Lithium battery growth space is optimistic? Yes

Lithium Battery Growth Space is Optimistic? Yes

Global Lithium Battery Market Overview and Exponential Expansion

The global lithium battery industry is experiencing unprecedented growth driven by multifaceted demand across electric vehicles, energy storage systems, and consumer electronics, with market indicators suggesting sustained expansion throughout the remainder of the decade. Current industry analyses project that global lithium battery demand will reach approximately 1873GWh in 2025 before expanding to 2238GWh in 2026, representing substantial year-over-year growth that underscores the sector's robust health and promising future6. This remarkable growth trajectory is fundamentally supported by technological innovations, manufacturing improvements, and supportive policy frameworks worldwide that collectively address historical limitations while unlocking new applications and markets for lithium-based energy storage solutions. The industry's development has transitioned from being primarily policy-driven to increasingly value-driven, with economic considerations now frequently favoring lithium battery deployments even without subsidies in many applications, particularly in energy storage and transportation sectors.

The manufacturing capacity for lithium batteries continues to expand globally, with leading producers accelerating their production capabilities to meet soaring demand. Chinese companies currently dominate global production capacity, accounting for approximately 75% of the world's battery production, though other regions are rapidly developing their manufacturing ecosystems to secure supply chain resilience and capture economic opportunities1. Despite concerns about potential oversupply in some market segments, capacity utilization rates remain generally healthy, with industry leaders operating at near-full production capacity while more marginal producers face competitive pressures. The industry's continuous innovation cycle ensures that newer, more efficient production methods constantly emerge, driving down costs while improving performance characteristics, thus creating a virtuous cycle of improvement and adoption across multiple end-use sectors.

Electric Vehicle Market: Primary Growth Driver

Accelerating Electric Vehicle Adoption Rates

The transportation sector represents the largest and most significant demand source for lithium batteries, with electric vehicle adoption accelerating across global markets despite varying economic conditions and policy environments. Industry data reveals that China's electric vehicle market has achieved remarkable penetration rates approaching 50%, with sales projections indicating approximately 1610 million units will be sold in 2025 alone8. This staggering adoption rate reflects both sophisticated consumer acceptance and comprehensive policy support that has addressed range anxiety, charging infrastructure limitations, and cost premiums that previously hindered market expansion. The European electric vehicle market has also demonstrated strong recovery and growth patterns, with demand particularly robust in Northern European countries that have implemented aggressive transition policies toward sustainable transportation systems.

The technological evolution of electric vehicles continues to drive increased battery content per vehicle, with average battery capacities expanding to meet consumer demands for extended range and improved performance. This trend toward larger battery packs is particularly evident in premium vehicle segments, though even entry-level and mid-market vehicles are experiencing gradual increases in battery capacity as costs decline and performance expectations rise. The emergence of electric trucks and other commercial vehicles represents an additional growth vector, with these applications typically requiring substantially larger battery systems than passenger vehicles, thereby multiplying the lithium battery content per unit sold. The combination of increasing electric vehicle sales volumes and expanding battery capacity per vehicle creates a compound growth effect that ensures transportation will remain the dominant driver of lithium battery demand for the foreseeable future.

Manufacturing Expansion and Supply Chain Development

Global automakers and battery producers continue to announce substantial investments in new production facilities, with recent developments particularly focused on regional localization strategies that address supply chain security concerns and optimize logistics. European and North American markets have witnessed numerous joint ventures between automotive manufacturers and battery specialists, with production facilities strategically located near automotive assembly plants to create integrated manufacturing ecosystems. This trend toward regionalization represents a significant evolution from the previously dominant China-centric production model and creates additional investment opportunities throughout the battery value chain, though Chinese manufacturers continue to maintain formidable competitive advantages based on their established scale and experience.

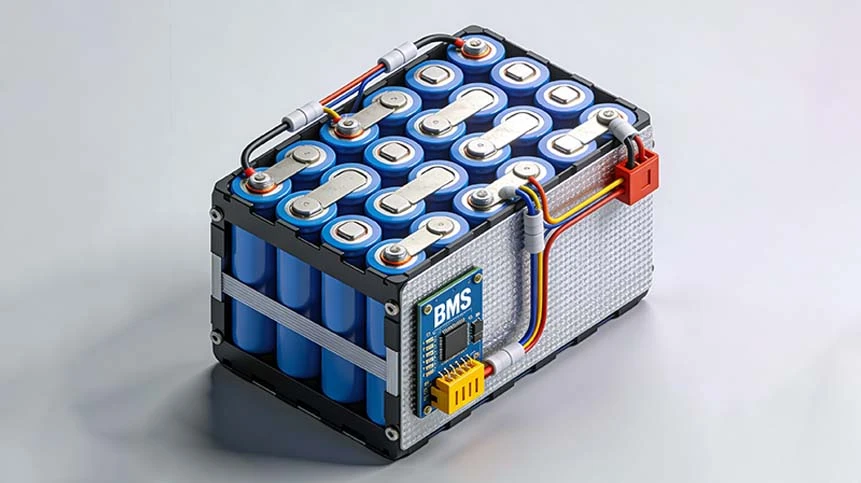

The electric vehicle battery market has also experienced notable technology shifts, with lithium iron phosphate (LFP) chemistries gaining significant market share at the expense of nickel-rich formulations due to their cost advantages, enhanced safety characteristics, and improving energy density. This chemistry transition has altered raw material demand patterns while creating new competitive dynamics within the battery industry, with different manufacturers possessing varying levels of expertise and intellectual property across battery chemistries. The continuous refinement of battery management systems and thermal management technologies has further enhanced the real-world performance and reliability of electric vehicle batteries, addressing consumer concerns while reducing warranty costs for manufacturers, thereby improving the overall economic proposition for electric mobility.

Energy Storage Systems: The Emerging Growth Frontier

Grid-Scale Storage Applications

Utility-scale energy storage represents the second-largest and fastest-growing application segment for lithium batteries, with project scales expanding dramatically to address renewable energy integration challenges and grid stability requirements. Contemporary grid-scale storage projects now frequently reach GWh-level capacities, representing orders of magnitude increases compared to typical projects just a few years ago3. These massive installations provide crucial grid services including frequency regulation, voltage support, capacity firming, and renewable energy time-shifting, with economic models increasingly demonstrating compelling value propositions even without specific policy support in many electricity markets. The fundamental driver of this growth is the accelerating transition toward variable renewable energy sources, particularly solar and wind power, which require energy storage to maximize their utilization and value.

The business case for grid-scale storage continues to strengthen as battery costs decline and market mechanisms evolve to properly value the unique capabilities that storage resources provide. Electricity markets worldwide are gradually adapting their rules and structures to accommodate and appropriately compensate energy storage resources, though significant regional variations persist in revenue opportunities and business models. Leading markets have developed sophisticated value stacking approaches that combine multiple revenue streams to create economically viable projects, while other regions continue to rely more heavily on mandated procurement targets or capacity payments. The ongoing electrification of heat and transport loads creates additional grid balancing challenges that further enhance the value proposition for grid-scale storage, suggesting that demand from this segment will continue its exponential growth trajectory throughout the coming decade.

Residential and Commercial Storage Adoption

Distributed energy storage systems have achieved remarkable market penetration in numerous regions, particularly where favorable electricity rate structures, equipment cost declines, and policy support have aligned to create attractive economic propositions for homeowners and businesses. Markets including Germany, Australia, Japan, and California have witnessed explosive growth in behind-the-meter storage deployments, with these systems typically paired with solar photovoltaic installations to maximize self-consumption and provide backup power capabilities. The fundamental economic driver for these applications is the widening difference between grid electricity prices and the levelized cost of solar electricity, with storage enabling greater utilization of self-generated electricity while providing additional grid services in increasingly sophisticated virtual power plant arrangements.

The residential storage market has demonstrated particularly impressive growth dynamics, with industry data indicating that installations increased from approximately 4,500 systems in 2018 to 13,000 systems in 2021 in Austria alone—representing a remarkable 222% year-over-year growth rate3. Other European markets have experienced similar expansion patterns, though from different baseline adoption levels, suggesting substantial runway remains for further market development. The commercial and industrial storage segment presents additional growth opportunities, though these applications typically involve more complex implementation requirements and longer sales cycles than residential systems. As electricity prices continue their generally upward trajectory across most global markets while battery costs continue declining, the economic case for distributed storage strengthens further, suggesting that adoption rates will continue accelerating across all market segments.

*Table: Lithium Battery Demand Projection by Application (2025-2026)*

| Application Segment | 2025 Demand (GWh) | 2026 Demand (GWh) | Growth Rate | Primary Drivers |

|---|---|---|---|---|

| Electric Vehicles | 1,420 | 1,680 | 18.3% | Rising EV adoption, larger batteries |

| Energy Storage Systems | 285 | 365 | 28.1% | Renewable integration, grid support |

| Consumer Electronics | 120 | 130 | 8.3% | Device proliferation, power requirements |

| Other Applications | 48 | 63 | 31.3% | Emerging uses, industrial applications |

| Total | 1,873 | 2,238 | 19.5% | Composite growth |

Source: Industry Reports and Market Analysis6

Technological Innovation and Performance Enhancements

Chemistry and Material Science Advancements

Lithium battery technology continues to evolve rapidly across multiple dimensions, with ongoing improvements in energy density, charging speed, cycle life, safety characteristics, and cost reduction. Contemporary battery development efforts focus particularly on reducing or eliminating cobalt content due to its price volatility and ethical concerns regarding mining practices, while simultaneously increasing silicon content in anodes to boost energy density2. The industry's material science innovations have produced successive generations of improved cathode and anode materials, with leading manufacturers now commercializing technologies that seemed distant prospects just a few years ago. These continuous incremental improvements collectively contribute to substantial performance enhancements and cost reductions that expand the feasible application space for lithium batteries while improving their economic attractiveness.

Solid-state battery technology represents the most anticipated advancement in the field, promising significant improvements in safety and energy density compared to current liquid electrolyte-based lithium-ion batteries6. While technical challenges remain regarding manufacturing scalability and cost competitiveness, industry leaders have made substantial progress toward commercialization, with various semi-solid transition technologies already reaching the market. The industry has increasingly converged on sulfide-based solid electrolytes for eventual full solid-state implementations due to their superior ionic conductivity and interface characteristics, though oxide and polymer approaches continue to be pursued by various manufacturers6. These technological developments suggest that lithium battery performance will continue its steady improvement trajectory for the foreseeable future, further expanding their applicability and economic viability across numerous sectors.

Manufacturing Process Innovations

Production technology advancements represent an equally important innovation vector for lithium batteries, with manufacturing improvements contributing significantly to cost reduction, quality enhancement, and production scalability. Contemporary battery manufacturing facilities increasingly incorporate sophisticated automation, artificial intelligence, and advanced process control technologies to achieve exceptional precision, consistency, and efficiency throughout the production process2. These manufacturing innovations have reduced defect rates to astonishingly low levels while dramatically increasing production speeds, with leading facilities now achieving output measured in gigawatt-hours annually from individual production lines.

Dry electrode processing has emerged as a particularly promising manufacturing innovation, potentially eliminating the energy-intensive drying steps required in conventional electrode production while enabling thicker electrode structures that improve energy density2. Other production innovations include multi-layer electrode designs that achieve higher area capacities, improved formation and aging processes that enhance battery performance while reducing processing time, and quality control systems that utilize machine vision and sophisticated sensing to detect microscopic defects. These manufacturing advancements collectively contribute to the ongoing cost reduction trajectory that has characterized the lithium battery industry since its inception, with further improvements expected to continue driving down costs while enhancing performance and reliability.

Supply Chain Evolution and Raw Material Considerations

Lithium Resource Development and Security

The lithium battery industry's rapid expansion has raised legitimate concerns regarding the availability and security of raw material supplies, particularly lithium, though market responses and technological adaptations have generally alleviated near-term scarcity concerns. Lithium production has expanded substantially to meet growing demand, with numerous new mining projects reaching production status and existing operations expanding their output capacities. Despite this production growth, lithium prices have experienced significant volatility, declining from their 2022 peaks but remaining substantially above historical averages, reflecting the complex dynamics between supply expansion and even more rapid demand growth10. This price volatility has created challenges for battery manufacturers and consumers while incentivizing further investment in extraction capacity and alternative technologies.

Battery recycling has emerged as an increasingly important component of the lithium supply picture, with recovering materials from end-of-life batteries helping to supplement primary production while addressing environmental concerns1. Contemporary recycling processes can recover approximately 90% of lithium content and over 95% of cobalt and nickel, with recovering economics becoming increasingly favorable as metal prices remain elevated and recycling technologies improve2. The growing availability of retired electric vehicle batteries represents a substantial potential resource, with projections suggesting that retired battery volumes will exceed 50 million tons by 2025, creating a circular economy opportunity that could eventually supply a significant portion of lithium battery material requirements1. This evolution toward a more circular approach to battery materials management enhances supply security while reducing environmental impacts and addressing ethical concerns regarding mining practices.

Cathode and Anode Material Innovations

Battery material suppliers have made substantial progress in developing and commercializing improved active materials that enhance performance while reducing costs and supply chain vulnerabilities. Cathode chemistry has evolved toward lower cobalt and higher nickel formulations, with NMC 811 and similar compositions increasingly dominating the market for applications prioritizing energy density2. Simultaneously, lithium iron phosphate (LFP) cathodes have gained significant market share in applications prioritizing cost, safety, and cycle life, particularly in energy storage and entry-level electric vehicles. These chemistry shifts have altered raw material demand patterns, reducing cobalt requirements while increasing nickel and lithium needs, though further innovations continue to reshape these dynamics.

Anode materials have experienced similarly important innovations, with silicon-based anodes increasingly complementing or replacing conventional graphite to achieve higher energy densities2. Contemporary silicon-carbon composite anodes can achieve specific capacities approaching 450 mAh/g, substantially exceeding the theoretical maximum of conventional graphite anodes, though practical implementation challenges remain regarding volume expansion during cycling2. These material innovations collectively contribute to continuous improvement in battery performance characteristics while addressing supply chain concerns through material diversification and reduced reliance on particularly problematic materials. The ongoing innovation cycle ensures that battery materials will continue evolving, with further improvements expected throughout the coming decade that will enhance performance while potentially altering raw material requirements.

Global Market Dynamics and Regional Developments

Asian Manufacturing Dominance and Expansion

Asian manufacturers, particularly Chinese companies, continue to dominate global lithium battery production, controlling approximately 75% of worldwide capacity while maintaining significant competitive advantages in scale, vertical integration, and manufacturing expertise1. This dominance reflects early strategic investments in battery technology and manufacturing capacity, supported by comprehensive government policies that identified energy storage as a strategic priority. Chinese battery manufacturers have leveraged their domestic market's rapid electric vehicle adoption to achieve scale advantages while continuously refining their technologies and production processes, creating formidable barriers to entry for potential competitors. These companies have increasingly expanded internationally, establishing production facilities in key markets including Europe and North America to better serve local customers while navigating evolving trade policies and geopolitical considerations.

Other Asian nations including Japan and South Korea maintain significant positions in the global battery industry, particularly in certain premium market segments and specific technology niches where their historical expertise provides competitive advantages. Japanese manufacturers continue to lead in solid-state battery development and certain advanced material technologies, while Korean companies maintain strong positions in electric vehicle battery supply through their partnerships with global automakers. The Asian battery industry's collective strength ensures that the region will remain the central hub of global battery production for the foreseeable future, though other regions are developing increasingly sophisticated capabilities to capture more value within their respective markets and reduce supply chain dependencies.

European and North American Market Development

European and North American markets have implemented ambitious policies to develop domestic lithium battery manufacturing capabilities, recognizing the strategic importance of this technology for transportation electrification, renewable energy integration, and industrial competitiveness. The European Union has particularly emphasized battery manufacturing as a strategic priority, with numerous member states providing substantial support for gigafactory development through various mechanisms including direct subsidies, loan guarantees, and regulatory streamlining. These efforts have yielded significant results, with numerous large-scale battery production facilities currently under development across Europe, though most remain dependent on Asian technology transfer through various partnership structures.

North American markets have similarly prioritized domestic battery manufacturing development, particularly through the Inflation Reduction Act's provisions that create strong incentives for localized production of electric vehicles and their components5. These policy measures have triggered numerous announcements of new battery production facilities across the United States and Canada, with investments totaling tens of billions of dollars that will substantially reshape the regional manufacturing landscape. Both European and North American strategies emphasize the development of complete local supply chains rather than merely final assembly operations, though achieving this goal will require substantial additional investment in material processing capabilities and component manufacturing. These regional development initiatives collectively contribute to global manufacturing capacity expansion while potentially altering competitive dynamics through the creation of alternative technology standards and regulatory frameworks.

Investment Landscape and Future Growth Trajectory

Capital Investment Patterns and Trends

The lithium battery industry continues to attract substantial capital investment despite periodic concerns about oversupply and competitive intensity, reflecting investor confidence in the sector's long-term growth prospects. Recent investment patterns demonstrate increasing sophistication, with funding increasingly targeted toward specific technology differentiators, manufacturing innovations, and supply chain integration opportunities rather than undifferentiated capacity expansion5. The industry has witnessed numerous mergers and acquisitions as established players seek to enhance their capabilities and market positions while accessing new technologies and customer relationships5. These consolidation activities reflect the industry's maturation while potentially creating more resilient competitors with comprehensive offerings across multiple market segments.

Venture capital and private equity investments continue to flow into battery technology startups, particularly those developing potentially disruptive technologies including solid-state batteries, silicon anode materials, and production innovations5. Investment patterns suggest particular interest in technologies that address critical industry challenges including cost reduction, performance enhancement, supply chain security, and sustainability metrics. The investment community has increasingly recognized that battery technology represents a fundamental enabling technology for broader energy and transportation transitions, suggesting that capital availability will remain strong for promising technologies and business models despite periodic market fluctuations and competitive challenges. This robust investment environment ensures that innovation will continue accelerating while supporting the capacity expansion required to meet rapidly growing demand across multiple sectors.

Future Growth Projections and Market Opportunities

Industry analysts project sustained strong growth throughout the remainder of the decade and beyond, with lithium battery demand expected to continue expanding at compound annual growth rates exceeding 20% despite the industry's already substantial scale6. This growth trajectory reflects the confluence of multiple favorable trends including ongoing electric vehicle adoption, renewable energy deployment, grid modernization requirements, and the emergence of new applications ranging from electric aviation to stationary power backup. The addressable market for lithium batteries continues to expand as performance improves and costs decline, creating new opportunities while expanding existing applications beyond previous limitations.

The energy storage market particularly represents a substantial growth frontier, with projections suggesting that storage applications could eventually rival or even exceed electric vehicles as the primary demand source for lithium batteries3. This potential reflects the fundamental requirement for energy storage to enable renewable energy integration while providing grid resilience and flexibility services. Emerging applications including electric vertical takeoff and landing aircraft (eVTOL), marine electrification, and advanced robotics present additional growth vectors that could become significant demand sources within the coming decade. The lithium battery industry's future thus appears exceptionally bright, with multiple growth drivers ensuring continued expansion despite periodic challenges and competitive dynamics across different market segments and geographic regions.

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More