China’s Role in the Global Lithium Battery Market: Key Trends & Opportunities in 2025

China leads the global lithium battery industry with unmatched production capacity and rapid market growth. The country controls 85% of global production, as shown in the table below. Chinese companies like CATL hold nearly 30% of market share, driving technological innovation in electric vehicles and renewable energy. Industry professionals and investors monitor these trends closely because China’s dominance shapes supply chains and pricing across the global china lithium battery market.

| Metric | Value |

|---|---|

| Global production capacity (2024) | >3 TWh |

| Percentage of capacity in China | 85% |

| CATL's market share (2024) | 29.5% |

Key Takeaways

- China dominates the global lithium battery market, controlling 85% of production and driving significant technological advancements.

- The lithium battery industry in China is expected to grow rapidly, with a projected market value exceeding USD 100 billion by 2030.

- LFP batteries are becoming increasingly popular due to their cost-effectiveness and safety, making electric vehicles more accessible.

- China's strong government support and investment in R&D help maintain its leadership in battery technology and production.

- Global demand for lithium batteries is rising, driven by electric vehicles and renewable energy, creating opportunities for innovation and collaboration.

Global China Lithium Battery Market

Market Size & Growth

China stands at the center of the global china lithium battery market. The country’s lithium battery industry continues to expand at a remarkable pace. In 2024, installations reached 548.4 GWh, marking a 41.5% year-on-year increase. The compound annual growth rate for China’s lithium battery market is 28% from 2024 to 2030. By 2030, analysts expect the market to reach US$ 644.5 million in revenue.

China’s lithium battery shipments grew by 68% year-on-year, while electrolyte shipments rose by 45%. These figures highlight the rapid acceleration in production and demand.

The market concentration remains high. The top five companies (CR5) control over 73% of the industry, which shows strong consolidation. China’s dominance in the global battery market is clear. The country holds about 60% of the global electric battery market share. In the top 20 global lithium-ion battery markets, China accounts for nearly 58.4% of total imports.

| Metric | Value |

|---|---|

| Lithium battery shipments growth | 68% year-on-year |

| Electrolyte shipments growth | 45% year-on-year |

| Market concentration (CR5) | Over 73% |

| Leading company market share | More than 36% |

Emerging and developing countries contribute just under 5% of global demand. This gap demonstrates China’s leading position and its influence on global supply chains. The country’s exports have surged, with a compound annual growth rate of 35.1% from 2019 to 2023. Export value jumped from $17.19 billion in 2019 to $77.4 billion in 2023. Major destinations include the USA and Germany, which rely heavily on Chinese battery technology.

Leading Companies

Several companies drive the global china lithium battery industry. CATL leads with an annual output of over 170 GWh and a global market share of 34.7%. Other key players include BYD, CALB, EVE Energy, Ufine Battery, SVOLT, and Guoxuan. These companies invest heavily in technology and production capacity, shaping the future of the global battery market.

| Manufacturer | Annual Output (GWh) | Global Market Share |

|---|---|---|

| CATL | 170+ | 34.7% |

| BYD | N/A | N/A |

| CALB | N/A | N/A |

| EVE Energy | N/A | N/A |

| Ufine Battery | N/A | N/A |

| SVOLT | N/A | N/A |

| Guoxuan | N/A | N/A |

These leading companies focus on electric vehicle batteries and energy storage solutions. Their investments in technology help China maintain its top position in the global china lithium battery market. The industry’s growth supports the expansion of electric vehicles and renewable energy worldwide.

China’s battery manufacturers continue to set new standards for efficiency and innovation. Their dominance shapes pricing, supply chains, and technology trends across the global battery market.

Readers interested in the latest developments can explore company reports, market analyses, and technology updates. Questions about the industry’s future or specific companies are welcome in the comments below.

Battery Technology Trends

LFP Dominance

China leads the world in lithium iron phosphate (LFP) battery production. The country holds a commanding position in the global supply chain, shaping battery technology trends for electric vehicles and energy storage. The table below highlights China's share in LFP battery production and supply:

| Metric | Value |

|---|---|

| Global LFP battery production capacity | 92.3% |

| Worldwide LFP battery shipments | 87.6% |

| LFP cathode material supply chain | 94% |

LFP batteries have become the preferred choice for many manufacturers. Their adoption has driven significant cost reductions and improved performance, making them highly competitive for electric vehicle applications. The following points summarize the impact of LFP batteries on the global china lithium battery market:

- LFP batteries lower vehicle costs, helping more people afford electric cars.

- The energy storage sector uses LFP batteries for their safety and long lifespan, supporting renewable energy growth.

- Supply chain localization and diversification are increasing as companies respond to geopolitical changes and battery demand.

China's dominance in LFP battery production supports the rapid expansion of the lithium battery industry. The country sets the pace for global battery technology, influencing both pricing and innovation.

Solid-State Progress

Solid-state batteries represent the next major leap in battery technology. Chinese companies and research institutes have made rapid progress in this field. They target energy densities above 350 Wh/kg, with projections to exceed 500 Wh/kg by 2027. Many prototypes now achieve over 2,000 full charge and discharge cycles with minimal capacity loss.

Key developments in solid-state batteries include:

- Commercial prototypes use ceramic, sulfide, and polymer-based solid electrolytes.

- Pilot lines from companies like WeLion and ProLogium deliver semi-solid and quasi-solid-state cells for testing.

- Major firms such as Ganfeng Lithium, Gotion High-Tech, and CATL lead innovation in solid-state battery technology.

- BYD tests its first-generation solid-state battery in real-world conditions with the Seal electric sedan. This new battery could offer a range of up to 1,500 km based on the NEDC test cycle. Initial tests will continue until 2027, with full-scale integration planned for 2030.

Solid-state batteries promise to transform electric vehicles and even air taxis. They offer higher energy density and improved safety compared to traditional lithium-ion battery packs. The global industry watches China's advancements closely, as these trends will shape the future of battery demand and market growth.

R&D & Patents

China invests heavily in research and development for lithium battery technology. Companies like Sunwoda have focused on solid-state battery research since 2015, showing a long-term commitment to innovation. In March, four solid-state battery supply chain projects completed new rounds of financing, supporting both new and existing projects.

Recent breakthroughs in the lithium battery industry include:

- CATL developed new analytical techniques to better understand the lifecycle of lithium metal batteries. They identified that the main cause of cell failure was the consumption of electrolyte salt LiFSI. This discovery led to optimized formulations and a prototype that achieved 483 cycles, doubling the lifespan of earlier designs.

- Chinese researchers uncovered the mechanisms behind solid-state lithium battery failures, focusing on cycle fatigue of the lithium metal anode. Solid-state batteries can now reach energy densities up to 500 Wh/kg, much higher than traditional lithium-ion battery packs.

- The Shenzhen Institute of Advanced Technology collaborates with BYD on solid-state battery advancements. Predictions suggest large-scale applications will arrive around 2030.

- China is building a solid-state battery production base in Chongqing. Companies like Ganfeng Lithium invest in the region to support the new energy vehicle (NEV) battery supply chain. Local automakers drive rapid advancements in battery technology.

China's leadership in R&D and patents strengthens its position in the global lithium battery industry. The country's focus on innovation ensures it remains at the forefront of battery technology trends, setting new standards for the global market.

Supply Chain & Pricing

Resource Access

China controls much of the global lithium supply chain. Companies in China access and process most of the world’s lithium resources. This control gives the country a strong advantage in the global china lithium battery market. The table below shows China’s share in key areas:

| Category | Proportion |

|---|---|

| Global lithium chemical production | 80% |

| Cathode production | 78% |

| Cell manufacturing for electric cars | 70% |

China dominates 75% of battery cell manufacturing capacity and 90% of anode and electrolyte production. The industry invests in battery production near raw material sources. This approach secures upstream access and localizes the supply chain. In contrast, Western countries often separate mining, processing, and manufacturing. This separation creates challenges for building domestic battery capacity.

China leads in 11 out of 12 sectors related to lithium-ion battery production. Its partnerships, such as with Indonesia, show systematic control over the supply chain.

Manufacturing Scale

The battery industry in China uses advanced manufacturing practices to reduce costs and increase efficiency. Companies classify products carefully to make cost-effective decisions. They control cost determinants and optimize production volumes. Automation plays a big role in boosting efficiency. Changes to cell and pack design also help lower prices.

- Innovative manufacturing techniques drive down costs.

- Increased automation improves production speed and quality.

- High localization of battery materials reduces expenses.

China’s manufacturing scale supports high battery demand for electric vehicles and energy storage. The industry’s focus on technology and efficiency keeps it ahead of global competitors.

Price Impact

Battery prices in China are much lower than in Europe and North America. Chinese battery packs can cost up to 31% less than those in the United States. Lower manufacturing and labor costs, along with strong government support, make this possible. The per kWh price of NCM811 cells is currently the lowest in Greater China.

- Battery prices in China are 30% cheaper than in Europe and 20% cheaper than in North America.

- Export prices for lithium-ion batteries have dropped from $32.9 per kilogram in 2020 to $20.1 in 2024.

- The increase in U.S. lithium-ion storage projects links to the decline in Chinese export prices.

China’s large export capacity affects global battery prices. As the country exports more batteries, global prices fall. This trend benefits electric vehicle makers and energy storage projects worldwide. The global china lithium battery industry continues to shape supply and pricing trends for the future.

Electric Vehicles & Market Demand

EV Growth

China drives the electric vehicle battery market with unmatched production and innovation. The country produces over 70% of the world's lithium-ion batteries. Its production capacity reached 600 GWh by the end of 2023 and is projected to exceed 1,200 GWh by 2025. The market value stood at USD 44 billion in 2022 and is expected to surpass USD 100 billion by 2030. Passenger vehicles accounted for 60% of demand, while commercial vehicles made up 40% in 2023.

| Metric | Value |

|---|---|

| Global Market Share | Over 70% |

| Production Capacity | 600 GWh (2023), 1,200 GWh (2025) |

| Market Value | USD 44B (2022), >USD 100B (2030) |

| Vehicle Demand Split | 60% passenger, 40% commercial |

BloombergNEF reports that lithium battery demand from electric vehicles and stationary storage reached about 950 GWh last year. China's production alone meets global battery demand. Companies like CATL and BYD highlight the rapid growth of the electric vehicle market. CATL leads the electric vehicle battery market by focusing on lithium iron phosphate technology and controls over a third of the global market.

- In 2021, 13% of vehicles sold in China were hybrid or pure electric.

- The demand for electric vehicles continues to rise, driving battery demand and industry growth.

- The expansion of electric vehicles challenges raw material supply and encourages recycling and reuse.

Renewable Energy

Lithium batteries play a vital role in China's renewable energy sector. In 2022, the country's cumulative installed NTESS capacity surpassed 13.1 GW. Lithium-ion batteries represented 94% of this capacity, which equals 28.7% of global capacity. These batteries improve grid stability and help integrate renewable energy sources into the power grid.

Lithium batteries enable reliable energy storage, which supports the growth of solar and wind power. This technology helps address the intermittency of renewable energy.

The expansion of renewable energy links closely to the development of the new energy vehicle battery industry. Advancements in battery technology and policy changes influence market trends and support China's energy transition.

Downstream Impact

China's dominance in the lithium-ion battery supply chain affects many downstream industries. The market supports electric mobility, grid-scale storage, and consumer electronics. Rising demand for high-performance batteries comes from decarbonization targets and energy transition initiatives.

| Metric | Value |

|---|---|

| Current battery storage capacity | 3.3 GW |

| Planned battery storage capacity | 100 GW by 2030 |

| Cost reduction target | 30% by 2025 |

- The lithium battery market is pivotal for electric vehicles, consumer electronics, and energy storage systems.

- China leads in production and technology innovation, shaping global trends.

- The industry aims to reduce costs and expand battery storage capacity.

China's leadership in the electric vehicle battery market and renewable energy storage drives global lithium battery demand. The country's influence shapes technology, pricing, and industry growth across the world.

China vs. Europe & USA

Policy & Support

China’s lithium battery industry benefits from strong state support. The government invests billions of dollars and provides long-term political backing. This approach allows Chinese companies to focus on growth and innovation without worrying about short-term profits. The US and Europe use market-driven strategies. They rely on public-private partnerships and policy initiatives. The US has a National Blueprint for Lithium Batteries, which aims to build a clean economy and combines supply-push and demand-pull strategies. The EU’s European Battery Alliance works to create a sustainable battery value chain. Both regions face challenges from political changes and the need to restructure their industries. China’s investment, estimated between $60 and $100 billion, gives it a clear advantage in the global battery market.

China’s government support helps the industry grow faster and maintain its lead in battery technology.

Tech Gaps

The US and Europe have similar battery cell manufacturing capacities, each around 200 GWh. The US expects to increase its capacity to over 1,000 GWh, while Europe aims for more than 600 GWh. The Inflation Reduction Act drives investment in the US. Europe and the US depend heavily on China for upstream components. Europe imported $35 billion worth of batteries in 2023. This reliance shows a gap in domestic production and supply chain control. Both regions work to close these gaps by investing in new technology and expanding local manufacturing.

- Manufacturing capacities are growing in the US and Europe.

- Heavy reliance on Chinese imports remains a challenge.

- Investments focus on improving battery technology and supply chain independence.

Market Response

Europe and the US respond to China’s leadership with several strategies:

- Innovation and R&D investment target next-generation batteries with higher energy density and faster charging.

- Governments provide subsidies for electric vehicle purchases and invest in charging infrastructure.

- Supply chain diversification secures critical battery materials.

- Collaboration between governments, manufacturers, and academia strengthens the industry.

- Sustainability efforts promote recycling and environmentally friendly manufacturing.

- Digital manufacturing improves efficiency and reduces costs.

- Market positioning focuses on quality and reliability.

- Direct incentives encourage local production.

- Investments expand LFP cell capacity.

- Trade policies become stronger.

- Permitting and site development accelerate.

These actions help Europe and the US compete in the global battery industry. They aim to reduce dependence on China and build stronger domestic supply chains. Readers can ask questions about policy differences or market strategies in the comments.

Future Trends & Outlook

2025 Projections

China will continue to lead the global battery market in 2025. Analysts expect the country to produce over 70% of all lithium-ion battery packs worldwide. The electric vehicle sector will drive much of this growth. Solid-state batteries and lithium iron phosphate technology will play a key role in shaping future trends.

- Power battery installations in China reached 548.4 GWh in 2024, showing a 41.5% increase from the previous year.

- LFP battery installations surged by 56.7%, making up nearly three-quarters of total installations.

- The lithium battery industry will see strong demand as manufacturers shift toward LFP technology and solid-state innovation.

Risks & Challenges

The industry faces several risks that could affect future growth. Trade relationships between countries create vulnerabilities in the supply chain. Trade restrictions, economic sanctions, and natural disasters can disrupt production and delivery. The COVID-19 pandemic showed how a single event can impact the entire global battery market.

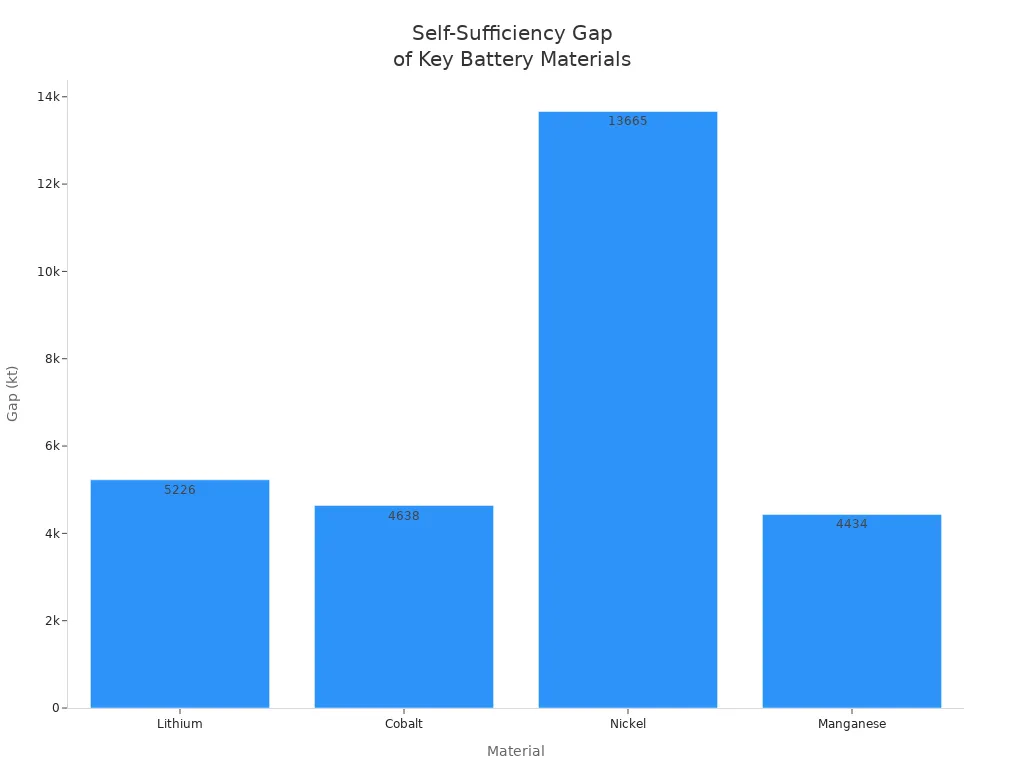

Material scarcity remains a major challenge. China relies heavily on imports for critical minerals such as lithium, cobalt, and nickel. The table below highlights the self-sufficiency gap for these materials:

| Material | Demand in 2022 | Import Reliance | Self-Sufficiency Gap (kt) |

|---|---|---|---|

| Lithium | 60% | >80% | 5226 |

| Cobalt | 30% | >80% | 4638 |

| Nickel | 10% | >80% | 13665 |

| Manganese | N/A | N/A | 4434 |

- Material scarcity due to rising EV demand.

- High reliance on imports for critical minerals.

- Geopolitical tensions affecting supply chains.

- Systemic risks from trade restrictions and natural disasters.

Collaboration Opportunities

International collaboration offers solutions to many industry challenges. Countries can work together to secure stable supplies of battery materials. Joint research projects can advance solid-state battery technology and improve recycling methods. Partnerships between companies and governments can help reduce import reliance and strengthen the lithium battery industry.

- Shared innovation can accelerate the development of solid-state batteries.

- Cross-border agreements can stabilize supply chains and support market growth.

- Collaboration can help address environmental concerns and promote sustainable battery technology.

The global battery market will benefit from open communication and shared goals. Readers can ask questions or share insights about future trends and industry challenges in the comments below.

China shapes market trends in the lithium battery industry for 2025. Professionals and investors see strong growth in global battery demand. They should watch technology changes and supply chain shifts. Companies can adapt by building partnerships and exploring new battery solutions. The global market will keep evolving as innovation drives new opportunities.

Readers can share questions or insights about battery technology and industry changes in the comments.

FAQ

What makes China a leader in the lithium battery market?

China leads with advanced technology, large-scale manufacturing, and strong government support. Companies like CATL and BYD invest heavily in research. The country controls most of the global supply chain, which helps lower costs and increase production.

How do China’s battery prices compare to other regions?

Chinese batteries cost up to 30% less than those made in Europe and 20% less than those in North America. This price advantage comes from efficient manufacturing, lower labor costs, and access to raw materials.

Why are LFP batteries important in China’s market?

LFP (lithium iron phosphate) batteries offer safety, long life, and lower costs. Chinese companies produce over 90% of the world’s LFP batteries. These batteries power many electric vehicles and energy storage systems.

What challenges does China face in the lithium battery industry?

China relies on imports for key minerals like lithium and cobalt. Trade tensions and supply chain disruptions can impact production. The industry also faces environmental concerns and the need for sustainable practices.

How can readers stay updated on lithium battery trends?

Readers can follow industry news, company reports, and government policy updates. Subscribing to newsletters or joining online forums helps.

For more insights or questions, readers can leave a comment below or contact the blog team.

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More