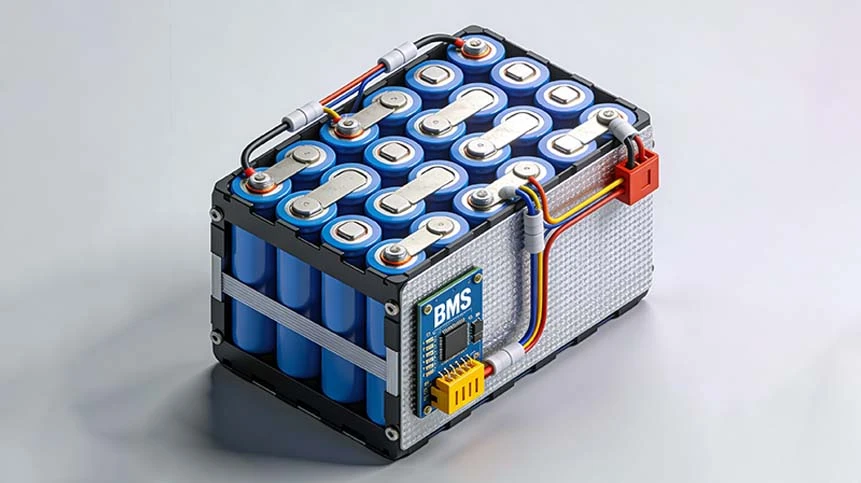

Austria's groundbreaking energy storage incentive program represents one of Europe's first national-level storage-specific subsidy mechanisms, with 6 million euros allocated exclusively for storage deployment alongside solar photovoltaic systems12. The program imposes no specific restrictions on storage system size or capacity, recognizing that optimal storage sizing varies significantly based on application-specific factors including load profiles, solar generation capacity, and utility rate structures. However, to qualify for funding support, projects must maintain a storage ratio between 0.5 kWh and 10 kWh of battery capacity for every kilowatt of installed solar generation capacity110. This ratio ensures that storage systems are appropriately sized to provide meaningful functionality without encouraging excessive oversizing that would diminish the economic efficiency of the incentive program.

The storage technology agnosticism embedded in the program guidelines allows for various battery chemistries including lithium-ion, flow batteries, and other emerging storage technologies that meet performance and safety standards1. This technology-neutral approach encourages competition among storage providers while ensuring that project developers can select the most appropriate technology for their specific application requirements and economic constraints. The eligibility requirements focus primarily on the technical relationship between solar generation and storage capacity rather than prescribing specific technology choices, allowing the market to determine optimal technology solutions based on evolving performance characteristics and cost structures. This flexibility acknowledges the rapid pace of storage technology innovation while creating a stable policy environment that can accommodate technological progress without requiring frequent regulatory adjustments.

Financial Support Mechanisms and Funding Allocation

The 6 million euros dedicated to energy storage incentives will be distributed through a rebate or direct investment subsidy program that reduces the upfront capital costs associated with storage system deployment12. While specific details regarding the exact subsidy amounts per kWh of storage capacity have not been publicly disclosed in the initial announcement, the overall funding allocation suggests substantial support that could cover between 30-45% of total project costs when combined with solar incentives7. The storage incentive is designed to be integrated with solar photovoltaic support programs, creating a comprehensive package that encourages the combined deployment of generation and storage assets rather than treating them as separate investments. This integrated approach recognizes the synergistic value of combining solar and storage to maximize self-consumption, enhance grid stability, and provide greater economic value to system owners.

The funding allocation mechanism will likely incorporate a stepwise or declining incentive structure that provides higher levels of support for earlier adopters while gradually reducing subsidies as storage costs decrease due to market maturation and economies of scale. This approach mirrors successful incentive programs in other countries that have effectively driven down costs while expanding market penetration. The substantial funding commitment demonstrates Austria's serious approach to building a storage ecosystem that complements its solar expansion goals while addressing the technical challenges associated with high penetration levels of variable renewable generation. By reducing the financial barriers to storage adoption, Austria aims to accelerate market learning, encourage technology innovation, and drive cost reductions through increased deployment volumes and competitive market dynamics.

Policy Context and Historical Development

Previous Solar Support Mechanisms

Austria's renewable energy support mechanisms have evolved significantly over the past decade, with the 2018 changes representing the latest iteration in a series of policy adjustments designed to maximize the effectiveness of public funding while driving sustainable market growth7. The country's initial comprehensive support for solar energy began in 2012 with the implementation of the Green Electricity Act, which established a new regulatory framework for renewable energy development7. This legislation included specific provisions for small-scale solar installations, providing a one-time financial grant for systems under 5kW and establishing a 13-year feed-in tariff incentive for systems between 5kW and 200kW7. These support mechanisms played a crucial role in developing Austria's residential solar market, which added approximately 50MW of capacity between 2013 and 20177.

The policy evolution from simple production-based incentives toward more sophisticated mechanisms that reward self-consumption and storage integration reflects broader trends in renewable energy policy across Europe. Earlier support mechanisms primarily focused on accelerating deployment through generous feed-in tariffs that guaranteed fixed payments for solar generation regardless of timing or grid conditions. While effective at driving installation growth, these mechanisms sometimes created grid integration challenges and failed to incentivize optimal system sizing based on actual consumption patterns. The 2018 policy revisions address these limitations by aligning economic incentives with technical and operational objectives that maximize the value of solar investments for both system owners and the broader electricity system.

Alignment with National Energy and Climate Goals

Austria's revised solar and storage incentive mechanisms directly support the country's ambitious energy and climate targets, including the goal of achieving 100% renewable electricity by 20307. Solar energy is expected to play a crucial role in meeting this target, with the government announcing plans to install solar panels on one million homes, a tenfold increase compared to the previous target of 100,000 residential solar systems announced in 20187. The Renewable Energy Expansion Act (EAG) passed in July 2021 sets a target of adding 27TWh of renewable generation, with approximately half (11TWh) coming from solar installations7. The 2018 incentive mechanisms represent early policy steps that established the foundation for these more ambitious targets by creating market structures that support integrated solar and storage deployment.

The policy framework also supports Austria's broader climate commitments under the Paris Agreement and European Union climate directives, which require substantial reductions in greenhouse gas emissions across all economic sectors. The electricity sector represents a particularly important focus for decarbonization efforts, and the combination of solar generation with storage capabilities enables greater renewable penetration while maintaining system reliability. The emphasis on self-consumption in the 2018 policy revisions also supports energy efficiency improvements by creating economic incentives for aligning electricity consumption with renewable generation patterns. This integrated approach to energy policy reflects a sophisticated understanding of the interconnections between generation, consumption, and storage in building a sustainable energy system for the future.

Market Impact and Implementation Results

Immediate Market Response and Project Development

The announcement of Austria's new solar and storage incentive mechanism in late 2017 generated significant interest among project developers, equipment suppliers, and potential system owners, leading to a substantial increase in project planning and development activity throughout early 20187. The clear policy signal provided by the national government encouraged investment in solar and storage projects even before the formal application process opened on January 9, 2018, as market participants positioned themselves to capitalize on the available funding1. The storage incentive component particularly attracted attention from innovative technology providers and early adopters who recognized the strategic importance of combining storage with solar to maximize system value under the new self-consumption-focused incentive structure.

The implementation of the incentive mechanisms produced significant market growth in both solar and storage deployments throughout 2018 and subsequent years7. Austria installed approximately 4,500 residential battery storage systems with a total capacity of 30MWh in 2018, representing the beginning of a sustained growth trajectory that continued in subsequent years7. The combination of federal and regional incentives created a favorable investment environment that drove increased adoption of both solar and storage technologies, particularly in the residential and commercial sectors where the economic case for self-consumption was strongest. The requirement that projects combining solar rebates with FIT support must be completed within nine months of securing funding ensured rapid deployment of funded systems, accelerating market growth while providing valuable installation experience that helped drive down costs through learning effects and increased competition.

Long-Term Market Transformation

The 2018 incentive mechanisms catalyzed a fundamental transformation of Austria's solar and storage markets, establishing a foundation for sustained growth that continued well beyond the initial policy period7. The residential battery storage market experienced particularly dramatic growth, with installations increasing from 4,500 systems in 2018 to 5,500 systems in 2019, 6,000 systems in 2020, and then surging to 13,000 systems in 2021—representing a remarkable 222% year-over-year growth rate7. The total storage capacity deployed in residential applications reached 132MWh in 2021, demonstrating the powerful market impact of the incentive mechanisms introduced in 20187. This growth trajectory established Austria as one of Europe's leading markets for residential storage deployment on a per capita basis, with sophisticated consumers leveraging storage to maximize self-consumption and reduce electricity costs.

The solar market also experienced significant growth following the policy implementation, with the emphasis on self-consumption driving more optimally sized systems that better matched generation with consumption patterns. The integrated approach to solar and storage incentives encouraged the development of a comprehensive ecosystem of installers, technology providers, and service companies that offered turnkey solutions combining generation and storage capabilities. This market maturation reduced transaction costs while improving system quality and reliability through increased competition and professionalization of the installation industry. The policy framework also encouraged innovation in business models and financing approaches, with new offerings emerging that minimized upfront costs while maximizing the economic value of solar and storage investments for system owners.

*Table: Austrian Residential Battery Storage Market Growth (2018-2021)*

| Year | Number of Systems Installed | Total Storage Capacity (MWh) | Year-over-Year Growth Rate |

|---|---|---|---|

| 2018 | 4,500 | 30 | Baseline |

| 2019 | 5,500 | 37 | 23% |

| 2020 | 6,000 | 41 | 11% |

| 2021 | 13,000 | 132 | 222% |

Source: European PV Industry Association Data7

Technical Considerations and System Design Implications

Optimal Solar-Storage Sizing Strategies

The Austrian incentive mechanism's storage ratio requirement of 0.5-10 kWh of battery capacity per kW of solar installation has significant implications for system design and optimization strategies110. This wide range acknowledges the diverse applications and consumption profiles across different customer segments while providing guidelines that ensure storage systems are appropriately sized to provide meaningful functionality. Residential systems typically fall toward the lower end of this spectrum, with optimal ratios typically between 1-2 kWh per kW of solar based on typical consumption patterns and the desire to shift solar generation from daytime to evening hours. Commercial and industrial applications often implement higher storage ratios to address demand charge management or provide backup power capabilities for critical processes.

The policy framework encourages system designers to carefully analyze consumption patterns, utility rate structures, and specific customer requirements when determining optimal solar and storage sizing. The economic value of storage increases significantly when properly sized to maximize self-consumption of solar generation while providing additional grid services or backup power functionality. The flexibility within the specified ratio range allows for customization based on individual site characteristics rather than imposing a one-size-fits-all approach that might not align with actual usage patterns or value propositions. This technical sophistication in policy design reflects Austria's comprehensive approach to building an efficient and effective solar-storage ecosystem that maximizes the value of both technologies while ensuring reliable system operation.

Technology Selection and Performance Standards

The technology-neutral approach of Austria's incentive mechanism allows market participants to select the most appropriate storage technologies based on their specific requirements, cost considerations, and performance expectations1. Lithium-ion battery technologies have dominated the residential and commercial storage markets due to their declining costs, high efficiency, and established supply chains, but other technologies including flow batteries and advanced lead-acid systems have found applications in specific use cases. The absence of technology-specific requirements encourages competition among technology providers while accelerating innovation that improves performance, reduces costs, and enhances safety characteristics.

Despite the technology-neutral approach, system performance and safety standards remain crucial considerations for ensuring reliable operation and maximizing the value of incentive funding. The policy framework incorporates requirements for system certification, installation standards, and interconnection protocols that ensure safe and reliable operation while maintaining grid stability. These technical standards have evolved over time based on operational experience and technological advancements, creating a robust regulatory environment that supports innovation while maintaining necessary safeguards for system safety and reliability. The balanced approach to technology regulation has enabled Austria to build a diverse and competitive market for storage technologies while ensuring that installed systems meet minimum performance and safety standards that protect consumers and the broader electricity system.

Economic Analysis and Consumer Value Proposition

Cost-Benefit Considerations for System Owners

The economic value proposition for solar and storage systems in Austria combines multiple revenue streams and cost savings opportunities that collectively determine the return on investment for system owners7. The fundamental economic driver is the difference between the cost of grid electricity and the levelized cost of solar generation, with storage enhancing this value by increasing self-consumption of solar energy and reducing electricity purchases during high-rate periods. Austria's electricity prices for household consumers have increased steadily over time, rising from approximately 0.20 euros per kWh to 0.30 euros per kWh by the end of 2021, significantly improving the economic case for solar and storage investments7. The incentive mechanisms further improve economics by reducing upfront costs through direct subsidies and providing premium payments for self-consumed solar generation through the revised FIT structure.

The economic analysis must also consider the potential value of ancillary services and grid support functions that storage systems can provide, though these revenue streams were less developed in 2018 when the incentive mechanism was introduced. As Austria's electricity market evolves to incorporate more distributed energy resources, additional value streams may emerge that further enhance the economic case for storage investments. The comprehensive incentive package that combines solar and storage support was designed to cover approximately 45% of total project costs through various subsidy mechanisms, significantly improving project economics and reducing payback periods to levels that attracted substantial consumer interest7. This strategic public investment aimed to stimulate private sector investment while driving market transformation that would ultimately lead to cost reductions through economies of scale and technological learning.

System-Level Economics and Grid Benefits

Beyond the direct economic benefits to system owners, Austria's solar and storage incentive mechanism delivers significant value to the broader electricity system and society more generally7. By encouraging self-consumption and reducing peak demand on the distribution grid, solar-storage systems can defer or avoid investments in grid infrastructure upgrades that would otherwise be necessary to accommodate growing electricity demand or distributed generation impacts. The value of these avoided investments can be substantial, though difficult to quantify precisely without detailed system planning studies. Additionally, the environmental benefits of increased renewable generation contribute to Austria's climate goals while reducing the health impacts associated with fossil fuel generation, though these societal benefits are typically not captured in traditional economic calculations.

The economic efficiency of the incentive mechanism depends critically on proper sizing and operation of solar-storage systems to maximize their value to both owners and the grid. The policy design encourages optimal system configuration through the self-consumption focus of the FIT structure and the appropriate storage ratio requirements, creating alignment between private economic interests and system-level needs. This sophisticated approach to incentive design represents an advancement over earlier mechanisms that sometimes created conflicts between individual economic optimization and system-wide efficiency. The comprehensive economic value proposition helps explain the strong market response to Austria's incentive mechanisms and their effectiveness in driving substantial deployment of both solar and storage technologies throughout the country.

Future Outlook and Policy Evolution

Subsequent Policy Developments

Austria's 2018 solar and storage incentive mechanism established a policy framework that continued to evolve in subsequent years based on market response, technological progress, and changing energy system requirements7. In 2020, the government introduced an expanded rebate program for residential solar and storage systems with a budget of approximately 36 million euros, with about two-thirds allocated for solar installations and one-third for storage systems7. This program provided subsidies of 250 euros per kW for solar installations and 200 euros per kWh for storage systems, further accelerating market growth and driving increased adoption7. The overwhelming success of these initiatives led to a substantial budget increase to 240 million euros in 2022, demonstrating the political commitment to solar and storage deployment as core elements of Austria's energy strategy7.

The policy evolution has also included refinements to technical requirements, incentive levels, and program structures based on lessons learned from earlier implementation experience. The continued emphasis on self-consumption reflects the enduring value of this approach in maximizing system benefits while minimizing grid integration challenges. As storage costs have declined and performance has improved, incentive levels have been gradually reduced to reflect changing market conditions while maintaining an appropriate level of support to continue driving market growth. This policy maturation process demonstrates the adaptive approach that Austria has taken to renewable energy support, with continuous refinement based on performance data and market feedback rather than static policy frameworks that might become less effective over time.

Long-Term Market Projections

The implementation of Austria's 2018 incentive mechanism established a foundation for sustained market growth that is expected to continue throughout the 2020s and beyond7. According to projections from the European PV Industry Association, Austria's residential battery storage market was expected to reach 223MWh of annual installations in 2022, representing a 70% year-over-year growth rate7. The association's mid-scenario projection anticipates continued strong growth with annual growth rates between 11% and 26% over the subsequent four years, reaching 430MWh of annual installations by 20267. The high-scenario projection suggests even more dramatic growth potential, with annual installations reaching 608MWh by 2026 if market conditions are particularly favorable7.

These projections reflect the powerful market momentum created by the 2018 policy framework and subsequent enhancements, combined with favorable economic conditions including rising electricity prices and declining technology costs. The completion of Austria's smart meter rollout in 2024 is expected to further accelerate market growth by enabling more sophisticated rate structures and control strategies that maximize the value of solar-storage systems7. The continued instability in energy supply markets, particularly following the geopolitical events of 2022, has increased consumer interest in energy independence and resilience, creating additional demand drivers beyond purely economic considerations7. The combination of these factors suggests that Austria's solar and storage markets will continue their strong growth trajectory throughout the decade, supported by the policy foundation established by the 2018 incentive mechanism.

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More