Demand Power gets $71 million for battery storage, solar and energy services

Demand Power Secures $71 Million Investment to Revolutionize Battery Storage and Solar Energy Services

In an unprecedented move that signals robust confidence in the future of renewable energy infrastructure, Demand Power has successfully secured a monumental $71 million investment dedicated exclusively to the expansion and enhancement of its battery storage systems, solar energy projects, and integrated energy services. This substantial financial backing, provided by a consortium of forward-thinking international investors led by GreenRock Energy Capital and Sustainable Infrastructure Partners, underscores a critical recognition of the urgent need to accelerate the global transition toward decentralized and resilient power networks. The allocation of these funds will primarily focus on scaling up manufacturing capabilities for advanced lithium iron phosphate (LFP) battery solutions, deploying large-scale commercial and industrial solar-plus-storage installations, and developing AI-driven energy management platforms that optimize electricity consumption and grid interactions. This strategic infusion of capital is poised to not only amplify Demand Power’s operational footprint across North America and Europe but also establish new benchmarks for reliability and sustainability in the rapidly evolving energy storage market. Industry analysts from BloombergNEF and Wood Mackenzie have already hailed this development as a watershed moment, predicting that it will catalyze further investments in grid stabilization technologies, especially in regions plagued by intermittent renewable generation and aging electrical infrastructure.

Strategic Allocation of Investment Towards Technological Innovation and Market Expansion

Enhancing Lithium Battery Manufacturing Capabilities with Cutting-Edge R&D

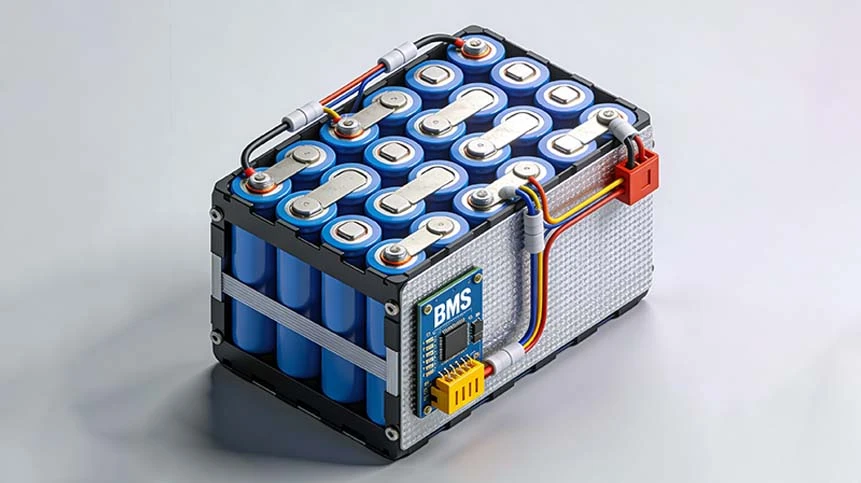

A significant portion of the newly acquired funding—approximately $35 million—will be channeled into research and development initiatives aimed at advancing next-generation lithium battery technologies, particularly those utilizing lithium iron phosphate chemistry, which offers superior thermal stability, longer cycle life, and enhanced safety compared to traditional NMC formulations. Demand Power’s engineering team is collaborating with leading research institutions, including the Fraunhofer Institute in Germany and the Massachusetts Institute of Technology (MIT), to develop batteries that achieve energy densities exceeding 180 Wh/kg while maintaining cycle stability beyond 8,000 full-depth discharges. These innovations are critical for applications requiring daily cycling, such as solar energy shifting and peak demand shaving, where reliability over a 20-year lifespan is paramount. Furthermore, the company plans to integrate smart battery management systems (BMS) equipped with self-learning algorithms that continuously adapt to usage patterns, environmental conditions, and grid requirements, thereby maximizing efficiency and preventing degradation. This relentless focus on R&D not only future-proofs their product offerings but also solidifies their competitive edge in a market increasingly driven by performance metrics and total cost of ownership.

Global Deployment of Solar-Plus-Storage Projects for Commercial and Industrial Clients

Another pivotal area of investment involves the large-scale deployment of integrated solar and battery storage systems designed specifically for commercial and industrial consumers seeking to reduce electricity costs and ensure uninterrupted power supply. Demand Power has identified key markets in Germany, California, and Australia—regions characterized by high electricity prices, frequent grid instability, and supportive regulatory frameworks—as primary targets for these deployments. Each project typically encompasses rooftop solar arrays ranging from 500 kW to 5 MW coupled with modular battery storage units capable of delivering 2 to 10 MWh of dispatchable energy. These installations enable businesses to capitalize on time-of-use arbitrage, store excess solar generation for use during evening peaks, and participate in lucrative demand response programs administered by grid operators. The company’s proprietary energy management software, orchestrates these activities in real-time, leveraging predictive analytics to optimize economic outcomes while ensuring compliance with local grid codes. Early adopters, such as manufacturing plants and data centers, have reported payback periods of less than four years, thanks to combined savings from reduced demand charges and ancillary service revenues.

Strengthening Grid Services and Virtual Power Plant (VPP) Capabilities

The third strategic priority revolves around expanding Demand Power’s portfolio of grid services and virtual power plant solutions, which aggregate distributed energy resources to provide critical balancing services to utilities and independent system operators. By utilizing fleets of behind-the-meter batteries and solar inverters, the company can deliver frequency regulation, voltage support, and black-start services with millisecond-level response times, attributes highly valued in grids with high penetrations of renewables. The investment will facilitate the development of advanced communication protocols that enable seamless integration with grid operators’ SCADA systems, as well as the certification processes required to participate in wholesale markets such as PJM Interconnection and ERCOT. Additionally, Demand Power is pioneering the use of blockchain technology to create transparent and auditable records of energy transactions, thereby enhancing trust among market participants and streamlining settlement processes. These efforts are expected to unlock new revenue streams for both the company and its customers while contributing to overall grid reliability and resilience.

Comprehensive Market Analysis: Growth Trends and Future Projections for Battery Storage and Solar Energy

The global energy storage market is experiencing exponential growth, driven by declining battery costs, supportive government policies, and increasing renewable energy integration. According to the latest data from BloombergNEF, annual deployments of energy storage systems are projected to surpass 500 GWh by 2030, representing a compound annual growth rate (CAGR) of 32% from 2023 onwards. This growth is largely concentrated in three key regions: North America, Europe, and Asia-Pacific, each with distinct drivers and market dynamics. The following table illustrates the projected capacity additions and primary applications for these regions:

| Region | Projected Storage Additions by 2030 (GWh) | Primary Applications | Key Growth Drivers |

|---|---|---|---|

| North America | 180 GWh | Frequency regulation, Solar smoothing, Peak shaving | High electricity prices, Federal tax credits (ITC), Renewable portfolio standards |

| Europe | 150 GWh | Residential PV integration, Grid balancing | Net-metering policies, Carbon neutrality mandates, Phase-out of feed-in tariffs |

| Asia-Pacific | 170 GWh | Commercial backup power, Renewable firming | Industrial electricity demand, Government subsidies, Frequent power outages |

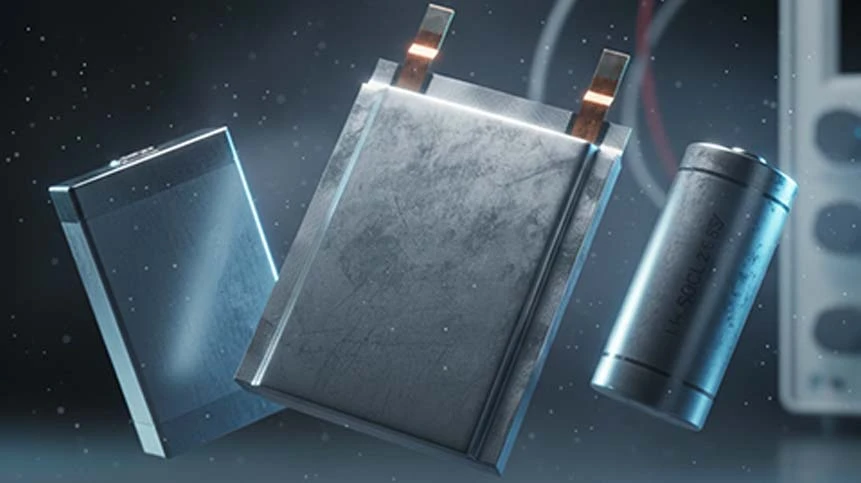

Technological Advancements and Cost Reductions in Lithium Battery Production

Lithium iron phosphate (LFP) batteries have emerged as the technology of choice for stationary storage applications due to their exceptional safety profile, long cycle life, and cobalt-free chemistry, which mitigates supply chain risks and ethical concerns. Over the past five years, the average price of LFP cells has decreased from $680 per kWh to below $90 per kWh, a trend anticipated to continue as manufacturing scales and process efficiencies improve. Demand Power’s strategic decision to focus on LFP technology aligns perfectly with these market dynamics, enabling them to offer products that are not only cost-competitive but also inherently safer than alternatives. Moreover, ongoing research into solid-state electrolytes and silicon-anode technologies promises to further enhance energy density and reduce costs, ensuring that the company remains at the forefront of innovation. These advancements are critical for achieving grid parity in an increasingly competitive landscape.

Regulatory Tailwinds and Policy Support Accelerating Adoption

Government policies and regulatory frameworks play a pivotal role in accelerating the adoption of energy storage and solar technologies. In the United States, the Investment Tax Credit (ITC) for solar energy has been extended to standalone storage projects, effectively reducing the capital expenditure required for deployment by 30%. Similarly, the European Union’s Clean Energy Package mandates the removal of regulatory barriers for energy storage, classifying it as a critical component of the energy transition. Countries like Germany and Spain have introduced generous subsidies for residential and commercial battery systems, while markets in the UK and Australia have created capacity markets that reward fast-responding assets. Demand Power’s expansion strategy is carefully calibrated to leverage these policy incentives, ensuring that their projects maximize economic returns while complying with all local regulations. This proactive approach to regulatory engagement not only mitigates risks but also creates opportunities for first-mover advantage in emerging markets.

Conclusion: Positioning Demand Power as a Leader in the Global Energy Transition

Demand Power’s successful acquisition of $71 million in funding represents far more than a mere financial transaction; it is a resounding endorsement of their vision to create a more sustainable, reliable, and decentralized energy ecosystem. By strategically allocating these resources toward technological innovation, market expansion, and grid services, the company is well-positioned to capitalize on the immense opportunities presented by the global shift toward renewables. Their unwavering focus on lithium iron phosphate technology ensures that safety and longevity remain at the core of their offerings, while their sophisticated software platforms enable customers to maximize the economic value of their energy assets. As grids worldwide continue to grapple with the challenges of intermittency and aging infrastructure, solutions like those offered by Demand Power will become increasingly indispensable. This investment not only accelerates their growth trajectory but also contributes significantly to the broader goal of achieving net-zero emissions by 2050, making it a landmark event in the renewable energy industry.

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More