California, the United States use battery energy storage to replace the peak gas power generation

California, the United States use battery energy storage to replace the peak gas power generation

The Strategic Shift from Fossil Fuels to Advanced Battery Storage Systems

The transition toward renewable energy integration has fundamentally transformed California's approach to managing peak electricity demand, with battery energy storage systems emerging as the preferred alternative to traditional natural gas peaker plants. This strategic shift represents not merely a technological substitution but a comprehensive reimagining of grid management principles and resource adequacy requirements. Over the past decade, California has systematically demonstrated that utility-scale battery storage can effectively replace conventional fossil fuel generation while providing superior operational flexibility, reduced environmental impact, and increasingly favorable economics. The state's experience with battery storage deployment offers a compelling blueprint for other regions seeking to balance renewable energy integration with grid reliability concerns, demonstrating that the technical challenges of intermittent resources can be effectively addressed through advanced energy storage solutions. This transformation has been particularly remarkable in its pace and scale, with California achieving in less than a decade what many experts had predicted would require multiple decades of gradual transition, establishing the state as a global leader in grid-scale energy storage implementation and setting new standards for the integration of variable renewable resources into modern power systems13.

California's journey toward battery storage adoption began in earnest following the Aliso Canyon natural gas leak in 2015, which exposed critical vulnerabilities in the state's reliance on fossil fuels for peak capacity requirements. The crisis prompted urgent action from regulators and policymakers, who implemented emergency procurement measures for energy storage to enhance grid resilience and reduce dependence on natural gas infrastructure. These initial steps have evolved into a comprehensive long-term strategy that now positions energy storage as a cornerstone of California's clean energy transition, with the state having established ambitious targets for storage deployment alongside its renewable portfolio standards. The successful integration of storage resources has been facilitated by complementary investments in solar generation, creating synergistic systems that collectively provide reliable capacity throughout peak demand periods, fundamentally altering the operational dynamics of California's electricity grid and establishing new paradigms for resource adequacy in high-renewable penetration scenarios510.

Market Dynamics and Growth Patterns in California's Energy Storage Sector

Exponential Capacity Expansion

California's battery storage capacity has experienced unprecedented growth, with the state now boasting approximately 12,419 megawatts of installed battery storage capacity, representing nearly 42% of the entire United States' utility-scale battery storage capacity as of 2025. This remarkable expansion has positioned California as the undisputed leader in energy storage deployment nationally, with Texas following as a distant second with approximately 8,130 megawatts of installed capacity. The growth trajectory has been nothing short of extraordinary, with capacity additions accelerating dramatically following the initial successful demonstrations of storage reliability during peak demand events. This expansion has been driven by a combination of policy mandates, declining technology costs, and demonstrated operational success, creating a virtuous cycle of increasing deployment and improving economics that has consistently exceeded initial expectations and projections35.

The scale of California's storage deployment becomes particularly impressive when examined in historical context. Since 2020, the state has increased its battery storage capacity by an astonishing 15 times, transforming from a market with modest demonstration projects to one where battery storage regularly contributes significant portions of peak capacity requirements. During critical peak demand events, battery storage systems have supplied up to 25.9% of California's total electricity needs, frequently surpassing natural gas generation during evening peak periods. This capacity growth has been systematically planned and executed through a series of procurement cycles mandated by the California Public Utilities Commission, which has required utilities to ensure sufficient storage resources are available to maintain grid reliability while retiring aging natural gas plants. The commission's forward-looking approach has created a predictable deployment pipeline that has enabled manufacturers to scale production and reduce costs through economies of scale35.

Comparative Regional Leadership

While California dominates the national landscape in absolute capacity terms, the transition toward battery storage extends beyond state borders, with nineteen states now boasting at least 100 megawatts of installed battery storage capacity. This geographic diversification demonstrates the broader applicability of storage solutions across different grid architectures and market structures. Texas has emerged as a particularly significant market, with the Electric Reliability Council of Texas (ERCOT) leveraging battery storage to manage the unique challenges of its isolated grid system. During peak demand events, Texas battery storage systems have contributed up to 5.33 gigawatts of power, representing approximately 7.2% of the state's total electricity requirement during these critical periods3.

The regional distribution of storage deployment reflects a combination of policy environments, renewable penetration levels, and specific grid challenges. States with high solar penetration, including Arizona, Nevada, and New Mexico, have aggressively deployed storage resources to manage the evening ramp requirement that follows declining solar output. These states have recognized that battery storage represents the most efficient solution to the net load curve challenges created by high solar penetration, enabling continued renewable growth without compromising grid stability. The expanding geographic footprint of energy storage deployment underscores the technology's versatility and increasingly compelling economics across diverse operating environments and market structures36.

Table: Energy Storage Capacity Comparison Among Leading States (2025)

| State | Installed Capacity (MW) | Percentage of National Total | Key Drivers |

|---|---|---|---|

| California | 12,419 | 42% | Renewable integration, gas plant retirements |

| Texas | 8,130 | 27.5% | ERCOT grid isolation, wind integration |

| Arizona | 1,450 | 4.9% | Solar smoothing, capacity deferred |

| New Mexico | 980 | 3.3% | Renewable mandates, transmission optimization |

| Nevada | 920 | 3.1% | Solar integration, peak demand management |

Economic Drivers and Cost Considerations

Declining Technology Costs

The dramatic reduction in battery storage costs has been perhaps the single most important factor enabling widespread adoption across California and other leading markets. Since 2022, battery system prices have declined by approximately 40%, driven by manufacturing scale, technological improvements, and supply chain optimization. The global average cost for battery storage systems reached under $300 per kWh in 2024, representing a critical threshold that enabled storage to compete effectively with conventional peaking resources. These cost reductions have occurred even as performance characteristics have improved significantly, with modern systems offering enhanced safety features, longer cycle life, and improved energy density compared to earlier generations of storage technology56.

The improving economics of energy storage have been quantified in detailed analyses from leading financial advisory firms. According to Lazard's 2025 Levelized Cost of Energy Storage analysis, solar-plus-storage systems now deliver electricity at between $50 and $131 per megawatt-hour, comparing favorably with new natural gas peaker plants that operate in the range of $47 to $170 per megawatt-hour. This cost competitiveness is particularly remarkable given that storage was once considered a premium solution only justified by specific grid needs or policy mandates. The convergence of storage costs with conventional alternatives has fundamentally changed the decision calculus for utilities and regulators, enabling storage to win contracts based on economic merits rather than solely on policy requirements or environmental considerations5.

Operational Value Stacking

Beyond simple energy displacement, battery storage systems deliver multiple value streams that enhance their economic attractiveness compared to single-function assets like natural gas peakers. Modern storage projects simultaneously provide capacity value, energy arbitrage, frequency regulation, voltage support, and congestion relief, creating revenue stacks that collectively justify investment even when individual value streams might not support project economics independently. This ability to serve multiple grid needs allows storage assets to achieve higher utilization rates and improved financial returns compared to conventional peaking resources, which typically operate only during limited hours of peak demand36.

The economic advantage of storage has become sufficiently compelling that utilities are increasingly choosing batteries over gas plants even for capacity-centric applications. Industry analysts have documented cases where the total cost of battery storage systems is lower than simply continuing to operate existing natural gas peaker plants, a reality that would have been unthinkable just five years ago. This economic crossover has accelerated the retirement schedule for aging gas plants across California, with regulators approving storage replacements that deliver superior reliability and flexibility while reducing emissions and operational costs. The multi-attribute value proposition of storage ensures that these systems remain economically viable even as market conditions evolve, providing a hedge against uncertainty that single-function assets cannot match18.

Technological Innovations and Performance Improvements

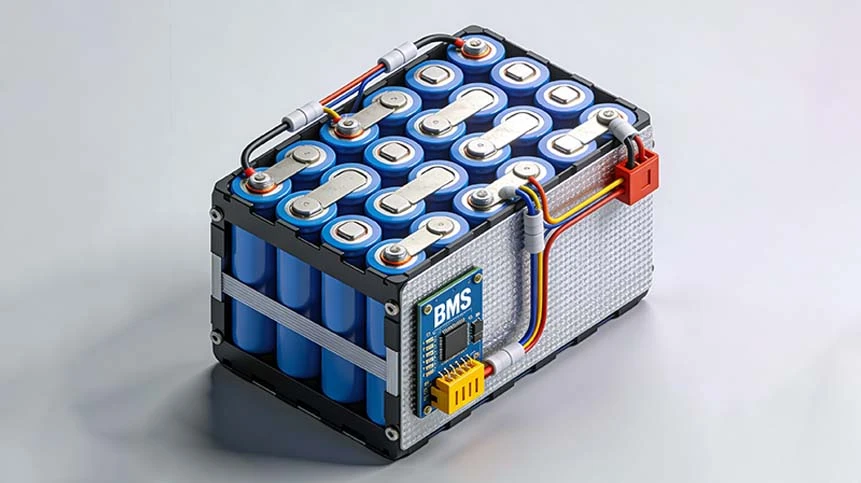

Evolution of System Design and Capabilities

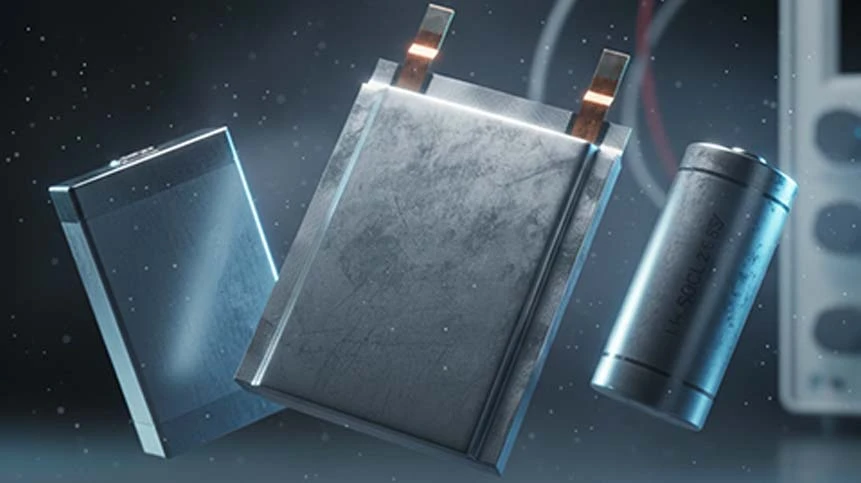

The rapid advancement of battery storage technology has been instrumental in enabling the scale of deployment witnessed in California and other leading markets. Early storage installations focused primarily on energy shifting applications, with limited duration and relatively simple operational parameters. Modern systems have evolved into sophisticated grid assets capable of providing multiple services simultaneously, with advanced power conversion systems that enable seamless transitions between different operational modes. The progression from 1-hour systems to 4-hour duration has been particularly significant, as this duration aligns optimally with California's net load curve characteristics and provides sufficient energy capacity to cover critical peak periods79.

Manufacturers have made substantial improvements in battery chemistry, system design, and integration capabilities. Lithium iron phosphate (LFP) chemistry has emerged as the dominant technology for grid-scale applications, offering enhanced safety characteristics and longer cycle life compared to earlier nickel manganese cobalt (NMC) formulations. Modern systems typically guarantee performance retention of over 80% capacity after 10,000 cycles, representing a operational lifespan that exceeds the economic life of many conventional generation assets. These durability improvements have addressed early concerns about degradation and replacement costs, providing confidence to investors and operators that storage assets will deliver consistent performance throughout their projected economic life69.

Grid Integration and Advanced Functionality

The integration of storage resources into grid operations has evolved significantly as system operators have gained experience with storage capabilities and limitations. California's grid operator, CAISO, has developed market products and operational protocols that enable storage to participate fully in wholesale markets, providing appropriate compensation for the unique attributes that storage brings to the system. These market innovations have been essential for unlocking the full value potential of storage resources and ensuring that they can compete on a level playing field with conventional generation310.

Advanced functionality including synthetic inertia, black start capability, and ramp rate control has further enhanced the value proposition of storage relative to conventional alternatives. These capabilities allow storage to provide essential reliability services that were previously the exclusive domain of conventional generation, supporting grid stability even as the generation mix becomes increasingly dominated by inverter-based resources. The development of standardized grid codes and interconnection requirements for storage resources has facilitated seamless integration while ensuring that storage deployments enhance rather than compromise system reliability36.

Table: Performance Comparison Between Battery Storage and Natural Gas Peakers

| Parameter | Battery Storage (4-hour) | Natural Gas Peaker | Advantage |

|---|---|---|---|

| Start-up Time | Milliseconds | 10-30 minutes | Battery |

| Minimum Load | 0% | 30-50% | Battery |

| Emissions | Zero during operation | High during operation | Battery |

| Fuel Price Risk | None | Significant | Battery |

| Part-load Efficiency | Consistent across range | Declines significantly | Battery |

| Duration Limitations | 4-6 hours typically | Unlimited with fuel supply | Gas |

| Energy Cost | Declining with technology | Volatile with gas prices | Context dependent |

Policy Framework and Regulatory Support

Legislative Mandates and Procurement Requirements

California's leadership in energy storage deployment has been underpinned by a comprehensive policy framework that has systematically addressed barriers to adoption while creating predictable demand signals for developers and manufacturers. The foundation of this framework was established by Assembly Bill 2514, passed in 2010, which directed the California Public Utilities Commission to establish energy storage procurement targets for the state's investor-owned utilities. The initial target of 1.325 gigawatts by 2020 seemed ambitious at the time but has been dramatically exceeded, demonstrating how policy targets can catalyze market development beyond initial expectations10.

The success of initial storage deployments led to increasingly ambitious policy measures, including the California Energy Commission's requirement that new solar facilities include storage capacity and the California Public Utilities Commission's ordering of additional procurement to ensure reliability following the retirement of natural gas plants and the San Onofre Nuclear Generating Station. These policy actions created a predictable pipeline of storage procurement that enabled manufacturers to invest in scale production and utilities to develop expertise in storage integration. The policy framework has evolved over time based on lessons learned from earlier deployments, with successive rounds of procurement incorporating refined requirements based on operational experience710.

Market Design and Compensation Mechanisms

California's grid operator has implemented significant market reforms to ensure that storage resources can participate fully in wholesale markets and receive appropriate compensation for the value they provide. These reforms have included the development of enhanced participation models for storage resources, market products that value fast response times, and compensation mechanisms that recognize the multiple services that storage can provide simultaneously. The market design evolution has been instrumental in unlocking the full value potential of storage resources and ensuring their economic viability310.

The capacity procurement mechanism has been particularly important for enabling storage to compete effectively against conventional alternatives. By recognizing the capacity contribution of storage resources during critical peak periods, the market design has ensured that storage can access a fundamental revenue stream that supports project economics. Storage resources in California regularly clear capacity auctions, demonstrating that they are recognized as reliable capacity resources by system planners and operators. This accreditation represents a critical endorsement of storage reliability and has been essential for securing project financing and utility procurement37.

Environmental and Community Benefits

Emissions Reduction and Air Quality Improvement

The substitution of battery storage for natural gas peaker plants has delivered significant environmental benefits, particularly in communities that have historically borne the burden of poor air quality due to proximity to fossil fuel generation. Natural gas peakers typically operate with lower efficiency and higher emissions than combined cycle plants, and they disproportionately impact air quality because they operate during periods when electrical demand is highest and atmospheric conditions often lead to poor air dispersion. By eliminating these emissions sources, battery storage deployments have contributed to improved air quality, particularly in disadvantaged communities that have historically hosted peaker plants due to land availability and zoning considerations18.

The environmental benefits extend beyond local air quality improvements to include greenhouse gas reductions. While the carbon footprint of battery storage depends on the grid mix during charging, the system-wide effect of storage deployment is to enable higher penetration of renewable resources and reduce reliance on fossil fuels. Lifecycle assessments demonstrate that the carbon reduction benefits of storage significantly exceed the embodied carbon in storage systems, particularly as the grid mix becomes increasingly clean over the operational life of storage assets. These carbon reductions contribute to California's ambitious climate goals, including the target of carbon neutrality by 204515.

Community Engagement and Environmental Justice

The transition from gas peakers to battery storage has involved meaningful engagement with environmental justice communities that have historically been disproportionately impacted by fossil fuel infrastructure. Community advocates have recognized the potential for storage to address both environmental and economic concerns, supporting deployment that provides local benefits while reducing pollution burdens. The community response to storage deployments has generally been more positive than for fossil fuel infrastructure, particularly when projects are sited in locations that repurpose existing industrial land or provide local economic benefits18.

The environmental justice implications of storage deployment extend beyond simple emissions reductions to include considerations of community resilience and energy equity. Storage installations can enhance local grid reliability, reduce vulnerability to transmission constraints, and support critical facilities during grid outages. When combined with solar generation, storage can create community resilience hubs that maintain operation during extended outages, addressing equity concerns that have emerged during public safety power shutoffs implemented to reduce wildfire risk. These resilience benefits represent an important dimension of the value proposition for storage deployments in vulnerable communities110.

Future Outlook and Development Trajectory

Near-Term Growth Projections

The momentum behind battery storage deployment in California shows no signs of abating, with utilities continuing to announce ambitious procurement targets and development pipelines. Pacific Gas & Electric, the state's largest utility, has indicated plans to deploy an additional 4.2 gigawatts of storage capacity beyond the 1 gigawatt that the company expects to bring online by the end of 2025. These projections reflect both the continuing reliability need created by retiring natural gas plants and the evolving recognition of storage as a multifunctional resource that can address multiple grid needs simultaneously10.

The growth trajectory is supported by continued technology improvements and cost reductions that further enhance the economic advantage of storage relative to alternatives. Industry analysts project that global energy storage deployments will increase by 44% in 2025 to reach 285 gigawatt-hours, with the United States representing one of the largest and fastest-growing markets. Within the United States, utility-scale storage is expected to grow by 41% to reach 40 gigawatt-hours in 2025, demonstrating the continuing acceleration of storage adoption as economics improve and operational experience accumulates26.

Long-Term Strategic Implications

The successful integration of battery storage at scale in California has fundamentally altered the planning paradigm for electric reliability, demonstrating that inverter-based resources can provide the essential reliability services historically provided by conventional generation. This transformation has implications beyond California, providing a template for other regions seeking to achieve high renewable penetration while maintaining reliability. The operational experience gained in California has addressed early concerns about storage reliability and durability, providing confidence to other system operators that storage can be relied upon for critical capacity needs36.

The evolution of storage technology continues, with manufacturers developing systems with longer duration, improved safety characteristics, and reduced costs. These advancements will further expand the applications for which storage can compete effectively, potentially enabling storage to provide firm capacity over extended periods and support seasonal storage requirements. The continuing innovation cycle ensures that storage will remain at the forefront of grid transformation efforts, with each successive generation of technology unlocking new value streams and applications69.

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More