Comprehensive Guide to Lithium Ion Battery HS Code for Global Import & Export Compliance

If you are involved in manufacturing, sourcing, importing, or exporting lithium-ion batteries, understanding the correct HS code for lithium ion batteries is not optional—it is essential.

I work closely with global buyers, logistics partners, and customs brokers, and one issue repeatedly causes shipment delays, unexpected tariffs, and even customs penalties: incorrect HS classification.

This guide is written from real export and compliance experience. It explains what HS codes apply to lithium-ion batteries, how different countries classify them, what tariffs apply, and how to avoid costly mistakes—all in one place.

What Is an HS Code and Why Lithium-Ion Batteries Are Sensitive

The Harmonized System (HS) is a globally standardized product classification system maintained by the World Customs Organization (WCO).

-

The first 6 digits are internationally harmonized

-

Additional digits (8–10) are country-specific

-

HS codes determine:

-

Import duties

-

VAT / GST

-

Regulatory controls

-

Trade statistics

-

Eligibility for FTA benefits

-

Lithium-ion batteries are high-risk, high-attention products because they are:

-

Energy-dense

-

Classified as dangerous goods for transport

-

Strategically sensitive (EV, energy storage, medical devices)

As a result, customs authorities examine their HS codes very closely.

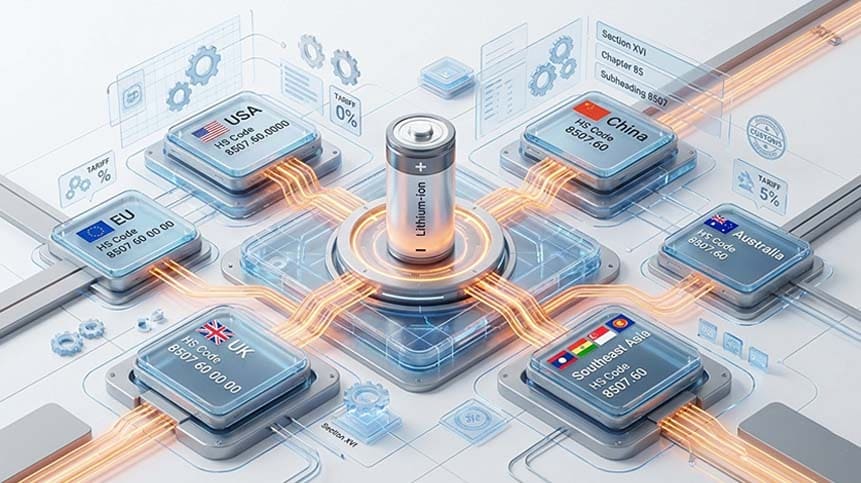

Core HS Code for Lithium-Ion Batteries (Global Standard)

At the global 6-digit level, lithium-ion batteries are classified under:

HS Code 8507.60 – Lithium-ion accumulators

This code covers:

-

Rechargeable lithium-ion battery cells

-

Battery packs

-

Modules and assemblies (unless classified elsewhere due to integration)

However, the real complexity begins at the national level.

Lithium Ion Battery HS Code by Country & Region (Detailed Breakdown)

United States (HTS – Harmonized Tariff Schedule)

Base HS Code: 8507.60.00 – Lithium-ion batteries

Typical Import Duty (MFN):

-

~3.4% ad valorem

Important Notes (US):

-

Most lithium-ion batteries enter under low MFN rates

-

Trade remedy tariffs (e.g., Section 301 on Chinese origin goods) may apply

-

Certain EV or large battery systems may face higher duties in future policy updates

Practical Tip:

Always verify country of origin + HTS statistical suffix, not just HS6.

European Union (EU) & Germany (TARIC System)

EU TARIC Code: 8507.60.00

Import Duty (EU Common External Tariff):

-

Typically 3%–8%, depending on sub-classification

Germany (as EU member):

-

Same customs duty as EU

-

VAT: ~19%

Key EU Characteristics:

-

One HS/TARIC classification applies across all EU countries

-

VAT varies by member state

-

Lithium batteries for EVs, industrial storage, or medical devices may be further subdivided

United Kingdom (UK Global Tariff)

HS Code: 8507.60

Import Duty:

-

Typically 3%–6%

VAT:

-

20% UK VAT

Post-Brexit Note:

-

UK now operates its own tariff system

-

Preferential tariffs may apply under UK FTAs if Rules of Origin are met

China (10-Digit HS System)

China applies extended HS codes beyond the 6-digit level.

Most Common Code:

-

8507600090 – Other lithium-ion batteries

China Import Taxes:

-

MFN Duty: ~10%

-

VAT: 13%

-

Non-MFN / punitive rate: up to 40% in some cases

Export Rebate (China exporters):

-

~9% export tax rebate

Special Sub-Codes Exist For:

-

EV battery cells

-

High-energy density battery systems

-

Industrial battery assemblies

Australia

HS Code: 8507.60.00

Import Duty:

-

5% MFN

GST:

-

10%

Good News:

-

Tariff concessions and FTAs may reduce duty

-

Lithium batteries often qualify for simplified clearance when documentation is complete

Malaysia

HS Code: 8507.60

Import Duty:

-

0% in most cases

Sales & Service Tax (SST):

-

Applies depending on end-use and importer registration

ASEAN Advantage:

-

Strong FTA network enables duty-free trade with many partners

Summary Table — Lithium Ion Battery HS Code & Tariffs

| Country / Region | HS Code | Import Duty | VAT / GST |

|---|---|---|---|

| United States | 8507.60 | ~3.4% | — |

| EU (Germany) | 8507.60.00 | 3–8% | ~19% |

| United Kingdom | 8507.60 | 3–6% | 20% |

| China | 8507600090 | 10% MFN | 13% |

| Australia | 8507.60 | 5% | 10% |

| Malaysia | 8507.60 | 0% | SST |

Common HS Code Mistakes That Cause Customs Delays

From real-world cases, the most common errors include:

-

Declaring battery packs as cells

-

Using a generic HS code for integrated battery systems

-

Ignoring country-specific extensions

-

Mismatch between HS code and invoice description

-

Declaring HS code without supporting technical data

Any of these can trigger:

-

Cargo holds

-

Physical inspections

-

Reclassification penalties

-

Retroactive tax collection

HS Code vs UN3480 / UN3481 — Do Not Confuse Them

A critical clarification:

-

HS codes are for customs & taxation

-

UN3480 / UN3481 are for transport safety

They serve different legal systems, but both must be correct.

Customs may reject shipments if:

-

HS code says “battery pack”

-

Transport documents describe “equipment with battery”

-

Technical specs are inconsistent

How to Classify Lithium-Ion Batteries Correctly (Best Practices)

I recommend always preparing:

-

Battery datasheet (voltage, capacity, chemistry)

-

Intended application (consumer, medical, EV, industrial)

-

Physical configuration (cell, module, pack)

-

Safety certificates (UN38.3)

Correct classification is not guesswork—it is technical documentation-driven.

FAQ — Lithium Ion Battery HS Code

Q1: Is HS code 8507.60 used worldwide?

Yes. 8507.60 is the global base code, but countries extend it differently.

Q2: Are lithium battery cells and packs the same HS code?

Sometimes at HS6 level, but often different at national sub-code level.

Q3: Can the wrong HS code increase my import duty?

Absolutely. It may also invalidate FTA benefits.

Q4: Do EV batteries use the same HS code?

They often start with 8507.60 but are frequently subdivided.

Recommended

Final Thoughts — Turning Compliance Into Competitive Advantage

Understanding the lithium ion battery HS code is not just about avoiding mistakes—it’s about controlling landed cost, accelerating customs clearance, and building trust with global buyers.

-

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More

May.2026.02.27Lithium-Ion Batteries: The Six Constraints Blocking the Path to PerfectionLearn More -

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More

May.2026.02.25Li-Polymer Battery 5000mAh: Complete Technical & OEM GuideLearn More -

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More

May.2026.02.24The Unparalleled Advantages of Lithium-Ion Batteries Over Traditional BatteriesLearn More -

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More

May.2026.02.243.6 Volt Battery: Complete Technical Guide for Engineers & BuyersLearn More -

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More

May.2026.02.24What Is a 3.8V LiPo Battery? A Complete Engineering & OEM GuideLearn More