The Future of Lithium-Ion Batteries: Innovation, Sustainability, and Global Market Trends

Lithium-ion batteries have become the heart of modern technology — powering everything from smartphones and electric vehicles to medical devices and renewable energy systems. As the global demand for efficient, safe, and sustainable energy storage continues to rise, lithium-ion technology is entering a new era of innovation and transformation.

According to BloombergNEF, global lithium-ion battery demand is projected to grow more than fivefold by 2035, driven by electric mobility, grid storage, and portable electronics. But this growth comes with challenges — including raw material supply, sustainability concerns, and the need for higher energy density.

1. The Rise of Lithium-Ion Technology

The journey of lithium-ion batteries began in the 1990s, revolutionizing consumer electronics with higher energy density and longer cycle life compared to nickel-cadmium or lead-acid batteries. Over the past three decades, continuous advancements in chemistry and manufacturing have expanded their applications far beyond laptops and phones.

Today, lithium-ion batteries are the dominant energy storage technology, with more than 90% of the electric vehicle market relying on them. The reasons are clear:

-

High energy density: Li-ion batteries store 2–3 times more energy per unit weight than traditional chemistries.

-

Low self-discharge: They retain up to 95% of their charge after several months of storage.

-

Longer lifespan: With proper management, they can last between 500–2000 charge cycles.

-

Efficiency: Round-trip energy efficiency often exceeds 95%, ideal for renewable integration.

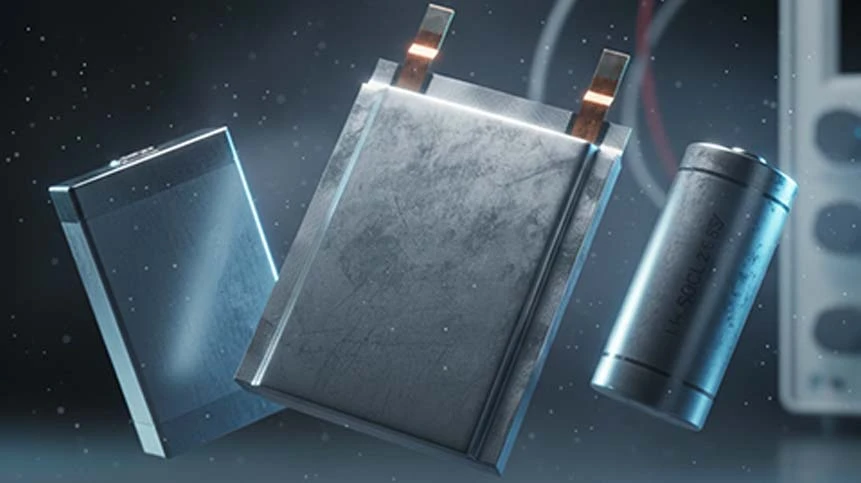

2. Chemistry Innovations: Beyond Traditional Li-Ion

While conventional lithium-ion chemistries (like NMC and LFP) dominate the market, the next generation of batteries focuses on improving energy density, safety, and sustainability.

a. Lithium Iron Phosphate (LFP)

LFP batteries have gained global traction, particularly in China, Europe, and North America, due to their superior safety, long cycle life, and cost efficiency. According to SNE Research, LFP’s global market share surpassed 35% in 2024, thanks to Tesla, BYD, and energy storage applications.

b. Nickel-Rich Cathodes

High-nickel NCA and NCM chemistries deliver higher energy densities — up to 300 Wh/kg — ideal for long-range EVs. However, they require advanced thermal management and precise manufacturing control to ensure safety.

c. Solid-State Batteries

Solid-state batteries, currently under development by Toyota, QuantumScape, and Samsung SDI, replace liquid electrolytes with solid materials. This promises 50–100% higher energy density and eliminates fire risks. Though commercialization remains challenging, experts expect mass-market adoption around 2030.

3. Sustainability and Recycling: Closing the Loop

As production surges, so do environmental concerns. Mining lithium, cobalt, and nickel can strain ecosystems and local communities. To ensure a sustainable supply chain, the global battery industry is pivoting toward recycling and circular economy models.

a. Recycling Breakthroughs

Companies like Redwood Materials (U.S.) and Li-Cycle (Canada) are pioneering recycling technologies that recover up to 95% of valuable metals, including lithium, nickel, and cobalt. This not only reduces mining pressure but also cuts carbon emissions by more than 50% compared to new material extraction.

b. Second-Life Applications

Used EV batteries still retain 70–80% of their capacity — enough for stationary energy storage. These “second-life” batteries are being deployed in grid systems, telecom towers, and home backup power.

c. EU Battery Regulation

Europe is leading the way with new sustainability standards. The EU Battery Regulation (2023) mandates minimum recycled content and full traceability of materials by 2027, setting a global benchmark for responsible battery production.

4. The Global Market Outlook

a. United States

Driven by the Inflation Reduction Act (IRA) and the push for domestic manufacturing, the U.S. lithium-ion market is projected to grow at a CAGR of 18.5% through 2032. Major players like Tesla, Panasonic, and LG Energy Solution are expanding gigafactories across Nevada, Texas, and Arizona.

b. Europe

The European Union’s Green Deal is fueling investments in local battery supply chains. Companies such as Northvolt (Sweden) and ACC (France) are leading efforts to achieve a fully European battery ecosystem, reducing reliance on Asian imports.

c. Asia-Pacific

China remains the global leader, accounting for over 70% of global lithium battery production. However, new players in South Korea, Japan, and India are investing heavily to diversify global supply and innovation.

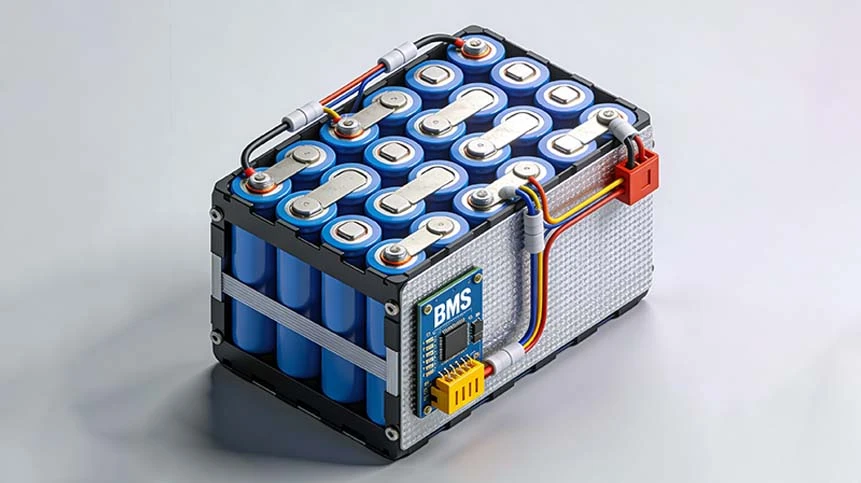

5. Custom Lithium-Ion Batteries: Tailoring Power for Every Industry

While large-scale EV and grid projects dominate headlines, custom lithium-ion batteries are quietly transforming B2B industries — from medical devices to smart wearables and industrial IoT.

a. Medical Devices

Portable medical instruments — such as infusion pumps, hearing aids, and ventilators — rely on compact, stable, and certified Li-ion batteries. Manufacturers like A&S Power specialize in custom designs meeting strict standards (UL2054, CB, UN38.3), ensuring safety and reliability.

b. Consumer Electronics and IoT

As devices shrink and connectivity expands, custom-shaped Li-ion and Li-Polymer cells enable creative product designs — thinner, lighter, and longer-lasting.

c. Industrial Applications

From GPS trackers to robotics, tailor-made battery packs offer optimized performance and integration, reducing downtime and maintenance costs.

6. The Road Ahead: Innovation Meets Responsibility

The lithium-ion battery industry stands at a crossroads — one that balances explosive demand with environmental responsibility and technological advancement.

Future innovations will likely focus on:

-

Silicon anodes for higher capacity

-

Cobalt-free cathodes for ethical sourcing

-

AI-driven Battery Management Systems (BMS) for predictive safety

-

Hydrometallurgical recycling for cleaner recovery processes

In short, the future of lithium-ion batteries is smarter, cleaner, and more adaptable than ever before.

Conclusion

From powering the smallest wearable to electrifying entire cities, lithium-ion batteries have reshaped modern life. As the world transitions toward cleaner energy and smarter mobility, their importance will only deepen.

Yet the challenge ahead is clear — balancing performance, sustainability, and accessibility. Manufacturers that invest in innovation, certification, and eco-conscious production will define the next decade of global energy storage.

Sources & References:

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More