Boeing invests in battery startup Cuberg to launch electric aircraft

Boeing Invests in Battery Startup Cuberg to Launch Electric Aircraft

Strategic Investment and Market Implications for Electric Aviation

The global aviation industry is currently undergoing a profound transformation toward electrification, a shift that promises to revolutionize air travel while significantly reducing its environmental impact. Boeing, through its venture capital subsidiary HorizonX Ventures, has made a strategic minority investment in California-based battery technology startup Cuberg, marking a significant milestone in the development of electric aircraft45. This investment represents Boeing's first direct investment in energy storage technology and demonstrates the aviation giant's serious commitment to developing sustainable aviation solutions3. The move comes at a time when international crude oil prices have reached their highest point in three years, making battery-driven aircraft technology increasingly attractive from an economic perspective45. Cuberg, founded in 2015 by Stanford University researchers, has developed innovative battery technology that combines lithium metal anodes, proprietary electrolytes, and high-voltage cathodes to deliver exceptional energy density and thermal resistance2. This technological advancement addresses two critical challenges for electric aviation: weight and heat management, which have traditionally limited the practical application of batteries in commercial aircraft2.

The investment in Cuberg is part of Boeing's broader strategy to position itself at the forefront of electric aviation technology. Prior to this investment, HorizonX Ventures had partnered with JetBlue Airways to invest in Zunum Aero, a company developing hybrid-electric aircraft24. The growing interest in electric aviation is not limited to Boeing; Airbus, Rolls-Royce, and Siemens have also formed partnerships to develop hybrid-electric propulsion systems for commercial aircraft, with their E-Fan X hybrid-electric test aircraft projected to make its first flight in 202023. These developments signal a fundamental shift in how major aerospace companies are approaching the future of air travel, with electric propulsion increasingly seen as a viable alternative to traditional fossil fuel-based systems. The market potential for electric aircraft is substantial, with projections suggesting that the electric aircraft market will exceed $22 billion over the next 15 years, representing a significant opportunity for companies that can successfully develop and commercialize these technologies36.

The transition to electric aviation is driven by multiple factors, including environmental concerns, economic considerations, and technological advancements. The aviation industry accounts for approximately 500 million tons of carbon dioxide emissions annually, and the International Civil Aviation Organization predicts that emissions from aircraft fuel could triple by 2050 if no corrective measures are taken68. Electric aircraft offer a pathway to significantly reduce these emissions, particularly if the electricity used for charging comes from renewable sources. Additionally, electric aircraft promise substantial operational cost savings, as demonstrated by the German-developed two-seat electric aircraft "e-Genius," which consumed only 25 kWh of electricity during a 100-kilometer flight segment, costing approximately $368. These economic and environmental benefits are creating strong incentives for aerospace companies to invest in electric propulsion technologies, with battery technology representing the critical enabling factor that will determine the pace and scale of adoption.

Technological Innovations in Aviation Battery Systems

Cuberg's Advanced Battery Chemistry and Performance Characteristics

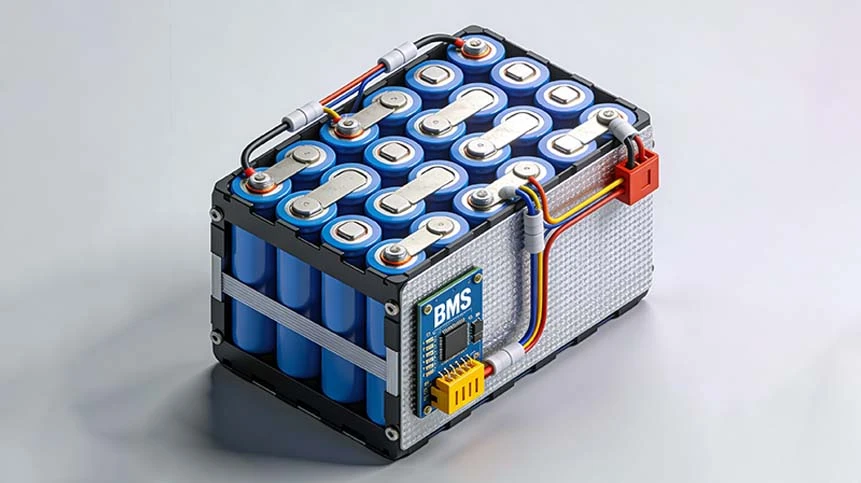

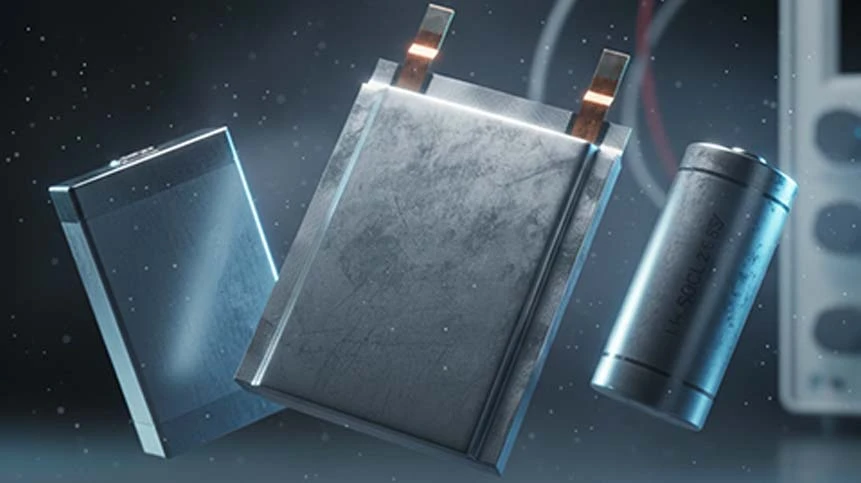

Cuberg's battery technology represents a significant advancement over conventional lithium-ion batteries, addressing specific challenges that have previously limited the application of batteries in aviation. The company's innovative approach combines lithium metal anodes with a proprietary electrolyte and high-voltage cathodes to create a battery system that offers higher energy density and improved thermal stability compared to existing solutions2. This unique chemical composition allows Cuberg's batteries to achieve what Boeing executives have described as "the highest energy density we've seen on the market," potentially providing a safe and stable solution for future electric transportation systems24. The company has demonstrated the safety advantages of its technology through videos showing its batteries remaining stable under conditions where conventional 18650 lithium-ion batteries catch fire1. This enhanced safety profile is particularly critical for aviation applications, where battery failures could have catastrophic consequences.

The technical specifications of Cuberg's batteries, while not fully disclosed, apparently address the fundamental weight limitations that have previously made batteries impractical for commercial aircraft. As Cuberg CEO Richard Wang explained, "Under existing technology, battery components are still quite heavy, making them unsuitable for existing mainstream commercial aircraft models. The entire battery technology market needs to make a comprehensive leap to the next generation"45. Current lithium batteries have an energy density of approximately 1 megajoule per kilogram, compared to aviation fuel which offers over 40 megajoules per kilogram68. This massive disparity means that replacing fuel with batteries using current technology would impose enormous weight penalties on aircraft, severely limiting their payload and range capabilities. Cuberg's technology appears to make significant progress in closing this gap, though the exact energy density figures remain proprietary information.

Comparison of Energy Density Between Aviation Fuel and Battery Technologies

Table: Energy Density Comparison Between Various Power Sources for Aircraft

| Power Source | Energy Density (MJ/kg) | Relative Efficiency | Current Application in Aviation |

|---|---|---|---|

| Aviation Fuel | 40+ | 1x | Primary power source for all commercial aircraft |

| Conventional Li-ion Batteries | ~1 | 0.025x | Limited to experimental aircraft |

| Cuberg's Battery Technology | Undisclosed | Significant improvement | Testing and development phase |

| Required for Commercial Flight | ~5-10 (estimated) | 0.125-0.25x | Not yet achieved |

Source: Compiled from multiple industry reports and technical publications

Market Context and Competitive Landscape

Growing Electric Aircraft Market Potential

The electric aircraft market represents one of the most promising segments in the broader transportation electrification trend, with significant growth projected over the coming decades. Market analysts predict that the electric aircraft market will exceed $22 billion within the next 15 years, creating substantial opportunities for companies that can successfully develop and commercialize the necessary technologies36. This growth is driven by multiple factors, including environmental regulations, potential cost savings, and advances in enabling technologies. The transition to electric propulsion is particularly attractive for regional and commuter aircraft markets, where many US airlines are currently withdrawing from routes serviced by 50-seat aircraft due to cost considerations68. Electric aircraft could make these routes economically viable again by significantly reducing operating costs.

The competitive landscape in the electric aircraft space is rapidly evolving, with established aerospace giants and startups alike vying for position. Boeing's main competitor, Airbus, has already developed a small all-electric aircraft called E-Fan and successfully flew it across the English Channel in 20151. Airbus has since partnered with Rolls-Royce and Siemens to develop a hybrid-electric aircraft called E-Fan X, with testing scheduled to begin in 202036. Meanwhile, startups like Zunum Aero (also backed by Boeing) are working to bring hybrid-electric aircraft to market by 202268. Even Tesla CEO Elon Musk has revealed that he has designs for a vertical takeoff and landing (VTOL) electric aircraft, though he acknowledges that battery energy density needs to reach at least 400 watt-hours per kilogram before such aircraft become feasible3. This level of competition and investment activity indicates strong confidence across the industry that electric aircraft will eventually become a significant segment of the aviation market.

Regional Adoption Patterns and Regulatory Development

The adoption of electric aircraft is likely to follow distinct patterns across different regions, influenced by regulatory frameworks, environmental policies, and existing aviation infrastructure. Europe has emerged as an early leader in electric aviation development, with the European Union implementing supportive policies and funding programs to accelerate the transition to sustainable aviation. The partnership between Airbus, Rolls-Royce, and Siemens exemplifies Europe's coordinated approach to developing electric aviation technologies23. In the United States, development has been more driven by private companies and venture capital, with Boeing's investment in Cuberg and Zunum Aero representing this approach24.

Regulatory frameworks for electric aircraft are still in early development, with aviation authorities worldwide working to establish certification standards for these new technologies. The Federal Aviation Administration (FAA) in the United States and the European Union Aviation Safety Agency (EASA) are both developing specific certification pathways for electric aircraft, though these processes are complicated by the novelty of the technologies involved. Safety concerns, particularly regarding battery systems, represent a significant challenge for regulators, who must balance the need for innovation with the imperative to maintain the exceptional safety record of commercial aviation. Cuberg's focus on developing safer battery technology with reduced flammability addresses these concerns directly, potentially helping to accelerate regulatory approval45.

Technical Challenges and Innovation Pathways

Energy Density Requirements and Current Limitations

The single greatest technical challenge for electric aviation remains the energy density of battery systems. As previously noted, conventional aviation fuel offers more than 40 times the energy density of current lithium-ion batteries, creating a massive disparity that must be overcome for electric aircraft to achieve practical ranges and payloads68. While Cuberg's technology represents a significant step forward, the company has not disclosed specific energy density figures, making it difficult to assess how close they are to meeting the requirements for commercial aviation. Industry experts suggest that battery energy density needs to reach at least 400 watt-hours per kilogram to enable practical electric aircraft designs, a substantial increase from the approximately 250 watt-hours per kilogram offered by current Tesla batteries3.

Beyond simple energy density, aircraft batteries must meet numerous other technical requirements that complicate their development. These include durability over multiple charge cycles, performance under extreme temperature conditions (particularly the cold temperatures encountered at high altitudes), thermal management to prevent overheating, and safety under potential failure scenarios68. Cuberg's approach of using lithium metal anodes with proprietary electrolytes appears to address several of these challenges simultaneously, particularly thermal stability and safety2. The company has stated that it plans to test a prototype battery later this year, which should provide more concrete data on its performance characteristics and viability for aviation applications45.

Supplementary Technologies and System Integration

The development of viable electric aircraft requires advances beyond battery technology alone, including improvements in electric motors, power management systems, aircraft design, and charging infrastructure. Electric motors for aircraft must achieve exceptional power-to-weight ratios while maintaining reliability under the demanding conditions of flight. Power management systems must efficiently distribute electrical power to multiple motors and systems while protecting against faults and managing thermal loads. Aircraft designs must evolve to accommodate battery systems and optimize aerodynamic efficiency for potentially different flight profiles compared to conventional aircraft.

Perhaps most importantly, charging infrastructure must be developed to support electric aircraft operations, particularly at airports where space and power availability may be constrained. Fast-charging systems will be essential to minimize turnaround times between flights, while maintenance facilities will require new equipment and training to service electric propulsion systems. These supporting technologies and infrastructure requirements create additional business opportunities beyond the battery systems themselves, contributing to the overall market potential of electric aviation. Companies that can provide integrated solutions addressing multiple aspects of electric aircraft operations will likely have significant advantages in this emerging market.

Environmental Impact and Sustainability Considerations

Emissions Reduction Potential

The potential environmental benefits of electric aircraft represent a primary driver behind the growing interest in these technologies. The aviation industry currently accounts for approximately 2-3% of global carbon dioxide emissions, with total emissions of around 500 million tons annually68. Perhaps more concerningly, the International Civil Aviation Organization predicts that emissions from aircraft fuel could triple by 2050 if no mitigation measures are implemented68. Electric aircraft offer the potential to significantly reduce these emissions, particularly if the electricity used for charging comes from renewable sources. A study comparing the emissions of electric versus conventional aircraft found that a round trip between New York and London on a fossil-fueled aircraft generates greenhouse gas emissions roughly equivalent to heating a family home for an entire year3.

Beyond carbon dioxide emissions, electric aircraft would eliminate other pollutants associated with aviation, including nitrogen oxides, sulfur oxides, and particulate matter. These emissions have particularly significant health impacts near airports, which are often located in or near populated areas. The elimination of these pollutants could thus provide important public health benefits in addition to addressing climate concerns. Furthermore, electric aircraft are significantly quieter than their conventional counterparts, with noise reductions of up to 50% compared to similar-sized fossil-fueled aircraft68. This noise reduction could allow airports to operate with fewer noise restrictions, potentially increasing capacity, or enable airports to be located closer to population centers without creating noise nuisances.

Lifecycle Environmental Considerations

While the operational environmental benefits of electric aircraft are clear, a comprehensive sustainability assessment must consider the full lifecycle impacts of these vehicles, including manufacturing, maintenance, and end-of-life processing. Battery production in particular involves significant environmental impacts, including mining of raw materials, manufacturing energy consumption, and management of hazardous materials. These impacts must be carefully managed to ensure that electric aircraft deliver net environmental benefits compared to conventional aircraft.

The durability and lifespan of aircraft batteries will significantly influence their overall environmental footprint, as shorter-lived batteries will require more frequent replacement, increasing manufacturing impacts. Cuberg and other battery developers are therefore focusing not only on energy density and safety but also on cycle life and durability2. Proper end-of-life management through recycling or repurposing will also be essential to minimize waste and recover valuable materials. As battery technology continues to advance, these lifecycle considerations are receiving increasing attention from researchers and companies alike, with the goal of ensuring that electric aviation delivers on its promise of more sustainable air travel.

Future Outlook and Development Trajectory

Near-Term Development Roadmap

The development of electric aircraft is proceeding along multiple parallel paths, with different companies targeting different market segments and timelines. In the near term (3-5 years), we are likely to see the certification and entry into service of small hybrid-electric aircraft for regional commuter routes. Companies like Zunum Aero (in which Boeing has also invested) are targeting 2022 for initial sales of hybrid-electric aircraft68. These aircraft will likely serve niche markets initially, particularly routes that have become economically unviable with conventional aircraft due to low demand or high operating costs. The reduced operating costs of electric aircraft could make these routes profitable again, improving connectivity for regional communities.

Cuberg's battery technology is likely to follow a similar development path, with initial applications focusing on smaller aircraft or hybrid systems rather than large commercial airliners. The company plans to test a prototype battery later this year, with commercial applications likely following within 3-5 years if testing is successful45. Boeing's investment will accelerate this development process by providing Cuberg with additional resources to expand its team and research facilities while working with customers to integrate its batteries into their products2. This phased approach allows for incremental validation and refinement of the technology while building operational experience that will inform future designs.

Long-Term Vision and Industry Transformation

Looking further ahead (10-20 years), electric propulsion could transform aviation in ways that extend beyond simple propulsion replacement. Electric aircraft enable fundamentally different design approaches, including distributed propulsion with multiple motors, blended wing bodies, and vertical takeoff and landing capabilities. These design possibilities could lead to aircraft that are not only cleaner and quieter but also more versatile in their operations. Urban air mobility concepts, including air taxis and personal aerial vehicles, represent particularly promising applications for electric propulsion, with numerous companies developing vehicles for this emerging market.

The widespread adoption of electric aircraft could also transform airport operations and infrastructure. The reduced noise footprint of electric aircraft might allow airports to operate extended hours without noise restrictions or to be located closer to city centers. Reduced emissions would improve local air quality around airports, potentially reducing opposition to airport expansion projects. Charging infrastructure would become a critical airport utility, requiring significant electrical distribution systems and potentially on-site energy storage or generation. These changes represent both challenges and opportunities for airport operators, aircraft manufacturers, and energy providers alike.

Investment Landscape and Business Opportunities

Current Investment Trends and Patterns

The electric aviation sector has attracted increasing attention from investors in recent years, with Boeing's investment in Cuberg representing part of a broader trend of aerospace companies investing in electrification technologies. Venture capital funding for electric aviation startups has grown significantly, with total investments reaching hundreds of millions of dollars annually. These investments are spread across various segments of the electric aviation ecosystem, including aircraft developers, component suppliers, and infrastructure providers. Established aerospace companies like Boeing and Airbus have been particularly active investors, seeking to position themselves for the industry's transition to electric propulsion while potentially disrupting new entrants.

The investment case for electric aviation rests on multiple factors, including the large addressable market, the potential for disruptive cost reductions, and the alignment with broader trends toward transportation electrification. However, investors also face significant risks, including technical challenges, regulatory uncertainty, and the capital-intensive nature of aircraft development. Successful investments will require careful assessment of these risks alongside the potential rewards. Boeing's approach of making multiple targeted investments in complementary technologies (e.g., both aircraft developers and battery manufacturers) represents a strategic method of managing these risks while maintaining exposure to the overall growth of the sector.

Opportunities for Battery Manufacturers and Suppliers

For battery manufacturers like Cuberg and their suppliers, the emergence of electric aviation represents a significant new market opportunity with potentially attractive margins. Aircraft batteries will need to meet exceptionally high standards for performance, safety, and reliability, creating opportunities for companies that can deliver certified aviation-grade products. The certification process for aviation applications is rigorous and time-consuming, creating barriers to entry that could protect early movers from competition once certified. Furthermore, the lifecycle value of aircraft batteries may extend beyond initial sales to include maintenance, refurbishment, and recycling services, creating additional revenue streams.

Suppliers to battery manufacturers also stand to benefit from the growth of electric aviation, though they will need to meet similarly high standards for quality and consistency. Materials suppliers in particular may find opportunities in providing specialized components for aviation batteries, including high-purity lithium, advanced separator materials, and proprietary electrolyte formulations. The demanding requirements of aviation applications may drive innovation in battery materials that eventually trickles down to other applications, similar to how aerospace innovations have historically benefited other industries. Companies that can establish themselves as trusted suppliers to the aviation battery industry may thus benefit both from the growth of electric aviation specifically and from spillover effects into other markets.

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More