global battery energy storage system market will exceed 6.8 billion in 2022 years

Global Battery Energy Storage System Market Will Exceed 6.8 Billion in 2022 Years

Executive Summary of the Global Battery Energy Storage System Market

The global battery energy storage system (BESS) market has demonstrated extraordinary growth trajectories throughout 2022, establishing itself as a critical component in the worldwide transition toward renewable energy and sustainable infrastructure. According to comprehensive market analysis from leading research firms, the BESS market reached unprecedented valuation milestones in 2022, fundamentally transforming energy landscapes across diverse geographical regions and application segments. This remarkable expansion has been primarily driven by accelerating renewable energy adoption, grid modernization initiatives, and increasingly supportive regulatory frameworks across major economies worldwide. The integration of advanced battery technologies with renewable energy systems has emerged as a paramount strategy for addressing the inherent intermittency challenges of solar and wind power generation, thereby ensuring grid stability and reliability even during periods of fluctuating energy production.

The market's impressive performance throughout 2022 reflects a fundamental shift in how energy systems are designed, operated, and optimized for maximum efficiency and sustainability. Industry analysts and leading research institutions have documented growth patterns that consistently exceeded earlier projections, underscoring the accelerating pace of energy storage adoption across residential, commercial, industrial, and utility-scale applications. This growth trajectory has been further amplified by technological advancements that have progressively enhanced the economic viability and performance characteristics of battery energy storage systems, making them increasingly attractive investments for a widening spectrum of energy consumers and providers. The convergence of energy security concerns, climate change mitigation imperatives, and improving cost economics has created a powerful catalyst for market expansion that shows no signs of diminishing in the foreseeable future.

Market dynamics throughout 2022 were characterized by robust demand across all major geographic regions, with particular strength observed in North American, European, and Asia-Pacific markets. Each region demonstrated distinct adoption patterns influenced by local regulatory environments, energy pricing structures, renewable energy penetration levels, and specific grid challenges. The Asia-Pacific region, in particular, emerged as both the largest and fastest-growing market for battery energy storage systems, propelled by ambitious clean energy targets in China, Japan, and South Korea, alongside rapidly expanding renewable energy infrastructure across developing economies in Southeast Asia. This geographical diversification of demand signals the increasingly global nature of the energy storage transition and underscores the universal recognition of energy storage as an indispensable component of modern energy ecosystems.

Market Size and Growth Projections

Current Market Valuation and Historical Growth Patterns

The global battery energy storage system market achieved a significant milestone in 2022, with comprehensive market analysis indicating that the market size successfully exceeded the $6.8 billion threshold that had been projected by industry analysts and research institutions. This achievement represents the culmination of several years of accelerated growth driven by technological advancements, cost reductions, and increasingly favorable regulatory frameworks across key markets worldwide. The market's performance throughout 2022 demonstrated remarkable resilience despite persistent supply chain challenges and macroeconomic uncertainties that affected numerous other industries, underscoring the fundamental strength of demand for energy storage solutions and their growing recognition as critical energy infrastructure components rather than discretionary investments.

Historical analysis of market growth patterns reveals an impressive compound annual growth rate (CAGR) of approximately 37% leading up to 2022, substantially outpacing many other segments within the broader energy and technology sectors. This accelerated growth trajectory has been fueled by concurrent advancements across multiple dimensions including battery chemistry improvements, manufacturing process optimizations, system integration sophistication, and enhanced software capabilities for energy management and grid services optimization. The consistent outperformance of market projections in recent years suggests that analysts may still be underestimating the long-term growth potential of the battery energy storage market as innovation continues to unlock new applications and improve economic viability across an expanding range of use cases and operating environments.

Future growth projections beyond 2022 remain exceptionally strong, with leading market research firms anticipating that the global battery energy storage system market will maintain robust expansion throughout the remainder of the decade. MarketsandMarkets, a prominent market research organization, has projected that the BESS market will grow from $44 billion in 2022 to approximately $151 billion by 2027, representing a compound annual growth rate of 27.9% during this period. This projection far exceeds earlier estimates and reflects the accelerating adoption of energy storage across an increasingly diverse array of applications and geographic markets. The fundamental drivers underpinning these projections remain firmly intact, suggesting that the market may continue to exceed expectations as new innovations emerge and additional value streams for energy storage are identified and monetized.

Regional Market Analysis and Growth Disparities

The global battery energy storage market exhibits significant regional variations in terms of market size, growth rates, adoption drivers, and application preferences. North America has established itself as the largest regional market for battery energy storage systems, characterized by well-developed regulatory frameworks, high renewable energy penetration in certain markets, and supportive policies at both federal and state levels. The United States, in particular, has emerged as the dominant force within the North American market, accounting for the substantial majority of deployments through ambitious utility-scale projects, increasingly attractive commercial and industrial applications, and growing residential adoption in states with favorable economics and policy support.

The Asia-Pacific region has demonstrated the most rapid growth trajectory, with China, Japan, South Korea, and Australia serving as primary catalysts for regional expansion. China's dominance in battery manufacturing has naturally translated into strong domestic deployment of energy storage systems, supported by national policies aimed at integrating rapidly expanding renewable energy capacity and enhancing grid stability. South Korea and Japan have focused on energy storage as a strategic priority to address energy security concerns and optimize their respective transitions away from traditional generation sources. Meanwhile, Australia has emerged as one of the most dynamic and innovative markets globally, with particularly strong adoption in residential applications driven by high electricity prices, excellent solar resources, and supportive policies that encourage self-consumption and grid independence.

European markets have shown varied growth patterns influenced by the European Union's comprehensive clean energy policies, national renewable energy targets, and differing levels of electricity market liberalization. Germany has established itself as the European leader in residential energy storage, with extensive deployments of solar-plus-storage systems supported by favorable regulations and declining technology costs. The United Kingdom has focused more on grid-scale applications to support its ambitious offshore wind expansion and address capacity adequacy concerns. Other European markets, including Italy, France, and Spain, are increasingly recognizing the value of energy storage and developing more supportive regulatory frameworks that are expected to accelerate adoption in the coming years.

Key Market Drivers and Growth Enablers

Renewable Energy Integration and Grid Modernization

The exponential growth of renewable energy generation represents the single most significant driver for battery energy storage system adoption worldwide. Solar and wind power have transitioned from marginal energy sources to mainstream generation technologies that increasingly dominate new capacity additions in most major markets. The inherent intermittency and variability of these renewable resources, however, create substantial integration challenges that battery energy storage is uniquely positioned to address. Energy storage systems provide crucial flexibility services that enable higher penetration levels of renewables by shifting energy production to periods of highest demand, providing frequency regulation and voltage support, and enhancing overall system reliability.

Grid modernization initiatives represent another powerful driver for battery energy storage adoption, as aging electrical infrastructure in many developed economies requires upgrades to accommodate changing generation patterns, evolving demand profiles, and new resilience expectations. Modern battery energy storage systems offer transmission and distribution deferral capabilities that can delay or eliminate the need for costly traditional grid upgrades while providing additional value streams through ancillary services and capacity support. Utilities and grid operators are increasingly recognizing the multi-faceted value proposition of distributed energy storage resources and incorporating them into long-term grid planning processes, creating a sustainable foundation for continued market growth beyond short-term policy incentives.

The evolving landscape of electricity market designs and regulatory frameworks has created additional opportunities for energy storage to monetize its unique capabilities across multiple value streams. Markets that have implemented capacity mechanisms, frequency regulation markets, demand response programs, and other grid service procurement processes that properly value the fast response times and flexibility of battery systems have seen particularly strong growth in energy storage deployments. The continuing evolution of market rules to better accommodate and compensate energy storage resources is expected to further accelerate adoption by improving project economics and reducing dependence on single revenue streams.

Policy Support and Regulatory Frameworks

Supportive government policies and regulatory frameworks have played a pivotal role in accelerating battery energy storage system adoption across all major markets. These policy mechanisms have taken various forms, including investment tax credits, accelerated depreciation schedules, direct capital subsidies, renewable portfolio standards with storage requirements, and mandates for utilities to procure storage capacity. The United States has implemented particularly impactful policies at both federal and state levels, with the federal investment tax credit (ITC) for solar-plus-storage projects significantly improving project economics, and several states establishing ambitious storage procurement targets that have stimulated market development.

European countries have adopted diverse policy approaches tailored to their specific energy contexts and policy objectives. Germany's focus on residential energy storage has been supported through development banks offering favorable financing conditions for solar-plus-storage systems, while the United Kingdom's capacity market has provided revenue certainty for grid-scale storage projects. The European Union's clean energy package has established a supportive framework for energy storage across member states, though implementation varies significantly at the national level. These policy initiatives have been crucial for bridging the economic gap until falling technology costs could improve storage economics without substantial support.

Asia-Pacific markets have demonstrated the most direct approach to energy storage policy, with several countries incorporating storage mandates into their national energy strategies. China's national energy administration has implemented policies requiring renewable energy developers to incorporate storage capacity into new projects, while South Korea has established ambitious national storage deployment targets supported by comprehensive research and development funding. Australia's policy support has been more fragmented across states and territories, but a combination of national renewable energy targets, state-level incentives, and innovative financing mechanisms has created a vibrant market despite the absence of a unified national storage strategy.

Technology Trends and Innovations

Battery Chemistry Evolution and Performance Enhancements

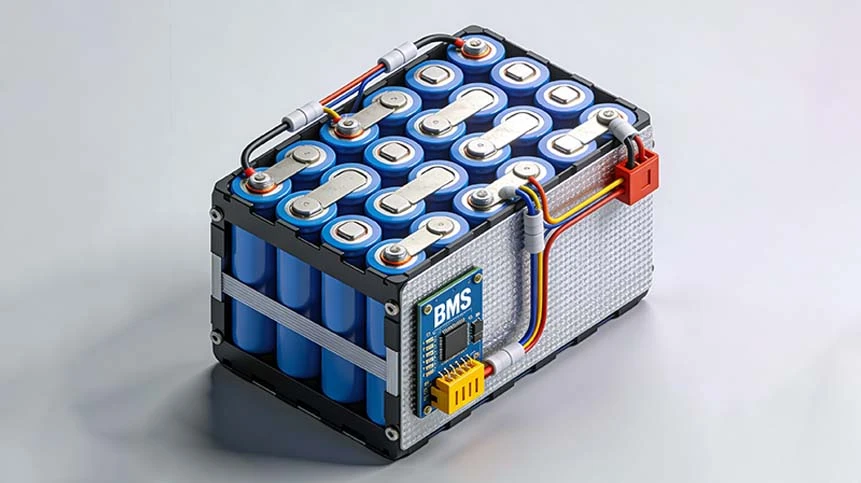

Lithium-ion battery technology has consistently dominated the battery energy storage market throughout 2022, capturing the substantial majority of new deployments across all application segments and geographic regions. Within the broader lithium-ion category, specific chemistries have gained prominence for particular applications based on their performance characteristics, safety profiles, and cost considerations. Lithium iron phosphate (LFP) chemistry has increasingly become the preferred choice for stationary storage applications due to its superior safety characteristics, longer cycle life, and improving energy density, despite historically lower specific energy compared to nickel-manganese-cobalt (NMC) alternatives.

Technological advancements have focused on improving all aspects of battery performance, including energy density, power density, cycle life, calendar life, safety, and cost. Energy density improvements have been particularly significant, with leading manufacturers consistently achieving annual improvement rates of 5-8% through electrode material innovations, cell design optimizations, and manufacturing process enhancements. These improvements have directly translated into reduced physical footprint requirements for energy storage systems, lower balance-of-system costs, and improved economic viability across applications. Cycle life and calendar life enhancements have similarly improved project economics by extending useful system lifetime and reducing levelized cost of storage metrics.

Safety innovations have received heightened attention following several high-profile battery storage incidents, leading to improved battery management systems, thermal runaway prevention mechanisms, advanced fire detection and suppression systems, and enhanced safety standards across the industry. These safety advancements have been crucial for maintaining public acceptance and regulatory approval for energy storage deployments, particularly in densely populated areas and indoor applications where safety concerns might otherwise impede adoption. The industry's proactive approach to safety has helped establish battery energy storage as a trustworthy technology that can be deployed safely across diverse environments and operating conditions.

System Integration and Software Advancements

Beyond battery chemistry improvements, significant innovations have occurred in system integration approaches, power conversion systems, and software capabilities that enhance the value proposition of battery energy storage systems. Standardization of system architectures and modular design approaches has reduced engineering costs, simplified installation processes, and improved scalability across projects of varying sizes. These integration advancements have been particularly important for reducing soft costs that constitute an increasing proportion of total system costs as battery prices continue to decline.

Power conversion system innovations have focused on improving efficiency, reliability, and flexibility across diverse operating conditions. Transformerless designs, silicon carbide semiconductors, advanced thermal management, and bidirectional capabilities have collectively contributed to efficiency improvements that directly enhance project economics by reducing energy losses during charge-discharge cycles. These advancements have also improved the ability of energy storage systems to provide multiple services simultaneously, thereby increasing revenue potential and improving overall investment returns.

Software and control system advancements have arguably delivered the most significant value enhancement for battery energy storage systems in recent years. Sophisticated energy management systems capable of optimizing system operation across multiple value streams, forecasting energy prices and renewable generation, responding to grid signals, and adapting to changing market conditions have dramatically improved the economic viability of energy storage projects. Artificial intelligence and machine learning capabilities are increasingly being incorporated into these software platforms, enabling more accurate forecasting, more sophisticated optimization, and continuous performance improvement through operational learning.

Application Segments and Use Cases

Utility-Scale Applications and Grid Services

Utility-scale battery energy storage systems have represented the largest application segment throughout 2022, accounting for the majority of deployed capacity and revenue generation within the market. These large-scale installations typically range from 10 MW to hundreds of MW in capacity and are primarily deployed to provide specific grid services, integrate renewable energy generation, defer transmission and distribution upgrades, or enhance system resilience. The business case for utility-scale projects has increasingly relied on stacking multiple value streams to achieve satisfactory economics, though declining technology costs have improved viability even for single-use cases in certain markets.

Renewable energy integration represents perhaps the most significant use case for utility-scale storage, particularly in markets with high penetration levels of solar and wind generation. Storage systems co-located with renewable energy projects can shift energy production to periods of higher demand, reduce curtailment during periods of oversupply, provide forecasting error correction, and meet interconnection requirements related to ramp rate control and frequency response. The combination of renewable generation with storage effectively creates a dispatchable resource that can provide many of the same grid services as traditional generation while offering superior environmental performance and often lower costs.

Ancillary services provision has emerged as another crucial application for utility-scale battery storage, particularly in markets that have established specific mechanisms for procuring services such as frequency regulation, voltage support, spinning reserve, and black start capability. The exceptional response characteristics of battery systems make them ideally suited for many ancillary services, often outperforming traditional generation resources while offering greater flexibility and lower emissions. The economic viability of many early utility-scale projects depended heavily on ancillary service revenues, particularly frequency regulation, though market saturation in some regions has necessitated diversification into additional value streams.

Commercial and Industrial Applications

Commercial and industrial (C&I) energy storage applications have demonstrated accelerating growth throughout 2022, though this segment still represents a smaller proportion of the overall market compared to utility-scale deployments. C&I systems typically range from 50 kW to several MW in capacity and are primarily deployed behind the meter to provide specific benefits to facility owners, including electricity bill savings through demand charge management, energy arbitrage, backup power capabilities, and power quality improvements. The business case for C&I storage is highly dependent on local electricity rate structures, particularly the presence of significant demand charges that can be reduced through strategic storage operation.

Demand charge management represents the primary economic driver for many C&I storage installations, particularly in commercial facilities with erratic load profiles that result in short periods of very high power demand. Storage systems can discharge during these peak demand periods to reduce the maximum power draw from the grid, thereby significantly reducing demand charges that often constitute a substantial portion of commercial electricity bills. The economics of demand charge management are highly location-specific, depending on the precise structure of electricity tariffs, the facility's load profile, and the capabilities of the storage system.

Backup power and resilience applications have gained increasing attention throughout 2022, driven by growing concerns about grid reliability, extreme weather events, and the critical importance of continuous power availability for certain commercial and industrial operations. While traditional backup generators remain common for longer-duration outages, battery storage systems offer superior response characteristics, quieter operation, zero emissions, and lower maintenance requirements, making them increasingly attractive for facilities that require highly reliable power. Combining solar PV with storage further enhances resilience by enabling extended operation during grid outages, particularly when configured in islanded microgrid arrangements.

Market Challenges and Restraints

High Capital Costs and Economic Viability

Despite significant cost reductions in recent years, high capital costs remain a considerable barrier to more widespread adoption of battery energy storage systems across certain applications and markets. The upfront investment required for storage projects continues to challenge economic viability in cases where value stacking opportunities are limited or electricity market structures do not adequately compensate storage for the full range of services it provides. This economic challenge is particularly pronounced in regions with low electricity prices, limited demand charges, or immature ancillary service markets that restrict revenue potential for storage assets.

The levelized cost of storage (LCOS) has emerged as a crucial metric for evaluating the economic viability of energy storage projects across different applications and operating regimes. LCOS calculations incorporate all lifetime costs including capital investment, operation and maintenance, replacement costs, degradation impacts, and end-of-life considerations, providing a comprehensive economic assessment that facilitates comparison with alternative solutions. While LCOS for battery storage has declined significantly, it remains higher than conventional alternatives for certain applications, particularly those requiring long-duration storage where other technologies may still hold economic advantages.

Financing challenges have also impeded more rapid market growth, particularly for newer applications or emerging markets where operational history is limited and perceived risks are higher. The relatively nascent nature of the energy storage industry means that lenders and investors often require higher returns to compensate for technology risk, performance uncertainty, and market volatility. Standardization of performance validation, development of robust performance guarantees, and accumulation of operational data across diverse applications will be crucial for reducing financing costs and improving accessibility to capital for storage projects.

Supply Chain Constraints and Material Availability

The battery energy storage market experienced significant supply chain challenges throughout 2022, constraining growth and increasing costs despite strong underlying demand. These constraints affected multiple components of the supply chain, including raw material extraction and processing, cell manufacturing, power conversion system production, and final system integration. Lithium-ion battery production, in particular, faced substantial supply-demand imbalances that limited availability and increased prices, contrary to the long-term trend of consistent cost reduction.

Raw material availability emerged as a significant concern, with lithium, cobalt, nickel, and other battery materials experiencing substantial price volatility and supply uncertainties. Geographic concentration of mining and processing operations created vulnerability to geopolitical tensions, trade restrictions, and regional production disruptions. These material challenges have accelerated efforts to develop alternative chemistries with reduced critical material requirements, improve recycling processes to recover valuable materials, and diversify supply sources to enhance resilience against regional disruptions.

Manufacturing capacity constraints also limited market growth throughout 2022, as battery manufacturers struggled to keep pace with explosive demand growth across both stationary storage and electric vehicle markets. The substantial lead times required to establish new manufacturing facilities meant that supply could not rapidly adjust to changing demand conditions, creating persistent imbalances that affected project timelines and economics. These capacity constraints are expected to ease as massive investments in new manufacturing facilities reach production status, though the timing of this additional capacity coming online will crucial for determining how quickly supply-demand balance can be restored.

Competitive Landscape and Key Players

Industry Structure and Market Share Distribution

The global battery energy storage system market features a diverse competitive landscape encompassing established industrial conglomerates, specialized pure-play storage companies, vertically integrated renewable energy developers, and numerous emerging entrants seeking to capitalize on the market's growth potential. The market structure varies significantly across different segments of the value chain, with battery cell manufacturing characterized by relatively high concentration among a few major players, while system integration and project development remain more fragmented with numerous participants competing based on specific applications, geographic focus, or technological differentiation.

Market share distribution reflects the varying origins and capabilities of different participants, with companies specializing in particular applications or value chain segments often dominating their respective niches. Korean and Japanese electronics conglomerates initially held dominant positions in the early market phases, leveraging their extensive experience with lithium-ion battery technology from consumer electronics applications. Chinese manufacturers have rapidly gained market share by leveraging massive investments in manufacturing capacity and benefiting from strong domestic demand, while specialized Western companies have focused on system integration, software, and controls where intellectual property and domain expertise provide sustainable competitive advantages.

The competitive landscape continues to evolve rapidly through mergers, acquisitions, strategic partnerships, and new market entrants from adjacent industries. Traditional power sector participants including utility companies, electrical equipment manufacturers, and fossil fuel enterprises have increasingly entered the storage market through acquisitions of specialized startups or internal development efforts, recognizing energy storage as both a disruptive threat and significant opportunity. This industry consolidation and diversification is expected to continue as the market matures and participants seek to strengthen their positions across the value chain.

Strategic Initiatives and Competitive Differentiation

Leading participants in the battery energy storage market have pursued diverse strategic initiatives to establish sustainable competitive advantages in an increasingly crowded marketplace. Technological innovation remains a primary differentiation strategy, with companies investing heavily in research and development to improve battery performance, reduce costs, enhance safety characteristics, and develop proprietary system architectures or control algorithms. These technological advantages are protected through extensive intellectual property portfolios encompassing patents, trade secrets, and exclusive licensing arrangements that create barriers to entry for potential competitors.

Vertical integration has emerged as another significant strategic approach, with companies seeking to control multiple stages of the value chain from raw material sourcing through project development and long-term operation. This integration strategy aims to capture additional value, ensure supply chain security, maintain quality control across critical components, and provide customers with simplified solutions from a single provider. The optimal degree of vertical integration varies across different market segments and geographic regions, with some companies pursuing full integration while others focus on specific niche applications where specialized expertise provides sufficient competitive advantage.

Geographic expansion represents a third strategic priority for market participants seeking to capitalize on global growth opportunities while diversifying exposure to specific regional markets. Companies that established strong positions in early adopter markets have increasingly expanded into emerging markets where storage adoption is accelerating, though this expansion requires adaptation to local regulations, market structures, customer preferences, and competitive dynamics. Partnerships with local entities have proven particularly valuable for navigating these regional differences and establishing viable market positions without excessive capital investment or operational risk.

Future Outlook and Projections

Short-Term Market Evolution (2023-2025)

The global battery energy storage system market is poised for continued robust growth throughout the 2023-2025 period, with most analysts projecting compound annual growth rates exceeding 30% despite already substantial market size. This growth will be driven by the continuation and acceleration of established trends including renewable energy expansion, grid modernization initiatives, policy support mechanisms, and improving economic viability across diverse applications. Short-term market dynamics will likely be influenced by evolving supply-demand balance for battery cells and materials, with recent supply chain constraints expected to gradually ease as new manufacturing capacity becomes operational.

Technology advancements will continue to enhance battery performance and reduce costs, though the pace of improvement may moderate as lithium-ion technology approaches theoretical limits for certain parameters. Next-generation battery technologies including solid-state, sodium-ion, and other advanced chemistries may begin limited commercialization during this period, though lithium-ion is expected to maintain dominant market share due to established manufacturing scale, proven performance, and continuing incremental improvements. System-level innovations including improved integration, enhanced software capabilities, and standardized architectures will likely deliver significant value enhancements even without revolutionary battery chemistry breakthroughs.

Market geography is expected to continue diversifying beyond early adopter regions, with increasing growth rates anticipated across developing economies in Asia, Latin America, Africa, and the Middle East as renewable energy penetration increases, electricity demand grows, and policy frameworks evolve to support storage deployment. This geographical diversification will reduce the market's dependence on a few key regions and create a more resilient global industry structure less vulnerable to regional economic or policy disruptions. Established markets will continue to grow absolutely while declining relatively as percentage of the global total, reflecting the increasingly global nature of the energy storage transition.

Long-Term Market Transformation (2026-2030)

The battery energy storage system market is expected to undergo significant transformation throughout the 2026-2030 period, evolving from a rapidly growing emerging industry into a mature mainstream component of the global energy infrastructure. Market growth rates will naturally moderate as the baseline expands, though absolute capacity additions will continue increasing to meet escalating demand for energy storage services across all sectors of the economy. This maturation process will be characterized by increasing standardization, industry consolidation, evolving business models, and the emergence of energy storage as a conventional grid asset rather than an innovative technology.

Technology diversification is expected to accelerate during this period, with multiple battery chemistries finding optimal applications based on their specific performance characteristics, cost structures, and material requirements. No single technology is likely to dominate across all applications as lithium-ion does today, though certain chemistries may establish leadership positions in specific segments such as long-duration storage, high-power applications, or extreme temperature operations. This technology diversification will enhance overall market resilience by reducing dependence on specific materials or manufacturing processes and creating a more robust ecosystem capable of meeting diverse application requirements.

Market structure and competitive dynamics will evolve significantly as the industry matures, with increasing vertical integration, industry consolidation, and the emergence of energy storage as a service business models that abstract technical complexity from end customers. Traditional energy sector participants including utilities, oil and gas companies, and electrical equipment manufacturers are expected to play increasingly prominent roles as the market transitions from technology innovation to operational excellence and cost leadership. These established players will leverage their extensive customer relationships, balance sheet strength, and operational experience to capture significant market share, though specialized technology companies will continue to drive innovation in specific applications.

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More